“Rally Over or Just Beginning?” Stock Market (and Sentiment Results)…

2023.12.21 11:04

Short Term Pain (maybe)?

Yesterday’s sell-off in equity markets coincided with another weak Treasury bond auction. That minor catalyst was compounded by the low liquidity of holiday markets.

Friday’s Core PCE inflation numbers should put the final nail in the coffin for any Fed Cut doubters. I doubt you will see any more officials paraded out (with a straight face) to try to walk back Powell’s dovish pivot after Friday’s print.

There is good instinct from many market participants that we’ve come “too far, too fast” – in recent weeks – and must now have a correction. They are probably right – to a degree… Here’s what they are looking at:

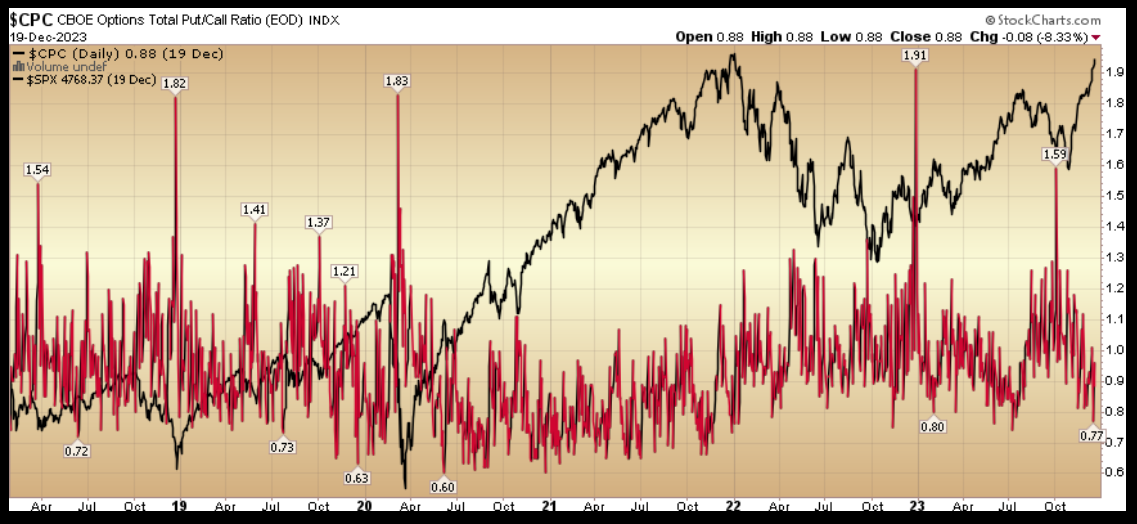

Put/Call Ratio-

CBOE Options Total Put/Call Ratio

CBOE Options Total Put/Call Ratio

All of the biggest bears who have missed the rally since the October 2022 (and Oct 2023) lows are now reluctantly and resistantly turning bullish “opinion follows trend”

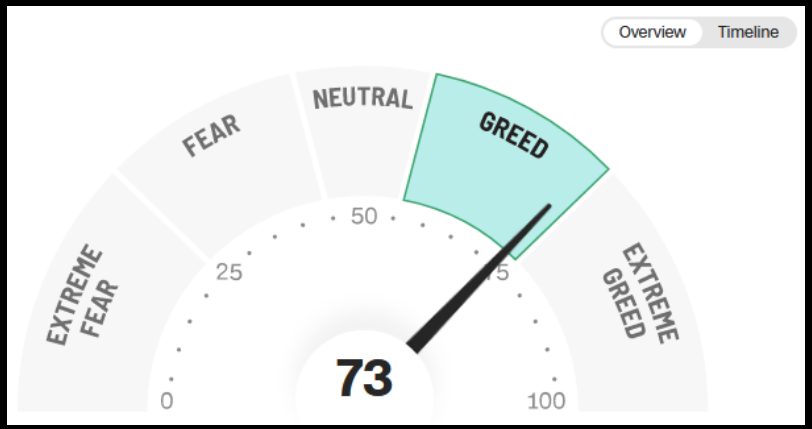

CNN Fear and Greed:

