Paradox: NFP Supports US Dollar But Reduces Odds Of A Rate Hike

2023.09.04 08:46

Friday’s batch of US statistics boosted the Dollar, while the US stock market was mixed as a sell-off replaced an initial rally.

US economy created 187K jobs in August

US economy created 187K jobs in August

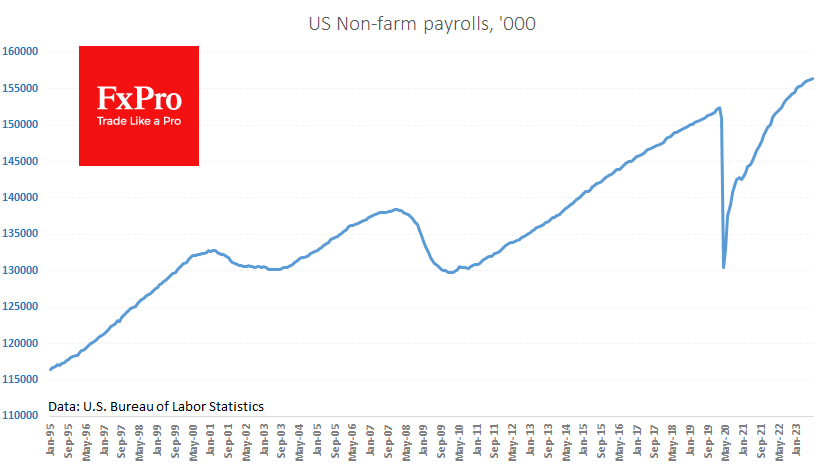

The data showed that the US economy created 187K jobs in August, but data for the previous two months showed a decline of 110K, painting a gloomier picture for the summer.

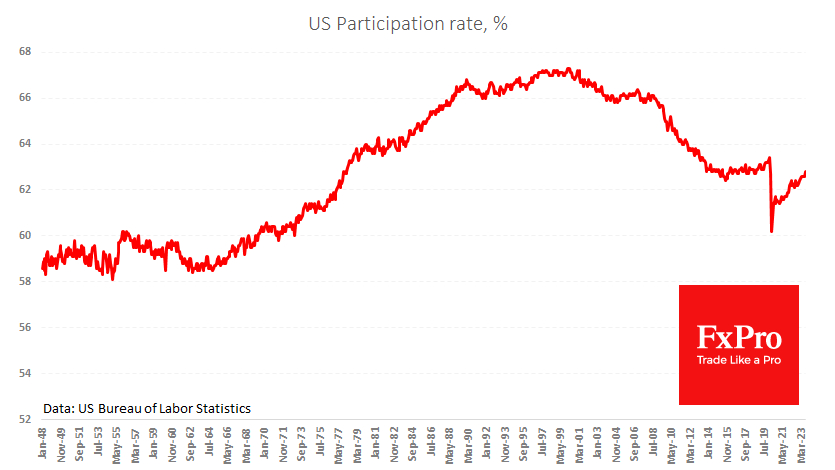

The unemployment rate rose from 3.5% to 3.8%—quite an unexpected jump given the steady rise in the employment rate. The increase was driven by a surge in the labour force participation rate from 62.6% to 62.8%. This is still below the pre-Cold War peak of 63.4%. It is even further from the peak of 67.1% in 2000.

Labour force participation rate jumped from 62.6% to 62.8%

Labour force participation rate jumped from 62.6% to 62.8%

People return to work as the stocks built up by the pandemic stimulus fade while fears of illness are receding. Inflation and high interest rates are encouraging people to look for work.

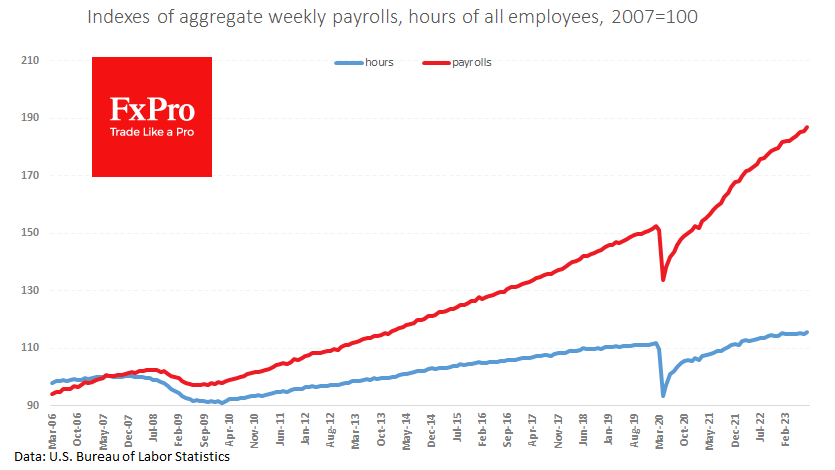

It is also worth noting that the total number of hours worked in the private sector is virtually stagnant. The corresponding index was 115.5 in August (2007=100), not much higher than 115.1 in January. And labour cost growth has exceeded 2.75% over this period. This puts additional pressure on corporate profits.

Wage growth slowed to 4.3% y/y

Wage growth slowed to 4.3% y/y

Wage growth has slowed. Over the month, average hourly earnings rose by 0.2%, compared with 0.4% m/m in the previous two months. The annualised growth rate fell to 4.3%, weaker than the 4.4% expected and recorded in June and July.

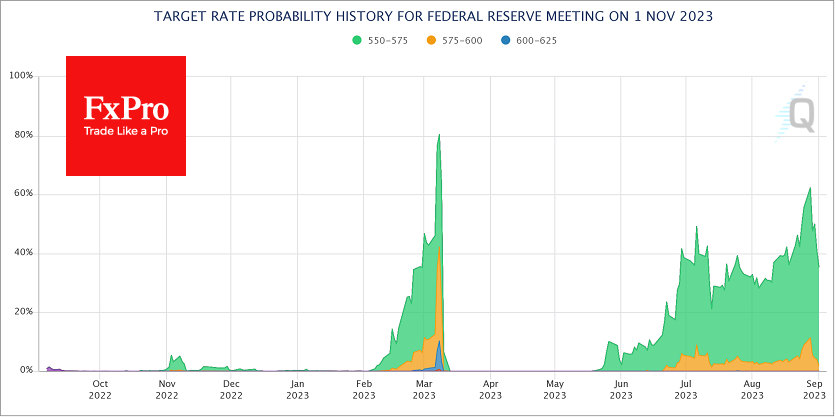

Some commentators point to the rise in the unemployment rate as an argument for the Fed not to raise rates again this cycle. This is supported by the FedWatch tool, which puts the probability of a November hike at 38%, down from 62.3% a week earlier.

FedWatch tool puts the probability of a November hike at 38%

FedWatch tool puts the probability of a November hike at 38%

On the other hand, we focus on the still solid inflationary trend in wages at the expense of the swelling service sector, which feeds the inflationary spiral. The Fed may decide not to raise rates any further, but it will keep them on hold for much longer than market participants currently expect, which will dampen economic activity, support a rising dollar and weigh on the equity market.

The FxPro Analyst Team