Powell does not convince dollar bulls, BoE enters the spotlight

2023.06.22 06:01

- Powell signals more hikes but fails to convince dollar bulls

- BoE meets with investors split between a 25 and 50bps hike

- Wall Street pulls back, extends rally

Dollar slides as Powell again fails to convince investors

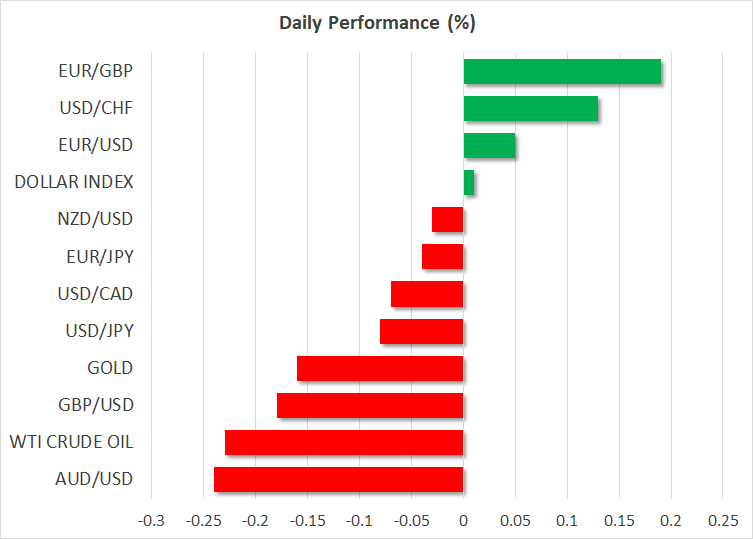

The dollar ended Wednesday lower against most of the other currencies, despite Fed Chair Powell delivering a relatively hawkish message when testifying before the House Financial Services Committee of the US Congress.

The Fed Chief said that rate increases are “a pretty good guess” of where the central bank is headed if the economy continues in the current direction. This served as another confirmation that their decision to stay sidelined in June was not the end of this tightening crusade. However, the fact that he used the word “guess” is way different than signaling two more quarter points are a done deal.

What’s more, the fact that he didn’t make any reference to a specific number of potential upcoming hikes allowed the market to maintain bets of only one more quarter-point hike, despite last week’s updated dot plot pointing to 50bps worth of additional increases. Currently, investors are convinced that another hike will be the case by November, while they are anticipating a series of rate cuts throughout 2024.

The uncertainty surrounding future hikes was heightened by comments from Chicago Fed President Goolsbee and Atlanta Fed President Raphael Bostic, who noted that they should wait and evaluate incoming data before deciding on further rate increases.

All the aforesaid developments disappointed dollar traders, prompting them to sell again, which validates the view that Tuesday’s recovery in the greenback was nothing more than a temporary boost and that it is very early to start discussing a full-scale dollar comeback.

Will the BoE rise to the occasion and hike by 50bps?

Today, Powell will have another chance to convince the market about the Fed’s intentions, when he delivers his testimony before the Senate Banking Committee. However, the main event of the day will probably be the Bank of England decision a few hours earlier.

With data yesterday pointing to further acceleration in the UK’s core inflation, investors are evenly split on whether the Bank should deliver a 25 or a 50bps hike, while they are anticipating around 150bps worth of additional rate increases in total.

Thus, for the pound to extend its gains after the decision, policymakers may need to not only press the 50bps hike button, but also deliver a message that is hawkish enough to allow market participants to maintain their aggressive hike bets. Anything less than that could result in a slide in the British currency, and considering the current market pricing, any potential fall in case of a disappointment could be notably larger than any potential gains due to a hawkish outcome. In other words, the current market pricing suggests that the risks are asymmetrical.