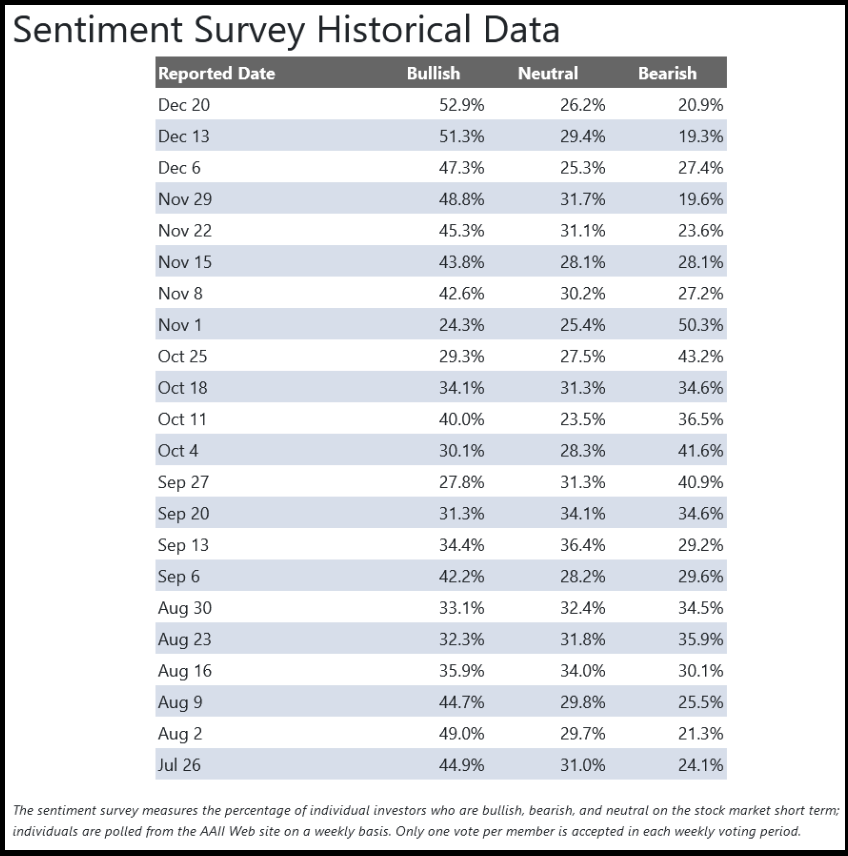

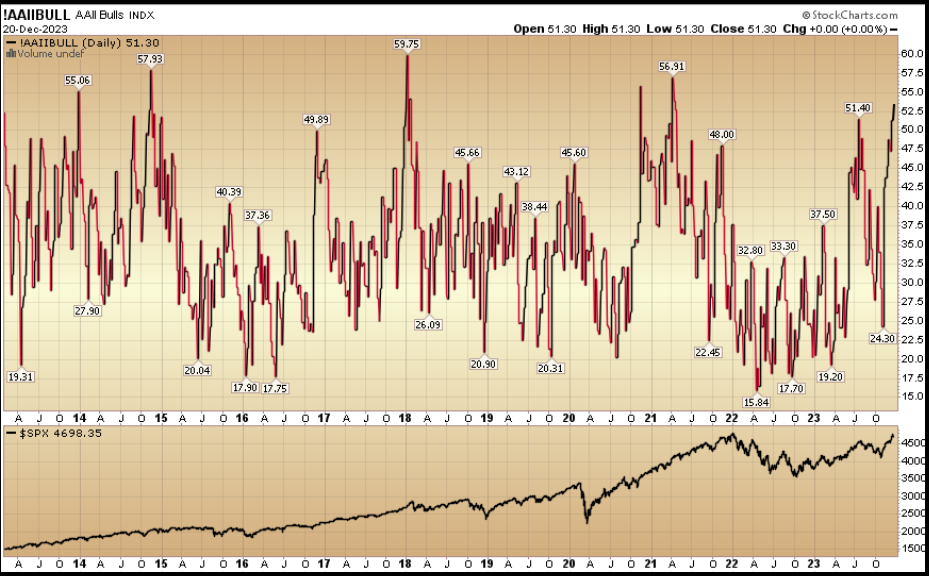

AAII Sentiment Survey Stretched:

Sentiment Survey Historical Data

Sentiment Survey Historical Data

National Association of Active Investment Managers Equity Exposure Index:

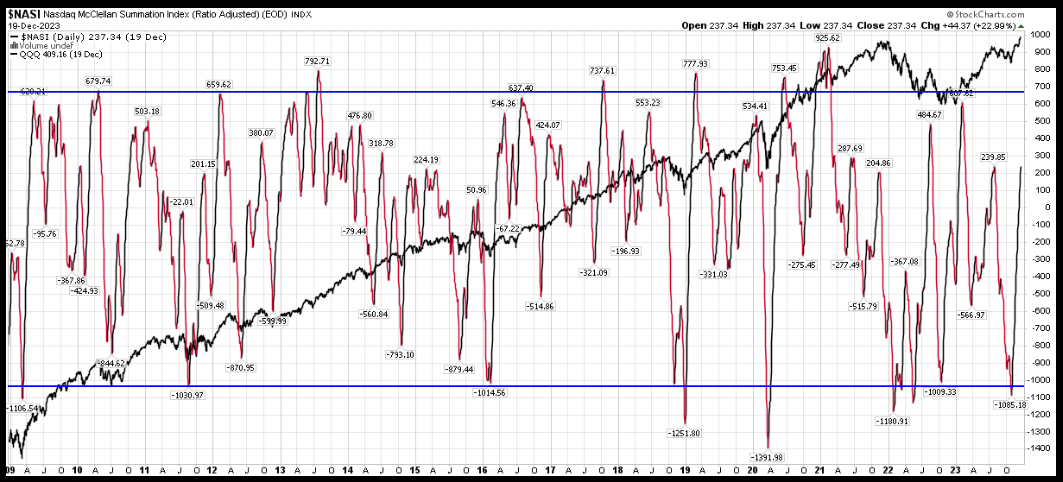

McClellan Summation Index:

