Rates Spark: No News Is Bad News

2022.06.21 13:31

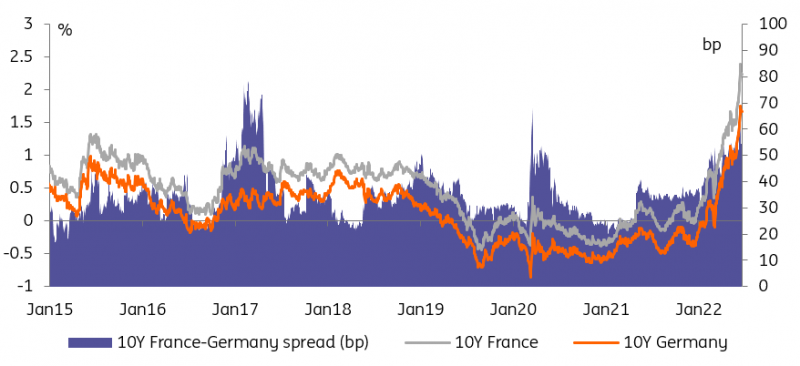

Markets ignoring French election results suggests that their fear of monetary tightening supersedes other drivers. The ECB has managed to cap sovereign spreads for now, but questions remain about its new instrument, and its impact on semi core bonds such as France’s.

French bonds shrug the election results…

One reason for the lack of market reaction to the French parliamentary election results, which saw president Emmanuel Macron lose his outright majority, is that they are difficult to interpret.

From the point of view of the bond market, we think potential changes along three policy axes matter: fiscal, structural reforms, and European integration.

Macron’s political fiasco comes at a time French spreads are already wide

France-Germany 10-Year Spread Chart

France-Germany 10-Year Spread Chart

French election results are difficult to interpret

As our economist colleagues have noted, only the probability of unpopular structural reforms can be said to have decreased. Macron’s vote deficit means he may well be pushed into an alliance with center-right MPs favorable to fiscal consolidation, while the lack of domestic policy leeway might nudge the president in the direction of a more forceful defense of his European integrationist agenda.

Combined with the uncertain shape of the future governing coalition, if any, we wouldn’t blame French bonds from shrugging the outcome of this vote.

…but remain in the market’s crosshairs

The lack of strong reaction suggests that investors have a much bigger monetary fish to fry. The fate of sovereign yields and spreads is beholden to monetary policy and, in that regard, European Central Bank (ECB) comments should continue to carry disproportionate importance in setting price action.

In a monetary tightening environment, it is logical that spreads would widen, to 55bp in the case of 10Y France-Germany, compared to an average of 34bp in the QE era that started in 2015.

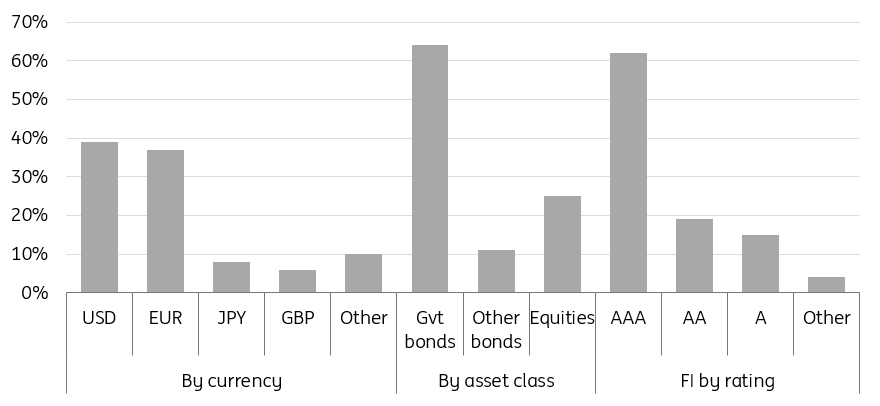

SNB bond-holding statistics suggest France is at risk in case of FX intervention

SNB Bond-Holding Statistics

SNB Bond-Holding Statistics

The ECB’s instrument against financial fragmentation is a double edged sword

The ECB’s promise to unveil an instrument against financial fragmentation is a double edged sword. French spreads benefitted from their correlation with Italy last week but one of the proposals under review, according to Bloomberg, is for the ECB to sell core bonds each time it buys peripheral debt.

The shape of the new facility isn’t the only unknown. Martins Kazaks seemed to suggest in an interview yesterday that the bar for ECB intervention is high. This adds to worries that SNB FX intervention could be most damaging to semi-core bonds, judging from its latest foreign bondholding statistics.

While spreads are distracting from the real issue

The debate about the shape and uses of this new fragmentation instrument has acted as a distraction to the more important debate: to what degree does the ECB need to tighten policy in the coming quarters.

Lagarde repeated yesterday that the first increment will be a 25bp hike in July, but the pressure is building for a larger move. Assuming the ECB sticks to its guns, this will only increase the market hike discount for subsequent meetings.

This is particularly true with energy prices remaining stubbornly high, and with elevated geopolitical tensions in Eastern Europe.

Linking hikes to wages would raise fears of over-tightening at the ECB

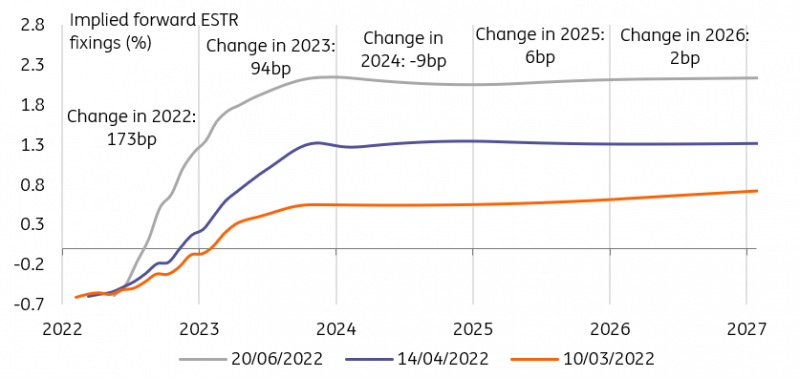

Implied Forward ESTR Fixings

Implied Forward ESTR Fixings

Lagarde raised the risk of over-tightening and subsequent easing perceived by the market

In that respect, her comment that wages have picked up, and that the portion of employee compensation covered by collective negotiation clauses will remain above average in the coming years, did resonate with markets.

More than an admission that investors are right in anticipating the case for hikes to only strengthen in the coming quarters, it also suggests the ECB is setting policy based on a lagging indicator.

This, to us justifies a further inversion of Estr forwards, as Lagarde raised the risk of over-tightening and subsequent easing perceived by the market.

Today’s events and market view

Supply consists on the EU launching a new 25Y green bond. This long-end deal is one of the few primary market deals this week and we think it has contributed to the long-end underperformance in recent days.

With elevated energy prices and hawkish central banks, we expect the front-end to take the lead in any subsequent bond market sell off.

Central bank speakers will never be far from investors’ minds, with interventions from Lauretta Mester and Thomas Barkin. Earlier in the day, Huw Pill of the Bank of England and Olli Rehn of the European Central Bank spoke.

Disclaimer: