Plan Engages

2022.11.11 11:06

[ad_1]

It was bound to happen sooner or later. October finally showed an easing comp in CPI and markets that were ripe to rally for other reasons used the report as the trigger.

We have been on alert for a potentially positive Q4, 2022 to Q1, 2023 seasonal play since first uncovering the post mid-term election cycle’s positive implications over a month ago.

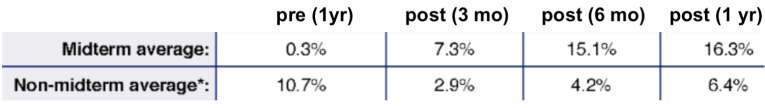

Here are the averages of all pre and post mid-term elections since 1962. Sure, nothing is ever guaranteed in the markets, including historical facts, averages, comps and analogs. But as we have noted it is considered a tailwind. Pre-election is consistently weak compared to non-election years and post-election is consistently strong compared to those same non-election years.

Mid-Term & Non-Midterm Averages

Mid-Term & Non-Midterm Averages

Some prime elements for such a play (and this is all it is indicated to be as those celebrating a fade in inflation will not be too happy down the road when inflation signals fall uncomfortably low) we’ve been tracking have been as follows:

- With a cyclical bear market for all of 2022 the tax loss selling was expected to be significant in Q4. As would be the relief to follow

- The aforementioned election cycle

- Mainly bullish seasonal averages beginning in November and lasting to a specific end point in Q1

- A negative divergence to the (the global asset market counterparty) by the / ratio (GSR). It has been important to keep an eye on silver, which has been out-performing gold indicating a phase of market liquidity relief. The GSR is leading the US dollar to a breakdown from its intermediate uptrend (but not its major uptrend, which will come into play later).

- Last but not least, the upside target area having been dinged and slightly exceeded to the elegant ‘Continuum’ chart of the Treasury bond yield. Oh, how elegant it is to my eye.

This was a pure expression of ‘equal and opposite’ dynamics to the Q1, 2020 deflationary fear fest. How poetic for inflationary hysteria to follow deflationary terror as represented by such a beautiful picture. A picture of excessive momentum in the opposite direction to 2020’s excessive momo.

Think about these elements:

- What equities have manufactured big losses for investors in 2022, thereby becoming tax loss seasonal ‘buy’ candidates?

- While many segments may rally, think more about those negatively correlated with rising bond yields (i.e. positively correlated with disinflation and firmer bonds).

- Here is also where inflation-centric gold bugs may want to finally change their views by casting aside the influential and promotional leader bugs and realizing that gold mining does NOT benefit from inflation. But of course, they will not cast aside the dogma.

- With a US dollar in correction, global markets to which it is a firm counterparty (e.g. Emerging Markets) could outperform.

- Cash is a position, now along with bonds. It is paying dividends and will again provide safety when the time is right.

Bottom Line

Realize that the odds were in favor of a relief phase in Q4-Q1, and bear market relief can be strong. But also realize that there are upside technical parameters well north of here that would need to be taken out before TA can call a new bull market. Realize also that celebrations about a fade in ‘inflation’ * will likely become tomorrow’s (or Q1, 2023’s) swing toward an uncomfortable drop in inflation expectations. These are the volatile considerations that your heroes at the market micromanaging Federal Reserve have created.

[ad_2]

Source link