Nasdaq McClellan Summation Index

Nasdaq McClellan Summation Index

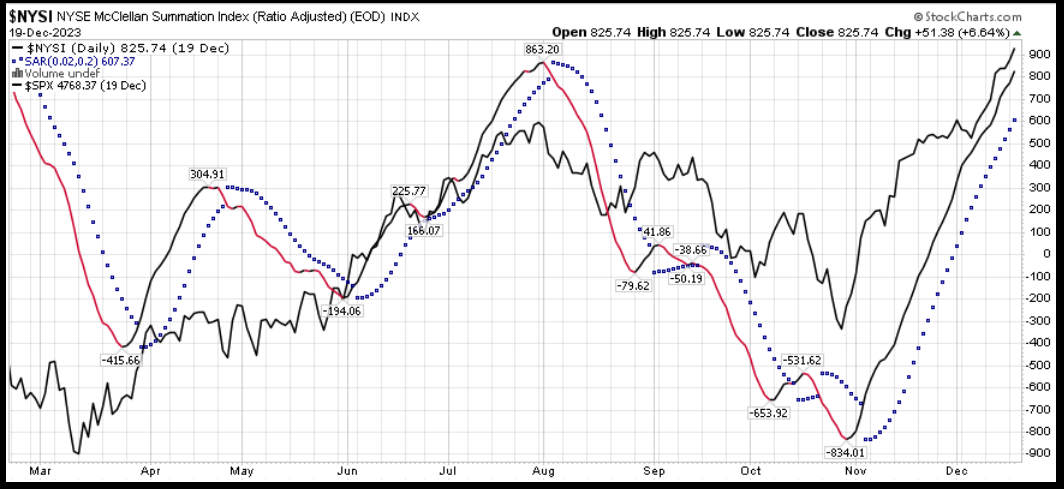

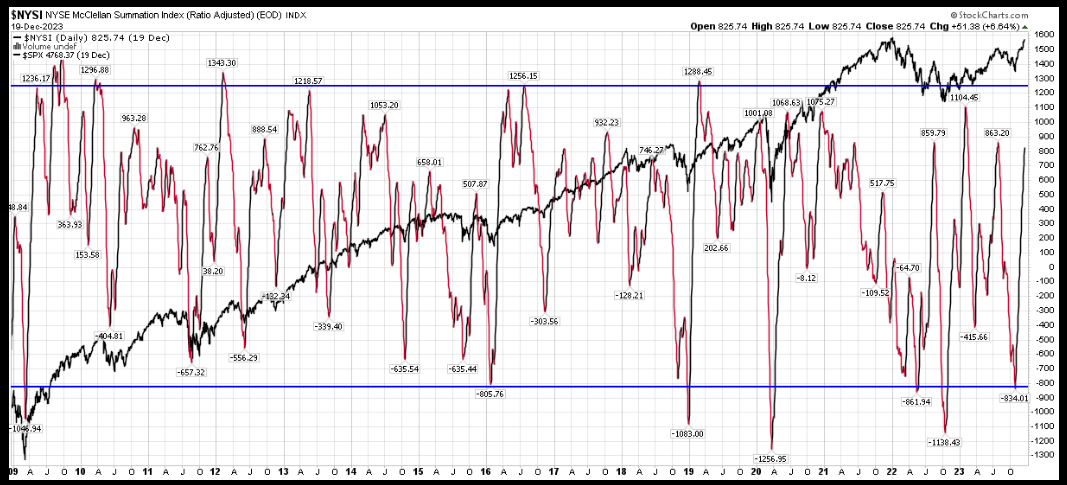

NYSE McClellan Summation Index:

NYSE McClellan Summation Index

NYSE McClellan Summation Index

NYSE McClellan Summation Index

NYSE McClellan Summation Index

Option Skew:

Bullish Percent:

Nasdaq 100 Bullish Percent Index

Nasdaq 100 Bullish Percent Index

Bullish Percent:

Nasdaq Composite Bullish Percent Index

Nasdaq Composite Bullish Percent Index

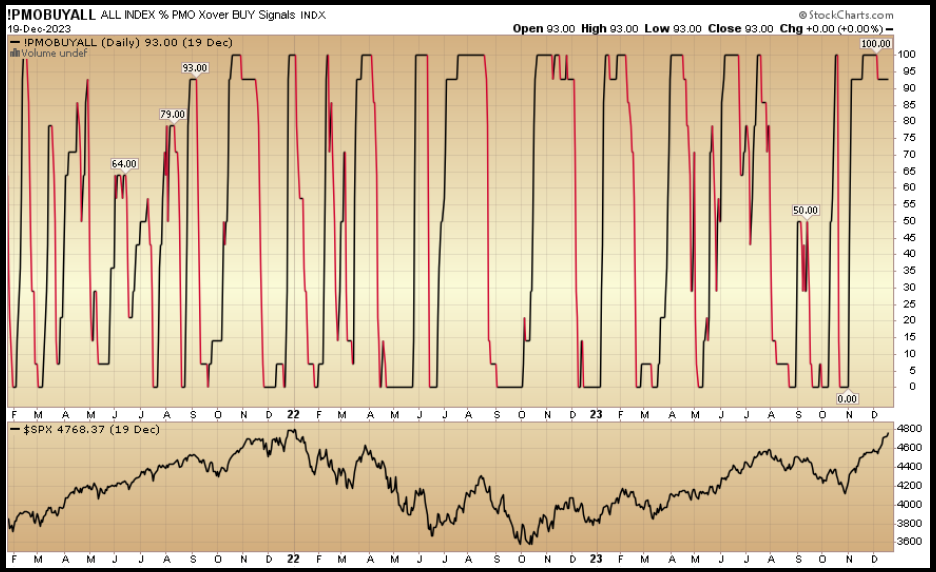

Percent of stocks on PMO crossover buy signal:

ALL INDEX % PMO Xover Buy Signals

ALL INDEX % PMO Xover Buy Signals

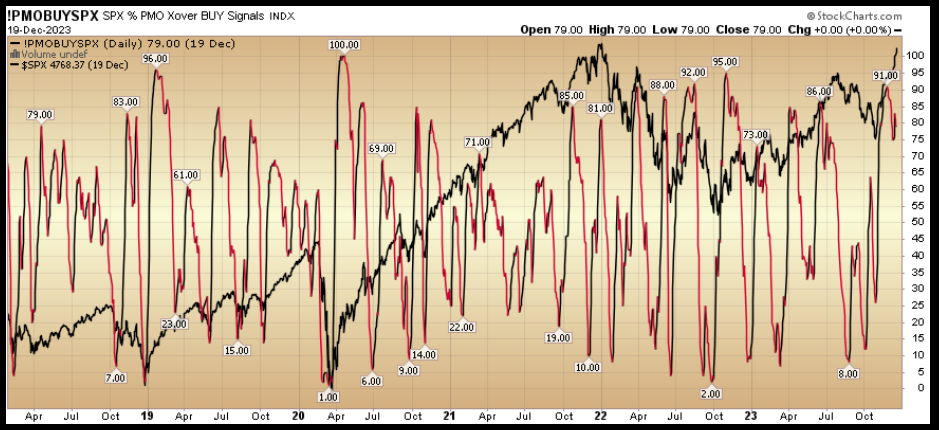

Percent of S&P 500 stocks on PMO crossover buy signal:

SPX % PMO Xover BUY Signals

SPX % PMO Xover BUY Signals

Or, Long Term Gain (our view)?

We are big proponents of “zooming out,” and while we acknowledge there are aspects that point to short term “overstretched” conditions, we don’t intend to get too cute with it. Here’s what WE are looking at:

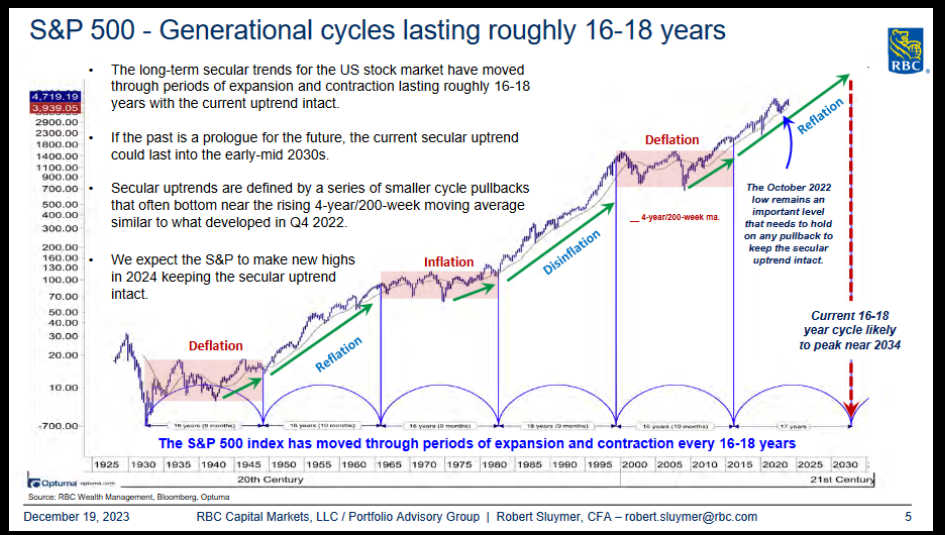

The above chart shows the last 14 years of multi-year correction recoveries followed by ~2 year consolidations of gains (blue boxes). It appears we have just finished a 2 year consolidation (with ~0% gains for the S&P 500 since 2021) which will be followed by a few years of nice gains. You can also see at the end of each consolidation (blue box), you get 2-3 months of a check back before you see the next move higher. It appears we got our “check back” in the 3 circled red months from Aug-Oct. Most people are strangled by recency bias (because the last two years have been continuous “hope dashing” – leading to a view that this time can’t be real and it’s time to “take profits”).

