PayPal Earnings Preview: Can New CEO’s Plans Breathe Life Into the Falling Stock?

2023.10.31 08:12

- PayPal’s stock has been in a two-year downtrend due to fierce competition and falling profits

- The new CEO, Alex Chriss, is expected to focus on SMBs and in-store payments to try and stage a turnaround

- Can better-than-expected earnings reverse the stock’s downward trend?

PayPal Holdings (NASDAQ:) has been in a sustained downward spiral for over two years now. The declining trend shows no signs of abating and is approaching another crucial support level.

Over the past three years, PayPal’s stock price has been marred by dynamic declines that have taken it to its lowest levels since 2017.

The primary reason for this sharp descent was a significant drop in net profits that began in the second half of 2021, following a pandemic-induced payment volume surge. Additionally, fierce competition, led by Apple Pay, has intensified the challenges in the electronic payments market, further pressuring share prices.

Nevertheless, the company retains a solid foundation and a few tricks up its sleeve to regain an upward trajectory.

The newly appointed CEO, Alex Chriss, is expected to unveil a recovery strategy during the upcoming quarterly results announcement, potentially heralding a return to the company’s glory days.

Can Alex Chriss Transform PayPal?

Alex Chriss was officially announced as PayPal’s new CEO a month ago. It is widely anticipated that his tenure will focus primarily on the small and medium-sized business sector, aligning with his previous experience.

His key challenges include maintaining a strong position in the in-store payments segment, where PayPal still holds an advantage over Apple (NASDAQ:).

Notably, Apple’s credit and debit cards are compatible with the iPhone and Apple Watch. An expanded app offering a range of tools in one place is also likely to be a target.

In his initial statements, Alex Chris highlights the company’s assets, including Venmo and the Honey app, which have substantial growth potential. Additionally, the company’s robust cash reserves of $5 billion offer the opportunity for potential acquisitions.

Can the Stock Break a Streak of Negative Reactions on Earnings Day?

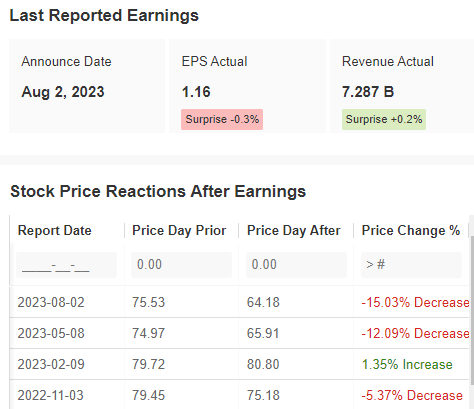

Recent quarterly results have set the stage for a continuation of the long-term downward trend. Looking at market reactions on publication days over the past two quarters, there were declines of over 10%, despite results that might not appear abysmal at first glance.

Previous Earnings

Source: InvestingPro

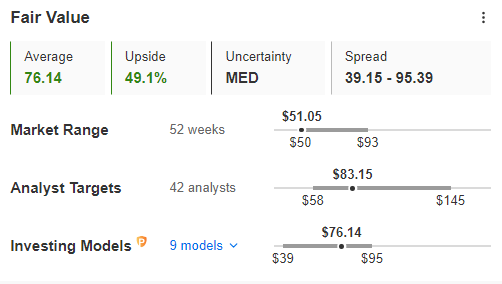

On the other hand, better-than-expected results could trigger a corresponding upward move, potentially generating a significant percentage gain in an oversold market. Currently, based on fair value, there is potential for nearly 50% upside.

Fair Value

Source: InvestingPro

PayPal Stock Technical View: Can it Recover From Oversold Levels?

The downward trend in PayPal’s stock persists, with the supply side nearing the next significant support level of around $50 per share. Currently, there is little technical justification for a reversal, as there are no clear upward signals.

PayPal 5-Hour Chart

A reversal would necessitate a distinct breakthrough of the nearest cluster of resistance levels in the $57-59 per share range, opening the possibility of challenging the $65 supply zone and the long-term downward trend line.

Buying simply because the stock is cheap can be risky, akin to trying to catch a falling knife. It is advisable to exercise patience and await the right signals from both the technical and fundamental perspectives, such as better-than-forecast quarterly results.

***

Find All the Info You Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.