Overly Optimistic Analyst Earnings Estimates Can Be Trojan Horses

2023.06.09 07:50

Since October 2022, the stock market has traded consistently higher as earnings improved. With the first quarter earnings season behind us and the second quarter approaching, will earnings improve further?

In 2021 and 2022, we wrote several articles discussing why analysts’ estimates were overly optimistic. As we head further into 2023, are analysts again becoming overly optimistic?

According to FactSet, with the vast majority reporting:

“78% have reported actual EPS above the mean EPS estimate, which is above the 10-year average of 73%. It is also the highest percentage of S&P 500 companies reporting a positive EPS surprise since Q3 2021 (82%).

In aggregate, earnings have exceeded estimates by 6.5%, which is above the 10-year average of 6.4%. It is also the highest surprise percentage reported by S&P 500 companies since Q4 2021 (8.1%).“

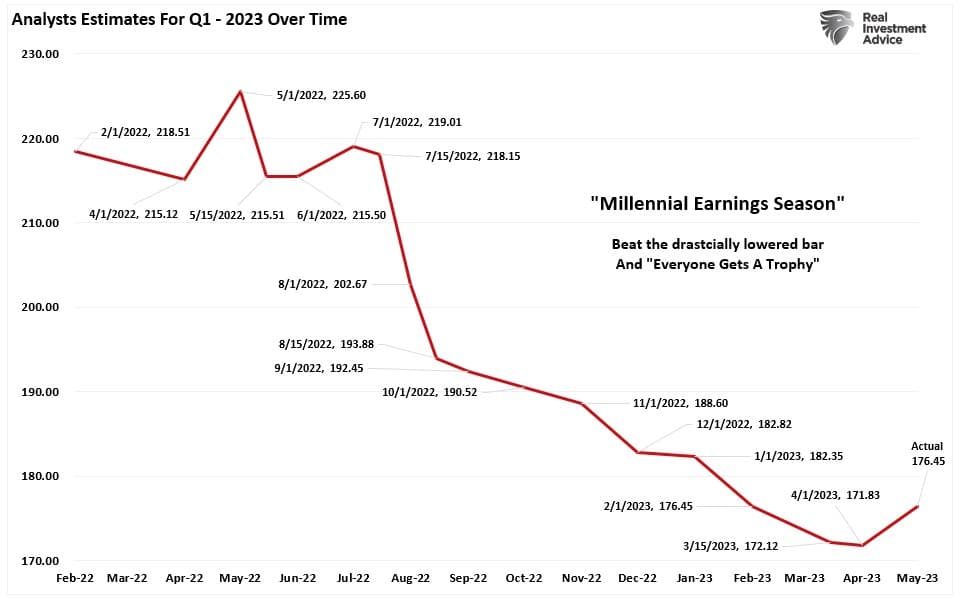

Of course, the reason for the high beat rate, as is always the case, is due to the sharp downward revisions in analysts’ estimates as the reporting period begins.

The chart below shows the estimate changes for the first quarter of 2023 from February 2022, when analysts provided their first estimates.

S&P 500 Earnings Estimates Q1 2023

S&P 500 Earnings Estimates Q1 2023

This is why we call it “Millennial Earnings Season.” Wall Street continuously lowers estimates as the reporting period approaches so “everyone gets a trophy.”

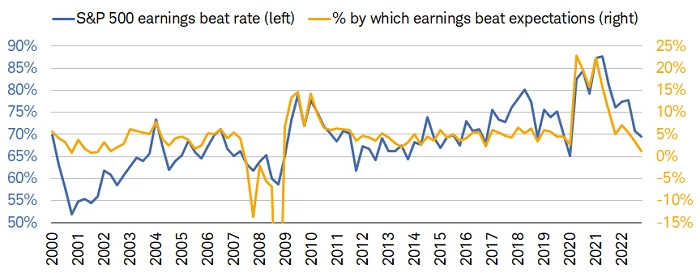

An easy way to see this is the number of companies beating estimates each quarter, regardless of economic and financial conditions.