They may be right for a few percent move, but I would not get too cute trying to play it. Sure there may be some profit taking in Jan (or Feb), but do you really want to be out of great companies if they have not yet reached your predetermined target of intrinsic value – just to save you a couple of tums tablets for short term volatility? I don’t. Do you want to give up 1-3% of your equity upside so that your “monthly” statement looks pretty (with low volatility), when it will only cost you compounding in the intermediate to long-term? I don’t.

Here’s the lens we are looking through and have shared with you since 2020. We believe we are mid-cycle in a normal secular bull market (18-20 years) that broke out to new highs ~2013:

S&P 500 – Generational cycles lasting roughly 16-18 years

S&P 500 – Generational cycles lasting roughly 16-18 years

Robert Sluymer version RBC (TSX:)

This is predicated on the largest portion of the population being ~33-34 years old (Millennials) and beginning housing and family formation. History shows this consumption level persists until they reach their early 40’s and then slows down dramatically. That takes us to the early 2030’s. Prior to then, it remains a “buy the dips/corrections” environment. There will be plenty of bumps in the road but the trend is up and it will be a period where fortunes are made due to consumption, innovation and productivity tailwinds.

Put simply, fortunes will be made and multiplied over the next 6-8 years. If you do not have money allocated to equities or a good equity manager you will miss out on a rare period in history. Maybe not in the next few days or weeks (you may even feel smart missing a few percent of volatility), but over months or years you will kick yourself. These opportunities show up a couple times in a lifetime. If you snooze, waiting for the perfect “dip” you will loose. You only have to ride these opportunities correctly ONCE…

We’ve talked about some of the specific names in recent weeks’ podcast|videocast(s) and our clients can see a number of them in their portfolios.

High Yield Credit Spreads declining (cost/availability of capital):

ICE BofA US High Yield Index

ICE BofA US High Yield Index

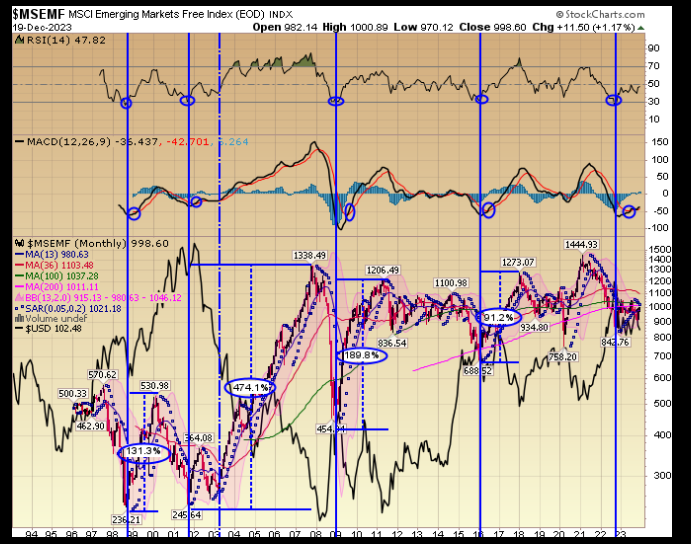

Emerging Markets Starting turn up as Fed steps back and Dollar weakens (a big focus prospectively):

MSCI Emerging Markets Free Index

MSCI Emerging Markets Free Index

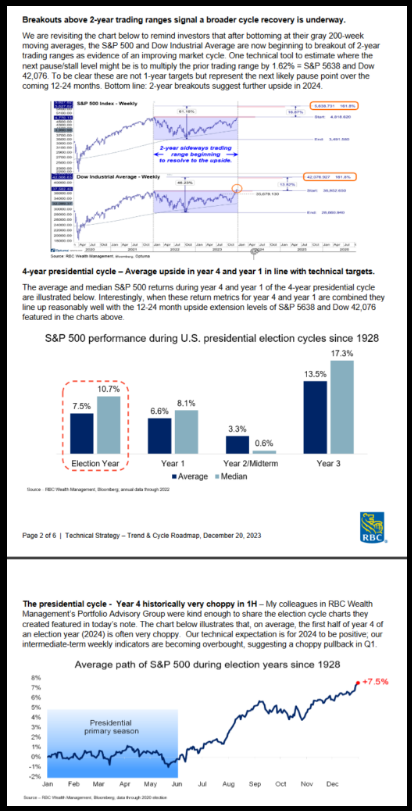

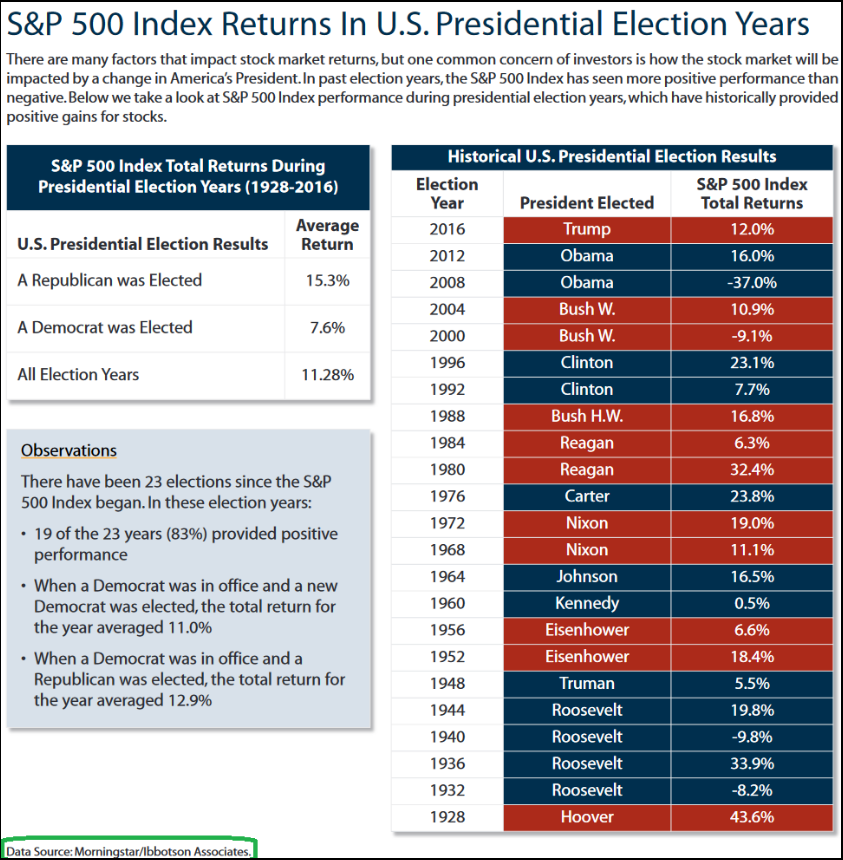

Breakouts and Election Years (Robert Sluymer RBC):

Breakouts and Election Years

S&P 500 Index Returns In U.S.Presidential election years

S&P 500 Index Returns In U.S.Presidential election years

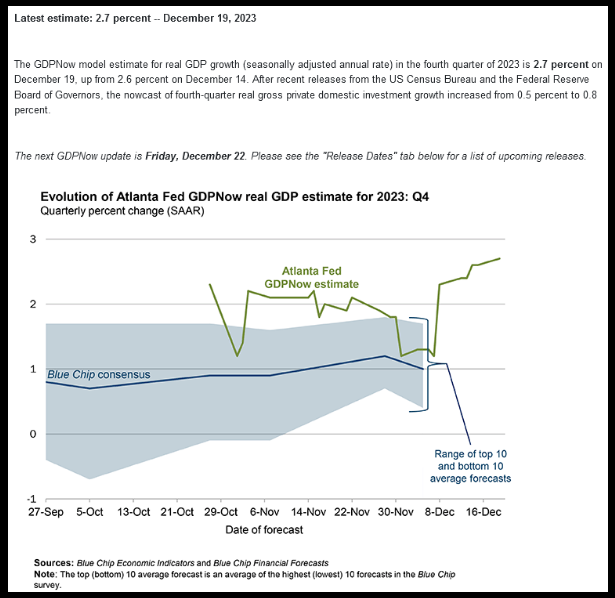

GDP continues to trend UP:

Evolution of Atlanta Fed GDPNow real GDP estimate for 2023: Q4

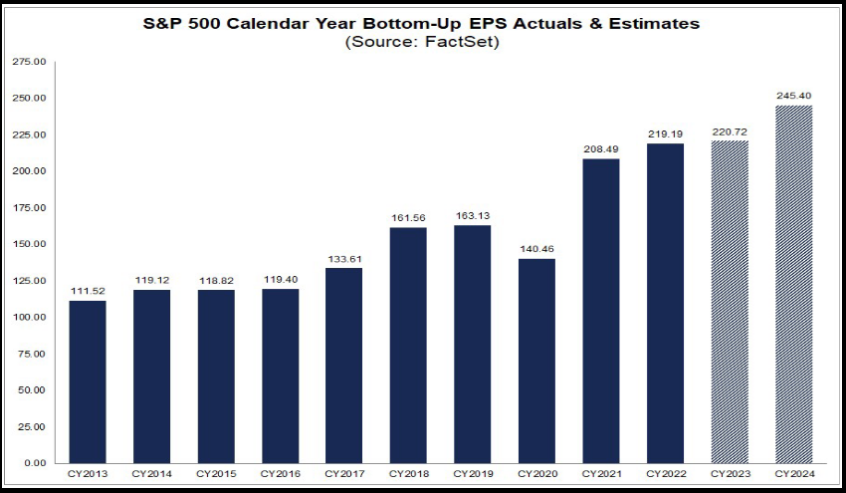

Earnings growth (and margins) re-accelerate(s) in 2024:

S&P 500 Calendar Year Bottom-Up EPS Actuals & Estimates

S&P 500 Calendar Year Bottom-Up EPS Actuals & Estimates

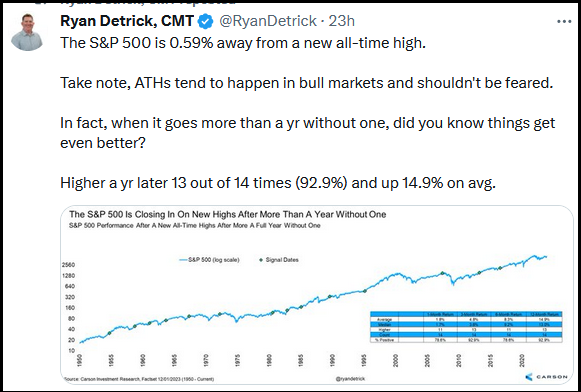

Quantitative stats. Like 2020 (and 2009) when you get a violent move off the lows – people always expect a leg down because they either missed the move or are fooled by recency bias:

The S&P 500 is Closing in on New Highs After More than a year

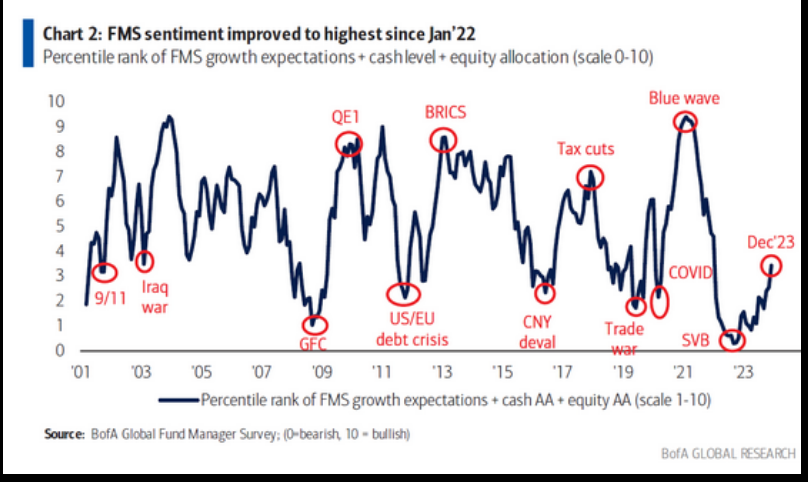

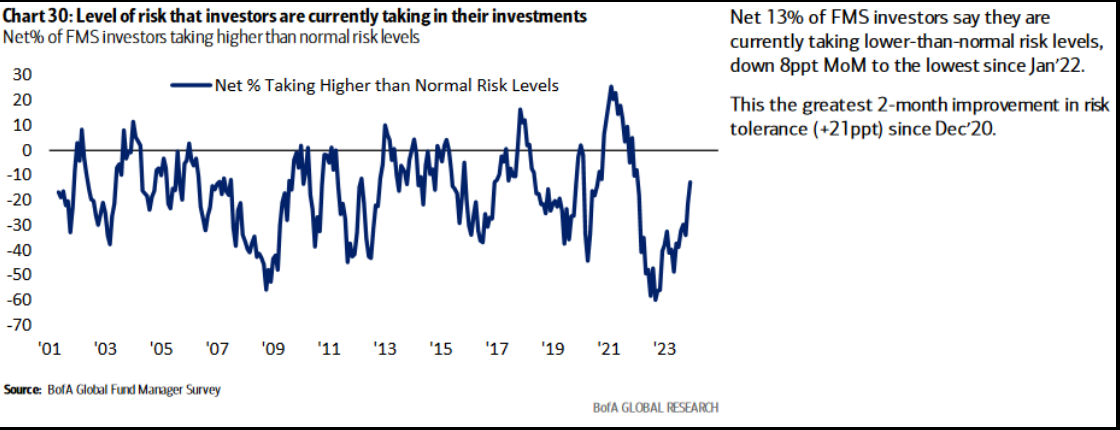

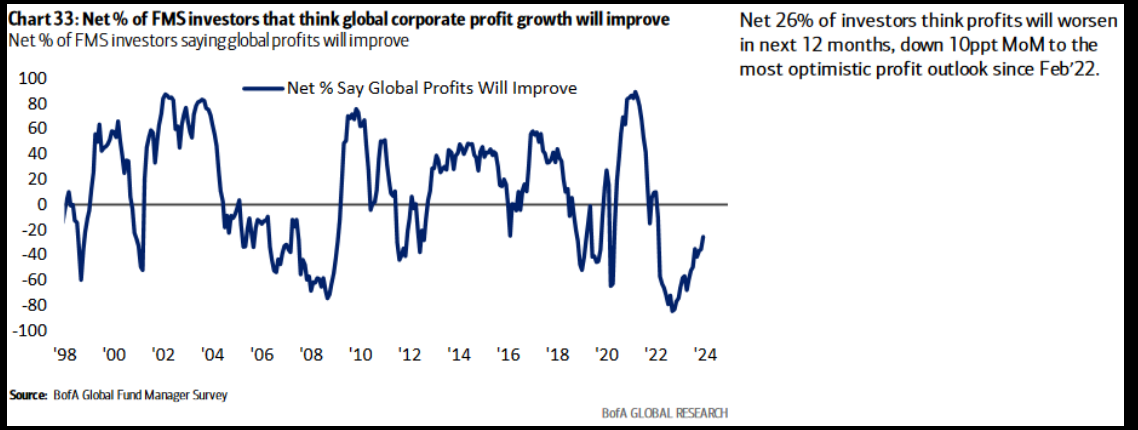

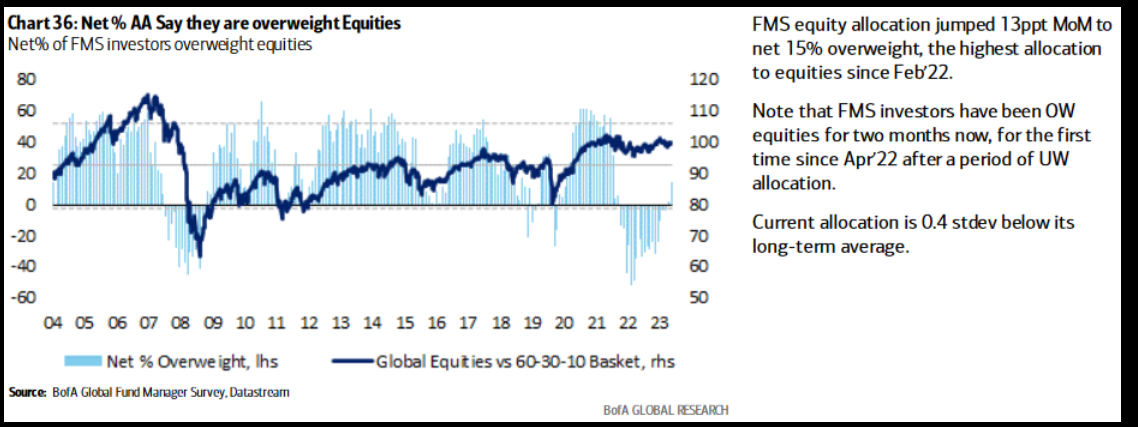

Institutional Positioning, Sentiment and Outlook JUST GETTING OFF THE MAT (full summary for Bank of America (NYSE:) Survey HERE):

