Rates Spark: Range-Bound Ahead of Inflation Releases

2023.04.25 09:31

We assess this year’s market themes against our 2023 outlook calls. Rates remain range-bound, and curves have only steepened moderately, but rates differentials keep narrowing. We expect little appetite to take new risks ahead of key inflation releases on Friday

Taking stock of markets so far in 2023

We would summarise the three main themes for this year identified in our 2023 rates outlook as follows: lower rates, steeper curves, and rate convergence. Four months in, the picture is mixed. On the positive side, we remain convinced that a further drop in rates is on the cards.

Events since then have reinforced our view that an economic slowdown and drop in inflation will allow central banks to pause and then reverse their hiking cycles. Our outright rates view hasn’t panned out. Rates remain at – or in some places above – where they started the year. We think it is fair to say that they have been trading in a range since the start of the year, currently near the top.

Our outright rates view hasn’t panned out

This upcoming policy pivot is a clear driver of lower rates, although it should also come with a rebound in term premia. In other words, a re-steepeing of yield curves. We have noted in a dedicated analysis that while the upcoming end to the Fed’s hiking cycle should limit further flattening impetus, re-steepening and dis-inversion will have to wait for cuts to materialise. We think this will occur by the fourth quarter of this year for the Fed, but it remains the subject of much debate. We score a little higher on this call, as curves have re-steepened on the back of the US regional bank crisis – but they still remain inverted, particularly in the US.

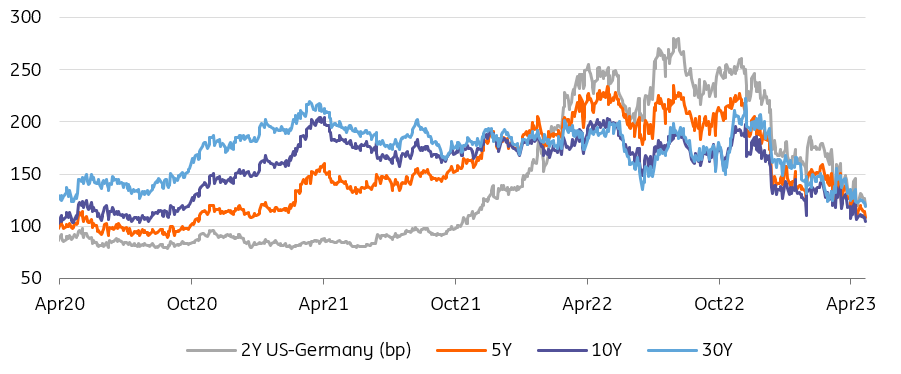

The US regional banking crisis is yet another indicator that points to a marked slowdown in the US later this year. The European economy’s resilience has frustrated our call for an end to the European Central Bank hiking cycle, which we now see ending in June and which the market implies could continue until July. Our call for a convergence in rates was mostly driven by a call for lower dollar rates, but Europe’s resilience has accelerated the narrowing of dollar-euro rates differentials. We should also note that the recent strength seen in UK data has meant sterling bonds outperformed their US dollar counterparts, tarnishing our record for our third 2023 call.

Narrowing rates differentials have been a key theme in 2023, in otherwise range-bound markets.

Narrowing Rates Differentials

Narrowing Rates Differentials

Source: Refinitiv, ING

Waiting for the next inflation release

Let us take a more short-term focus. Markets very much await the next batch of inflation releases from the US and Europe to make up their mind about the next policy steps. In this context, the appetite to chase yields above the top of their recent ranges (roughly 3.6% for 10Y Treasuries and 2.5% for 10Y Bund) is likely to be limited.

This is especially true since these releases will be followed by Fed and ECB policy meetings next week. This doesn’t rule out higher yields entirely, however. Lack of risk appetite also means a limited capacity to fade sudden market moves, and both Fed and ECB officials have encouraged the recent hawkish repricing higher in yields.

The appetite to chase yields above the top of their recent ranges is likely to be limited

If rates are range-bound for now, the market’s default mode seems to be re-flattening. Perhaps this isn’t entirely surprising given the recent jump higher in yields from their post-Silicon Valley Bank lows, but this is yet another sign that markets aren’t as convinced as we are of an imminent end to hiking cycles. Fortunately for us, these doubts are more salient in Europe. This means that even as the direction of rates remains sideways, the compression of rates differentials continues apace.

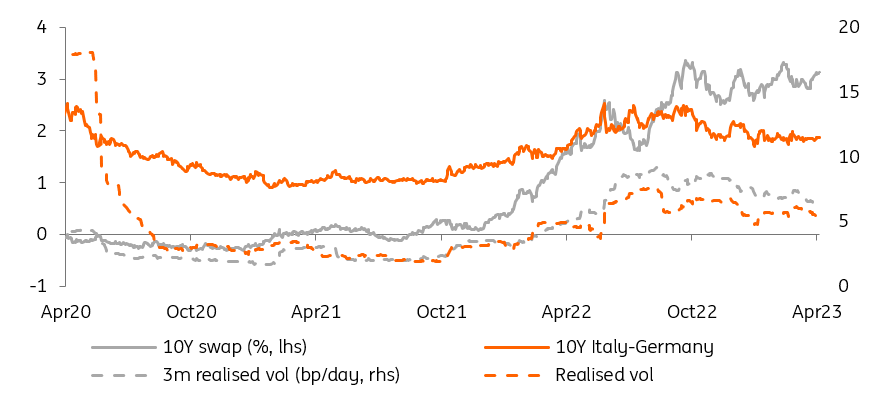

One last theme that has wrong-footed us this year has been the relative resilience of European sovereign spreads. Perhaps surprisingly, given their historically high sensitivity to ECB policy changes, spreads have remained well below their 2022 peak. That statement underplays the strength of high beta sovereign bond markets, however. As measured by realised spreads volatility, we have to go back to early 2022 to find a period of such calm. Given the amount of policy tightening that has been implemented since, this is nothing short of remarkable.

Spreads’ realised volatility has collapsed even faster than rates volatility.

Spreads’ Realised Volatility

Spreads’ Realised Volatility

Source: Refinitiv, ING

Today’s events and market view

Germany is firing on all cylinders today, with a 3Y auction complementing the launch of a new 10Y green Bund via syndication.

The main release to note today is the conference board consumer confidence index. Stabilization at a moderate level is expected, but it is the details of the job market situation that will likely receive the most attention. Other data releases include three regional Fed surveys from the Philadelphia, Richmond, and Dallas Feds, and two housing indicators, US house prices and new home sales.

The dip-buyers that are active in the US Treasury market seem to elude their euro-denominated equivalents as ECB hawks grow more vocal. Isabel Schnabel signaled in no uncertain terms that a 50bp hike in May is on the table. The ECB’s bank lending survey and the April inflation report (member states’ publications start this Friday) will be key in deciding between 25bp or 50bp but in light of such comments, the terminal rate priced by the curve for later this year is fast approaching 4%. As a result, 10Y US-Germany spreads have crossed through 100bp, and we think a dip to 75bp is now a clear possibility.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post