Since 2000, roughly 70% of companies regularly beat estimates by 5% in the . Again, that number would be lower if analysts were held to their original estimates.

S&P 500 Earnings Beat Rate

S&P 500 Earnings Beat Rate

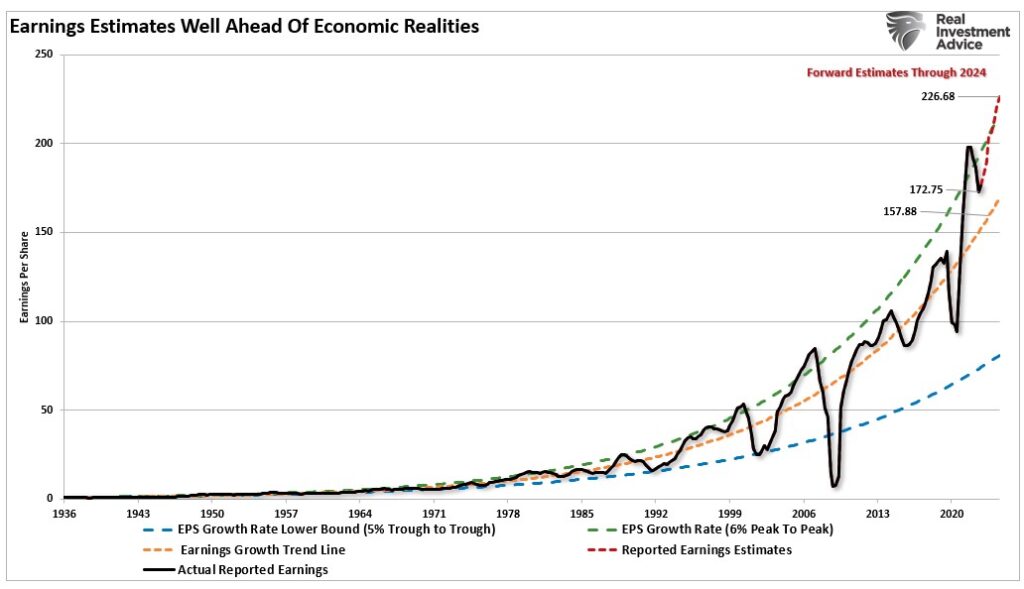

Analysts remain optimistic about earnings even with economic growth weakening as inflation increases, reduced liquidity, and declining profit margins.

As shown above, analysts expect the first quarter of 2023 will mark the bottom for the earnings decline, and growth will accelerate into year-end.

Again, this is despite the Fed rate hikes and tighter bank lending standards that will act to slow economic growth.

The problem with these expectations is the detachment of earnings estimates above the long-term growth trend.

Earnings Estatimes Vs Long-Term Growth Trend

Earnings Estatimes Vs Long-Term Growth Trend

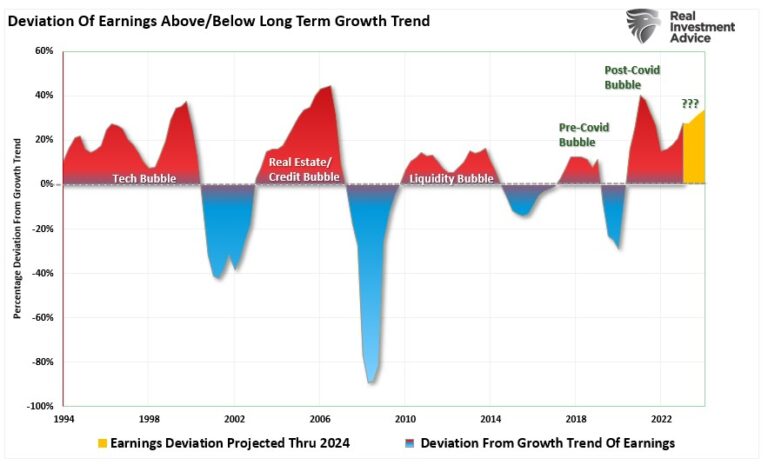

That deviation from the long-term growth trend is shown more clearly in the following chart. The only two previous periods with similar deviations are the “Financial Crisis” and the “Dot.com” bubble.

