Powell Testimony Eyed as Trump’s Tariffs Raise Inflation Risks

2025.02.11 08:43

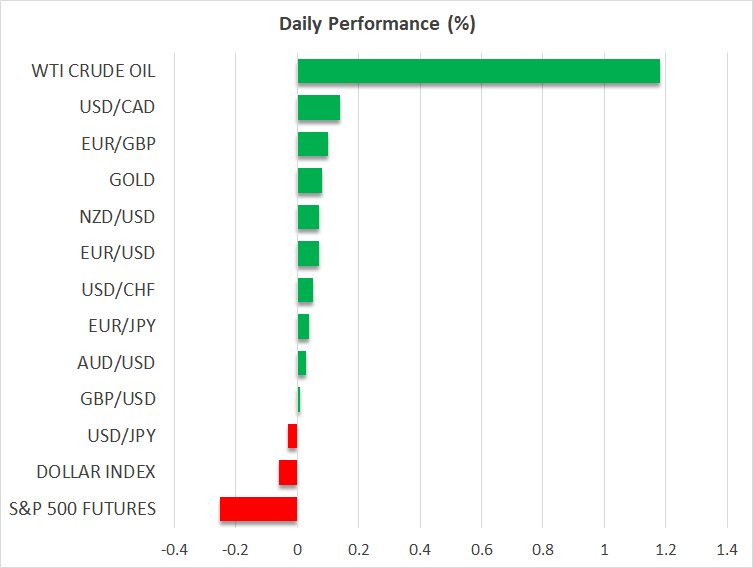

- Dollar extends tariff gains ahead of Powell’s congressional hearing.

- Stocks mixed amid limited tariff fallout.

- Gold jumps to new all-time high before retreating.

- Pound struggles as BoE’s Mann reiterates dovish pivot.

Trump’s Latest Tariffs Add to Fed’s Inflation Headache

US President Donald Trump doubled down on his tariff pledges on Monday by formally signing the executive orders for raising the duties on and to 25%. In addition, Trump repeated his threat of imposing reciprocal tariffs on “every country”, likely to be announced today or tomorrow.

The latest measures couldn’t have come at a worse time for the , which is battling to manage inflation expectations. Some market-based measures of expectations such as the two- and five-year breakeven rates have been creeping higher this year, and the latest surveys from the University of Michigan and the New York Fed suggest consumers’ expectations of inflation have also started to rise.

Fed Chair Powell has already hinted that a rate cut is unlikely at the next meeting in March but so far, most officials have maintained that further cuts are on the horizon later in the year. However, investors aren’t so sure. Rate cut bets for 2025 have fallen to around 40 basis points in recent days, meaning that only a single 25-bps reduction is fully priced in for the whole year.

Will Powell Rock the Boat?

With Trump potentially targeting more imports in the coming days and the risk of a further escalation with China, in particular, looking quite high, investors may soon start to doubt whether the Fed will cut at all this year.

This puts the spotlight on Jay Powell, who is due to begin a two-day testimony before Congress today. He will address the Senate Banking Committee at 15:00 GMT and may tell lawmakers that the Fed cannot rule out the possibility of a rate increase this year.

However, such comments would probably not go down too well with Trump, so Powell will likely try to tread the subject very lightly. Still, markets may not respond too well to any signals of a long pause and his remarks could put an end to the unusual calm that followed the latest tariff decisions.

Dollar Up on Tariffs but Stocks Muted

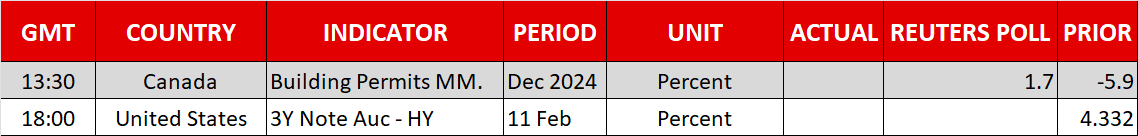

The and Treasury yields have already been edging higher in the past few sessions but there’s been no broad-based selloff in equities. The US Treasury Department plans to issue $125 billion in and notes this week, so any hawkish rhetoric from the Fed could spark some volatility in yields.

On Wall Street, traders have mostly been brushing off the tariff headlines, with only the stocks directly impacted, whether positively or negatively, seeing the most volatility. Not even the AI scare or underwhelming tech earnings have been able to shake and out of their recent consolidation phases.

Nevertheless, overall Q4 earnings growth has been stronger than the estimates at the start of the season and this is providing support, while the AI jitters appear to have merely led to a recalibration in the stock prices of the Magnificent 7 rather than a prolonged correction.

The market tone could change, however, if either Powell or the incoming US inflation data cast further doubt on the prospect of rate cuts. The CPI report for January is out tomorrow and may offer a glimmer of hope regarding the disinflation process.

Another Record High for Gold, Pound Struggles

In the meantime, has continued to march higher on the back of Trump’s protectionist as well as expansionist views. The precious metal hit a new intra-day record peak of $2,942.70 on Tuesday before pulling back to just above the $2,900 mark.

were up more than 1% as the latest US sanctions on Russia and Iran are putting a strain on supply.

In currency markets, the is somewhat underperforming today after coming under pressure from comments by Bank of England MPC member Catherine Mann, who voted for a larger 50-bps cut at last week’s policy meeting. Mann justified her surprise dovish shift by arguing that weak domestic demand will make it difficult for firms to raise prices.