PMI Data Lifts Some Q4 Nowcasts, but Median Growth Estimate Remains Modest

2024.12.17 09:15

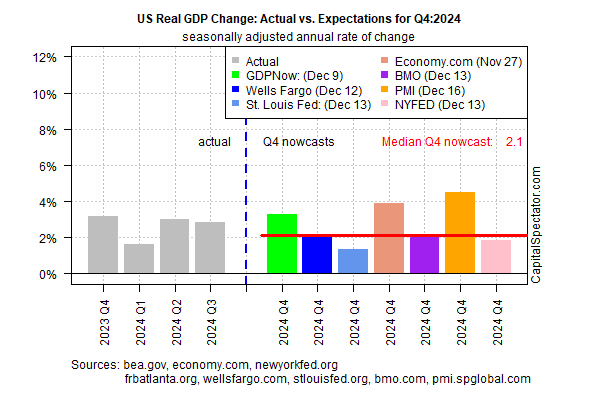

Several updated nowcasts for US economic activity in the fourth quarter have been revised sharply higher recently, but the median estimate barely changed, based on the several data points from a range of sources compiled by CapitalSpectator.com. The US still, as a result, still looks set to slow in the final quarter of the year via the median nowcast.

Output for Q4 is on track to rise at an annualized 2.1% pace. That’s a touch higher than our . A 2.1% rise for Q4 is also well below Q3’s 2.8% increase.

Although the median estimate continues to reflect moderate growth, three of the seven estimates are now posting sharply higher rates of expansion. The strongest estimate is a sizzling 4.5% advance, based on survey data for December.

The US PMI Composite Output Index rose to a 33-month high this month. Running the PMI numbers through a regression model vis-à-vis historical GDP implies a 4%-plus rise. “Business is booming in the US services economy, where output is growing at the sharpest rate since the reopening of the economy from COVID lockdowns in 2021,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

Yet there’s still room for debate about how fast the US economy will grow in Q4. The Bureau of Economic Analysis is scheduled to publish its initial estimate in late-January. Meanwhile, the median estimate noted above remains our preferred guesstimate.

If Q4 GDP is on track to post significantly stronger growth than is currently reflected in the median, the evidence will soon begin to emerge as one or more of the softer nowcast components are revised up. The opposite is also possible and the high-flying nowcasts are revised down.

The one thing that’s clear with a high degree of confidence: recession risk remains low and US economic activity, at a bare minimum, continues to expand at a solid pace.