Rates Spark: No Season For Flip Flops

2022.10.12 10:42

[ad_1]

US data and policy should remind markets of the difficulty in timing the Fed’s pivot. Conditions for market volatility should remain in place until year-end. The Bank of England is keeping gilt investors on their toes – expect more volatility, and more interventions

Navigating on sight

Rates markets can look forward to a couple of days driven not by Bank of England (BoE) intervention on the gilt market, but by old-fashioned macroeconomic drivers. This is the hope at least. Today’s US and Federal Open Market Committee will be reminders that the hawkish Fed juggernaut and strong wrecking ball are the key forces behind the current market volatility. This will be followed by US tomorrow.

The hawkish Fed juggernaut and strong dollar wrecking ball are the key forces behind the current market volatility

Markets are on high alert for a Fed pivot, and have been disappointed so far. Some Fed speakers of late have highlighted that the Fed will soon be in an area where there are two-way risks to tightening policy. If similar comments were made in the minutes, they are likely to get much airplay. In plain English, some Fed officials are worrying about over-tightening but recent data, such as job creations and tomorrow’s CPI, should support another 75bp hike according to our US economist.

Treasury yields could well climb above 4% this year before the pivot comes into view. Markets are navigating on sight and volatility is reducing their ability to position for longer-term moves such as the end of this cycle and the subsequent cuts that some, including us, are expecting. The danger of course is that the 75bp November hike is followed by another in December (we expect 50bp), and then another in February (we expect none), should data fail to turn as quickly as we think.

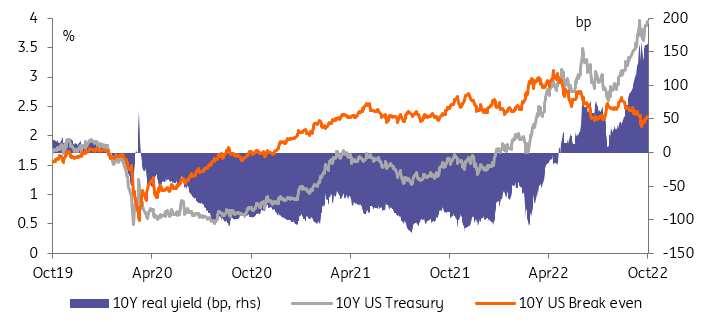

Rising real yields and falling inflation swaps suggest the Fed will reach its target

Rising real yields and falling inflation swaps

Rising real yields and falling inflation swaps

The BoE sticks to piecemeal intervention

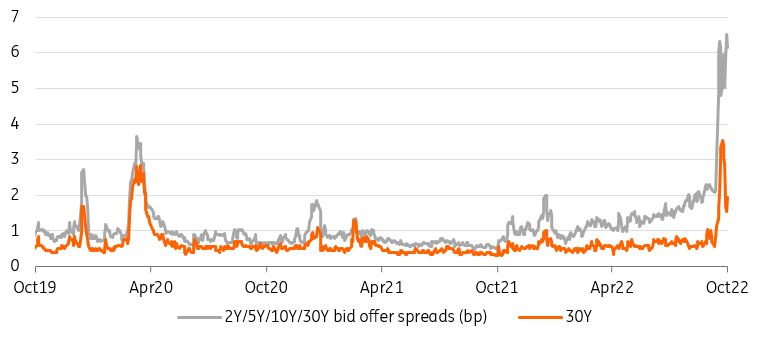

The BoE’s game of financial whack-a-mole pushed it to announce purchases of gilt linkers yesterday morning. The first operation was more successful than its earlier conventional gilt counterparts, managing to hoover up almost £2bn. Gilt markets remain understandably nervous about the end of the purchases scheduled for this Friday. The is still the worst performing sector on the curve, but at least some measures of bid-offer spreads have tightened from the extreme levels reached in late September.

The underlying concern for gilt investors remains of course the lack of BoE commitment to support the market in times of stress. Interventions have so far been piecemeal, targeted, and limited in scope and time. Markets are, rightly in our view, inferring that there is strong reluctance at the monetary arm of the BoE to engage in any operations that could expose it to accusations of monetary financing, or more simply to contradict its monetary tightening stance.

Our base case is for a continued gilt sell-off followed by more BoE intervention

All these concerns are understandable but the end result is markets questioning the efficacy of BoE market intervention. History has shown that central bank interventions need to have as little restriction in time or amount in order to be effective. The alternative, market jitters close to each intervention cliff edge (the next one is this Friday), could serve a purpose however. Effectively, by not extending its support in time, the BoE is piling pressure on pension funds to use the facility before it expires. We’re far from a level of purchases that would reassure markets, however, for now our base case is for a continued gilt sell-off followed by more BoE intervention.

Tha approach of dealing with cliff edges and market stress when they arise was highlighted by Andrew Bailey yesterday evening. The governor repeated the BoE’s ultimatum to pension funds, that they had only three more days to reduce their interest rates exposure before gilt support ends. The stance seemed later contradicted by an article in the Financial Times saying the Bank is ready to extend purchases.

Gilt bid-offer spreads remain elevated but there is some improvement at the long end

Today’s events and market view

European industrial production features prominently on today’s European economic calendar.

Germany () and Portugal (/) will be today’s supply slate.

In the afternoon, US PPI will set the stage to tomorrow’s CPI. The September FOMC minutes will be closely scrutinised for hints of a pivot. More specifically, any worries about financial stability would resonate with markets in light of the recent volatility.

There is an impressive roster of central banks today to crown this already busy events calendar. Andrew Bailey and Christine Lagarde of the BoE and ECB respectively will be the headliners. It is hard to imagine the BoE governor acknowledging that he expects more gilts purchases, with the focus of his comments more likely to be the fight against inflation. In that light, this should not prove a very positive session for gilts unless the BoE steps up its purchases again (see above).

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

[ad_2]

Source link