Powell does little to ease recession concerns but selloff eases

2022.06.23 13:16

- Powell talks inflation and recession but Wall Street holds its nerve

- Flash PMIs underscore recession risks, euro and pound slip

- Oil extends losses as outlook weighs, investors question supply tightness

Powell sticks to the script, mentions the ‘R’ word

Fed Chair Jerome Powell largely stuck to familiar language in his semi-annual testimony before the Senate Banking Committee on Wednesday, repeating his message that the Fed is “strongly committed” to bringing inflation down. Most market participants expect the Fed to hike rates by another 75 basis points in July after several FOMC members lined up in recent days to back such a move.

However, Powell appeared to keep his options open, refraining from providing specific guidance. Although this may not necessarily be good news for the markets as he did not rule out a 100-bps increase when asked about it by a lawmaker.

But what was more striking for investors was that Powell didn’t exactly go out of his way to soothe fears about a possible recession. Powell made it clear the Fed is not intentionally trying to “provoke” a recession but admitted that it was a possibility.

The overall takeaway from yesterday’s hearing and recent speakers is that the Fed will continue to front load its rate hikes. However, whilst this may increase the likelihood of a sharp and sudden downturn, one silver lining is that rates may peak sooner. Fed rate hike bets beyond November have already started to be scaled back and this is somewhat weighing on Treasury yields.

Oil slump likely a bigger drag for stocks than Powell

Shares on Wall Street closed marginally lower on Wednesday as investors were unable to shake-off worries about the US economy contracting in the upcoming quarters. But neither was there any panic. If anything, Powell’s acknowledgement of the real threat of a recession might have been taken as a sign by some traders that the Fed will adjust its policy if the data worsens.

The S&P 500 would probably have been able to eke out some gains if it wasn’t for the energy sector dragging the index lower.

Oil prices have been on a downward path for much of June as recession fears have intensified, dampening the demand outlook. However, there is also growing scepticism about how tight supply is as all the indications are that Russia has been able to redirect its oil shipments from Europe to Asia and other emerging market economies.

WTI futures were trading off yesterday’s one-month lows on Thursday but remained within scope of $100 a barrel.

US stock futures, meanwhile, were flat, suggesting mixed sentiment ahead of Powell’s second day of testimony later today, this time before the House Financial Services Committee.

In Europe, the major indices were paring earlier losses despite dismal PMI numbers out of the Eurozone.

Euro tumbles on weak PMIs, pound fares slightly better

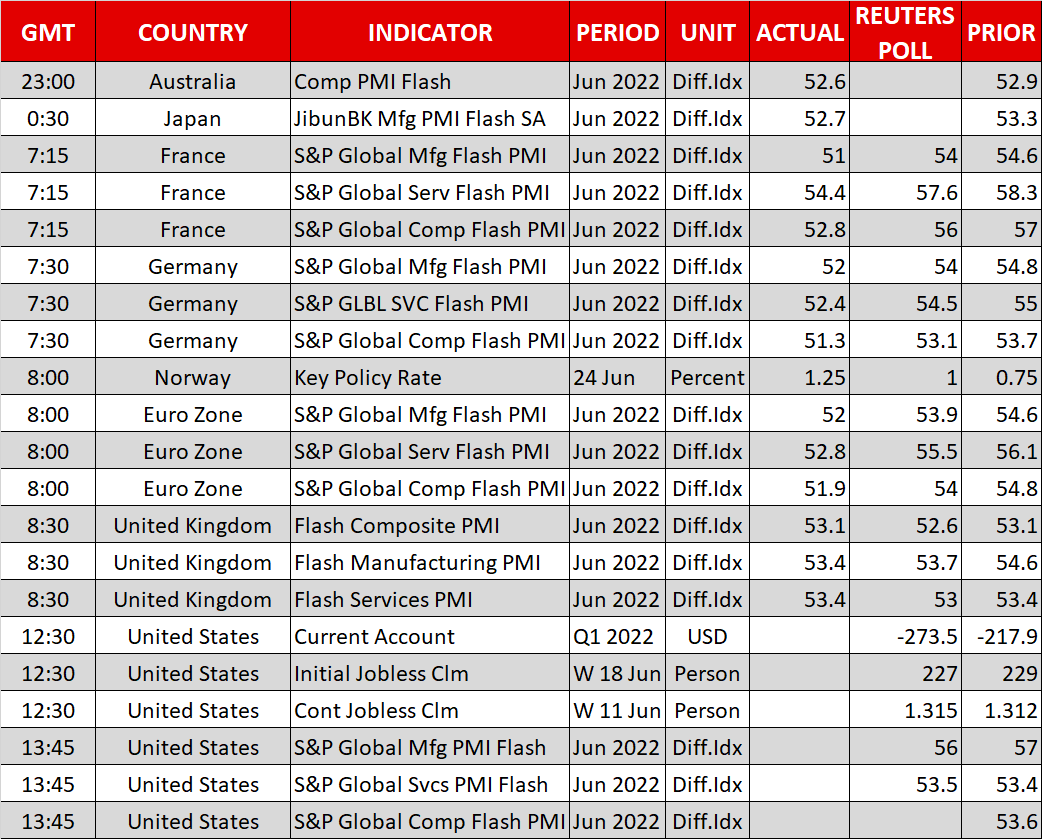

The flash composite PMI for the euro area fell by an unexpectedly steeper amount in June to 51.9 versus forecasts of 54.0 and from the prior reading of 54.8.

Higher prices appear to be squeezing consumers, forcing them to cut back on spending. At the same time, input costs continued to skyrocket for businesses, raising the prospect of stagflation.

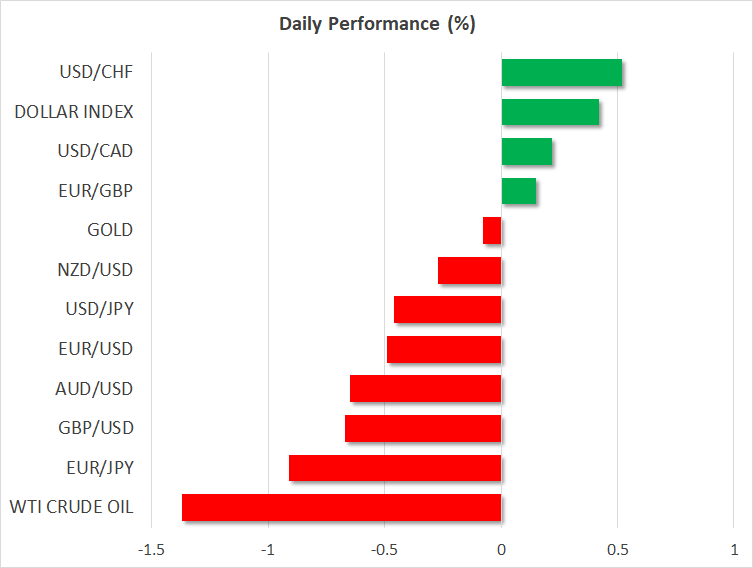

The euro skidded on the data, dipping to around $1.0480, having yesterday brushed the $1.06 level.

UK PMIs on the other hand beat expectations, with the composite PMI holding steady at 53.1. This helped sterling to bounce off intra-day lows, although it was struggling to get a grip on the $1.22 handle.

Investors will also be keeping an eye on two by-elections taking place in the UK today. The seats being contested are currently held by the Conservatives. Should they lose both seats, it’s likely to reflect badly on Prime Minister Boris Johnson’s leadership following a series of scandals, most recently the Partygate saga.

The Australian dollar continued to underperform amid the ongoing risk-off mood, which boosted the Japanese yen for a second day, providing it with some much-needed reprieve from the heavy selling of the previous sessions. But the US dollar was back on the front foot on Thursday after reversing lower yesterday.