Rates Spark: Headline Risk

2023.01.10 09:05

[ad_1]

A lot of central bank comments will hit newswires today, but the odds of any meaningful signal being communicated to markets are low. On balance, we expect bonds to retain their bullish bias as long as today’s deals are well absorbed

Bonds Keep Bullish Bias and Look Past Powell

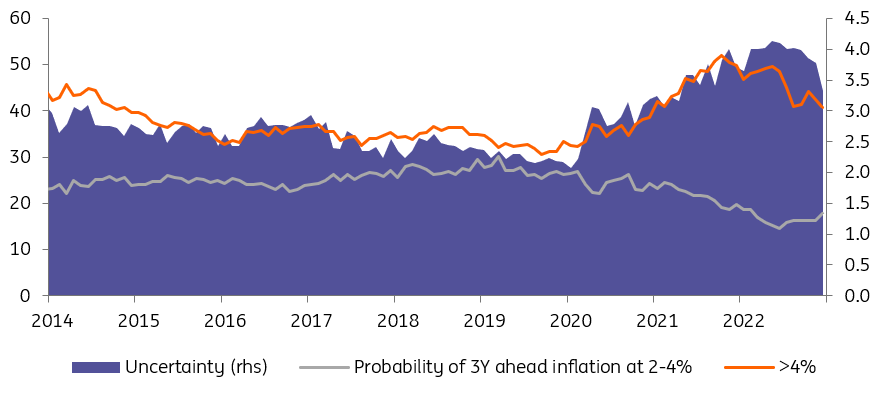

Bonds continue to trade with a bullish bias. After weakness at the open yesterday, fixed-income markets recovered the ground lost thanks to the New York Fed consumer expectations survey seemingly confirming that the inflation upside is abating. Most notable was the reduction in uncertainty and falling probability of three years ahead inflation remaining above 4%. Taken together, they aren’t sufficient to conclude that inflation is heading back to the Fed’s 2% target, but they will comfort investors in their view that the period of jumbo hikes from the Fed trying to cap inflation upside is behind us.

Too sharp a fall in market interest rates is detrimental to the Fed’s objective

The end of the Fed’s interest rate shock therapy is proving particularly beneficial for risk assets. In rates, the long-end has benefitted the most, courtesy of growing rate cut expectations: almost 50bp from the Fed Fund peak this year, and a further 150bp in 2024. While we agree, too sharp a fall in market interest rates is detrimental to the Fed’s objective. Indeed, while encouraging inflation news may spell the end of the aggressive phase of this tightening cycle, we expect the Fed to continue pushing back against cut expectations. This is in order to prevent financial conditions from easing too fast and undoing its policy-tightening work. Raphael Bostic was for instance insisting yesterday that the Fed should hold a rate above 5% through 2024.

Chair Jerome Powell is listed among today’s speakers. His attempts to impress his hawkish view on markets in recent months ended in failure. Recent data have, on balance, made his job even more difficult. For now, the focus is on the size of the next hike. Markets think 25bp is more likely, and both Bostic and Mary Daly said yesterday this is one of the options on the table. But the next step absents an effective pushback from the Fed is for the curve to price out any subsequent hikes, or even to price no more hikes in this cycle. Markets don’t need much encouragement to see the dovish side of everything.

US consumers see lower inflation upside and inflation uncertainty within three years:

Source: Refinitiv, ING

Headline and Supply Risk Today in Europe

Over in Europe, a paper by the European Central Bank (ECB) seemed to foresee a further acceleration of wages in the coming quarters. Whilst ECB economic papers aren’t a conduit for policy signals, wages are a key piece of the inflation puzzle in Europe and elsewhere. We expect the view of research staff on that topic to be something that resonates with governing council members, and by extension with markets. Along a similar vein, Bank of England (BoE) chief economist Huw Pill listed the reasons why inflation in the UK risks being more persistent than in Europe. The speech was full of hawkish soundbites but the fact that it was mostly backward-looking provided an excuse for bonds to ignore them.

Issuance has failed to make much of a dent in the (US-led) rally in bonds

There is also a long list of ECB and BoE speakers today. If recent history is any guide, a hawkish tone will dominate but the format of panel discussions brings the risk of out-of-context comments being reflected in headlines in news services. The other main potential market-moving event today is supply. So far, issuance has failed to make much of a dent in the (US-led) rally in bonds but much will depend on how well each deal is received.

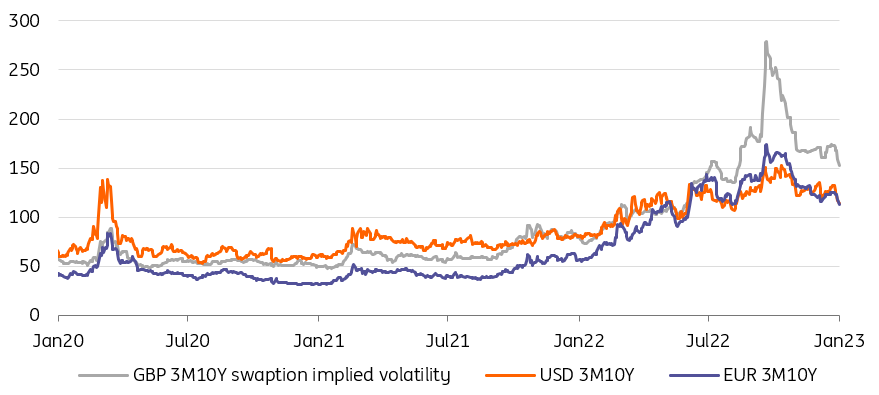

Falling implied volatility shows markets think the central bank shock therapy is behind us:

Source: Refinitiv, ING

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

[ad_2]