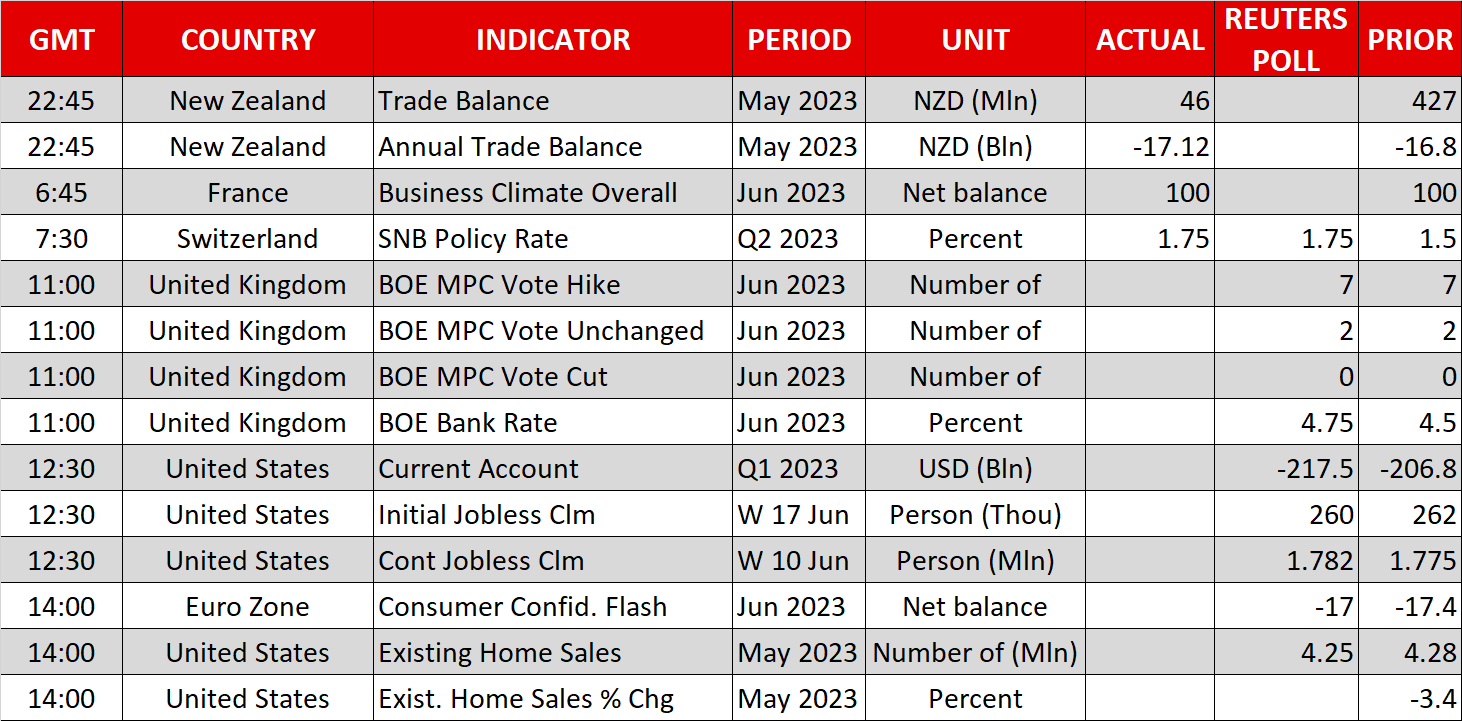

The SNB gathered today as well and announced its decision to raise interest rates by 25bps, disappointing those expecting a bigger hike and thereby pushing the franc lower.

Wall Street investors are they only ones convinced by Powell

Contrary to FX traders, equity investors perceived Powell’s testimony as adequately hawkish and subsequently continued reducing their risk exposures. All three of Wall Street’s main indices traded in the red, with the Nasdaq losing the most ground.

However, taking into account that the index pulled back only 3% after surging almost 47% from its October lows, examining a bearish case may be unwise for now, especially with market participants pricing in a series of rate cuts for next year.

In the crypto arena, Bitcoin surged above $30,000 for the first time since April, fueled by BlackRock’s announcement that they will create a bitcoin exchange-traded fund (ETF) even as the sector is facing massive regulatory pressure and scrutiny. From a technical standpoint, on Tuesday, the cryptocurrency emerged above the downward sloping trendline drawn from the high of April 14, which probably means that some further advances may be in store.