Rates Spark: Higher for Longer Hits Selectively, for Now

2023.02.15 16:00

Higher-for-Longer Narrative Hurts Bond Longs

Monthly came in line with expectations in January. After hesitating, rates went resolutely higher. Given the lack of a clear signal in the CPI report, we take this as a sign that there are still complacent longs vulnerable to the higher-for-longer narrative. decisively crossed the 3.75% threshold, and the is quickly converging to 5%. The 2Y reaching 5% would either presuppose a much higher terminal rate than currently priced (5.25%) or hardly any rate cut within that horizon. It’s a tall order, but momentum is on the side of bears.

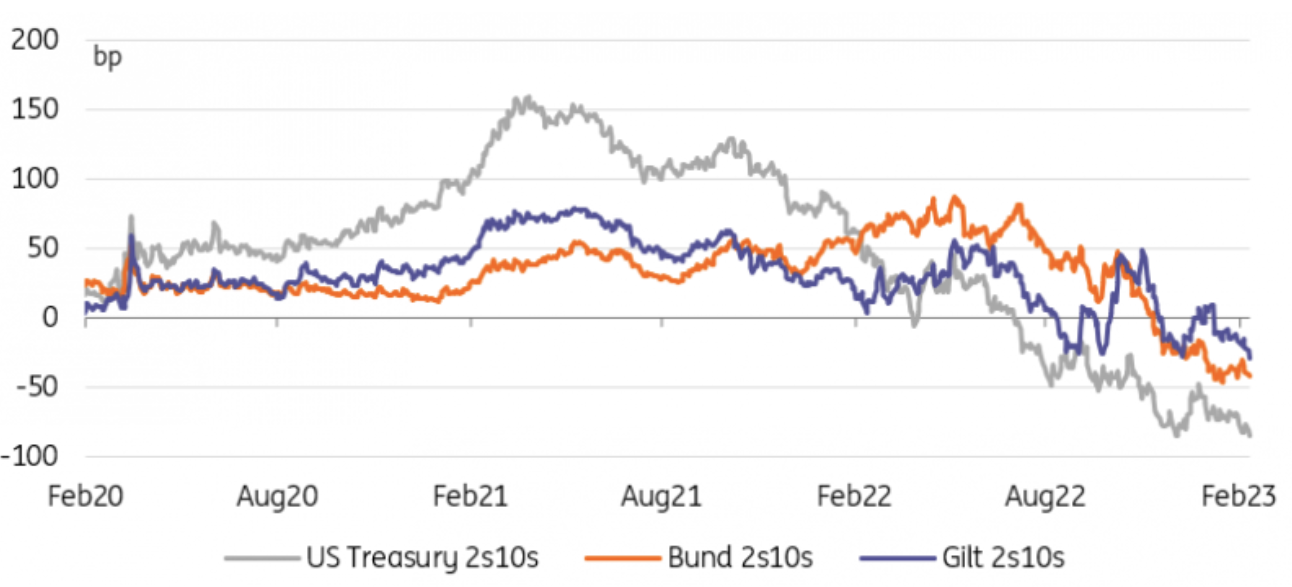

In comparison, the curve flattening at longer tenors seems like a relatively slow-burning trend, but 2s10s have reached the flattest level since the 1980s. A more hawkish path for Fed funds rates is the main culprit but it is easy to forget how long-end rates are anchored, making the current inversion possible. At its core, low long-term rates simply illustrate that markets aren’t easily changing their view on the equilibrium levels of real rates and inflation. In practice, we think the remnants of past Federal Reserve intervention in the bond market continue to suppress term premium, and keep the curve flatter than it would otherwise be.

The good news is that our economics team sees declining to 2% by year-end. Even if we were to miss that forecast by a full percentage point, we think this will be significant relief for financial markets. This is not the way investors think at the moment, however, and today’s data should further delay the move lower in that we’re expecting for later this year.