FMS sentiment improved to highest since Jan’22

FMS sentiment improved to highest since Jan’22

Level of risk that investors are currently taking in their investme

Level of risk that investors are currently taking in their investme

Net% of FMS investors that think global corporate profit growth wil

Net% of FMS investors that think global corporate profit growth wil

Net% AA Say they are overweight Equities

Net% AA Say they are overweight Equities

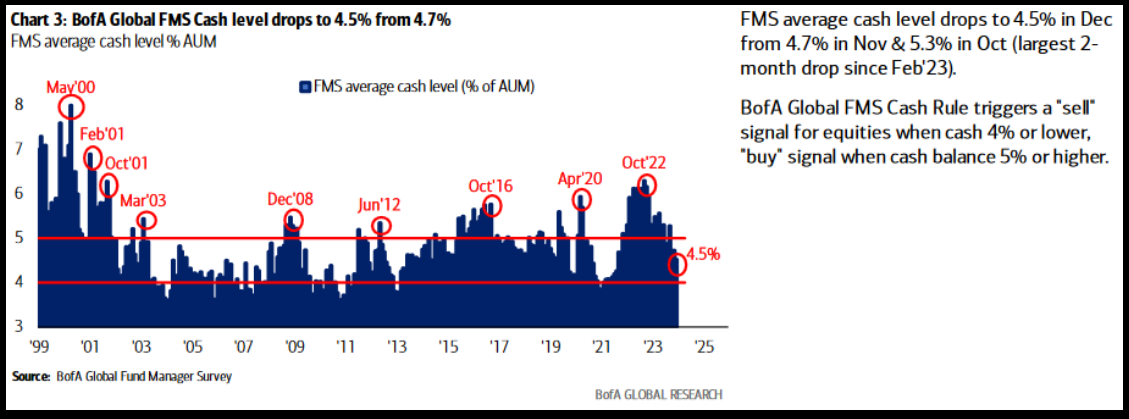

BofA Global FMS Cash level drops of 4.5% from 4.7%

BofA Global FMS Cash level drops of 4.5% from 4.7%

This content was originally published on Hedgefundtips.com.