-

Past Fed Bond Market Intervention Is Preventing Longer Rates From Rising as Fast as the Short End

U.S., Germany, U.K. Yield Curves

U.S., Germany, U.K. Yield Curves

Source: Refinitiv, ING

Risk Sentiment Stronger Than Ever, but Sovereign Risk Is Unattractive

Unlike their high-rated peers, high-beta fixed-income markets are still enjoying their moment in the sun. This is in sharp contrast to 2022 when anticipation of tighter monetary policy sent stocks down and credit spreads wider. On paper, the current repricing higher in core rates in response to better growth prospects is the right kind of tightening. But, in the words of Lorie Logan of the Dallas Fed, rates may have to be raised “to respond to changes in the economic outlook or to offset any undesired easing of financing conditions.” Understand, the Fed would hike to cool growth and/or financial markets. This, to us, sounds like a direct shot at Goldilocks carrying market sentiment on her shoulders since January.

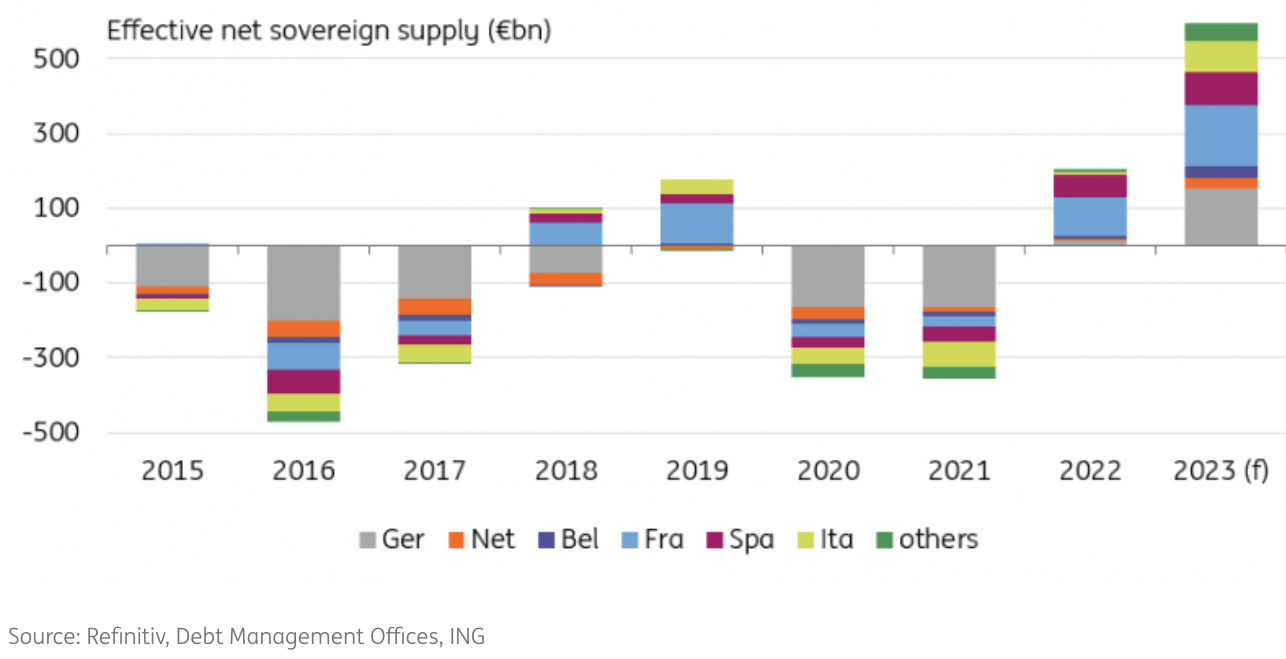

European sovereign spreads are one area where better risk appetite is most visible. On paper, all is going well – higher beta bonds benefit both from central bank easing expectations, and from better growth prospects. The first assumption is being questioned, and near-term data shouldn’t distract from weakening economic fundamentals, albeit deteriorating slower than expected. Even if risk sentiment holds up, there are plenty of political catalysts for risk appetite to soften going forward. The Italian government is locking horns with the European Commission over the suspension of the Stability and Growth Pact, and over the pre-agreed national recovery plans. Farther afield, Greece and Spain both have elections due this year. All this should compound greater supply pressure this year.

-

There Are Plenty of Risks for Sovereign Spreads, Not Least Supply

Effective Net Sovereign Supply by Country

Effective Net Sovereign Supply by Country

***

Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. This publication has been prepared by ING solely for information purposes without regard to any particular user’s investment objectives, financial situation, or means. For our full disclaimer please click here.

Original post