Earnings Deviations From Growth Trend

Earnings Deviations From Growth Trend

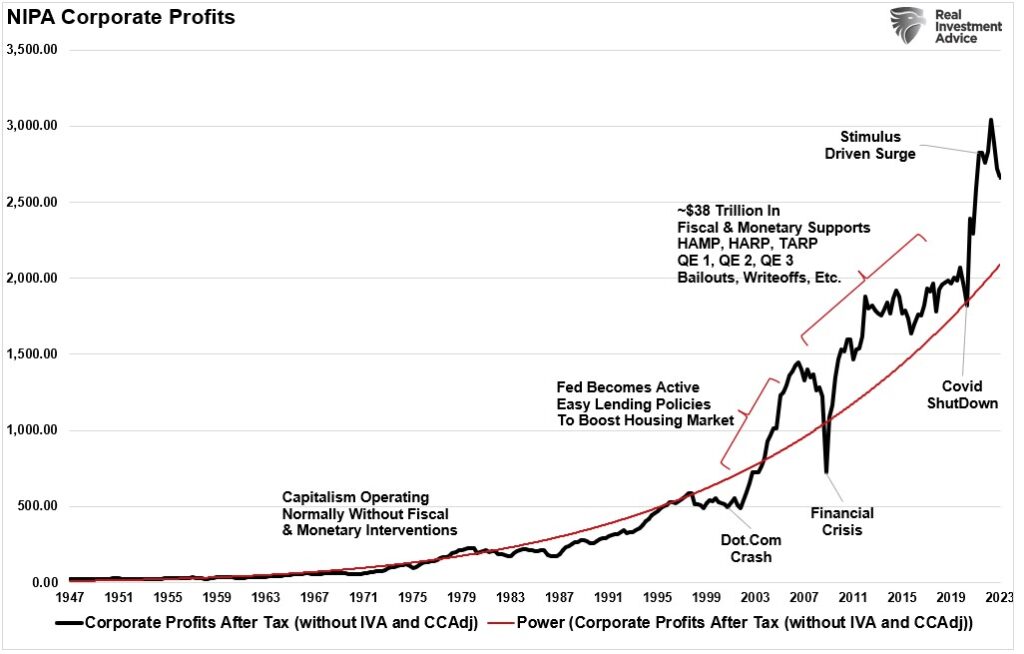

Given that earnings are the byproduct of economic growth, the sustainability of record-high earnings and corporate profit margins is problematic. As we discussed in this :

“With the economy shut down and an inorganic surge in demand due to “free money,” the selling prices of a restricted supply of goods rose. The basic economic function of supply and demand proves capitalism is functioning properly. Furthermore, as shown, corporate profits surged with labor costs greatly reduced due to the shutdown and higher prices due to artificially stimulated demand.”

Of course, with supply chains functioning and inventories rebuilt, profit margins have started their inevitable reversion.

Reversion to the Mean

So, what happens next? If we assume the combination of a shuttered economy, no supply, and massive rounds of fiscal stimulus fostered the surge in corporate earnings and profits, can earnings improve without those supports?

Over the next few years, the environment will look different than in the past.

- The economy is returning to a slow growth environment with a risk of recession.

- Inflation is falling, meaning less pricing power for corporations.

- No artificial stimulus to support demand.

- Over the last two years, the pull forward of consumption will now drag on future demand.

- Interest rates are substantially higher, impacting consumption.

- Consumers have sharply reduced savings and higher debt.

- Previous inventory droughts are now surpluses.

Notably, this reversion of activity will become exacerbated by the “void” created by pulling forward consumption from future years.

“We have previously noted an inherent problem with ongoing monetary interventions. Notably, the fiscal policies implemented post the pandemic-driven economic shutdown created a surge in demand and unprecedented corporate earnings.”

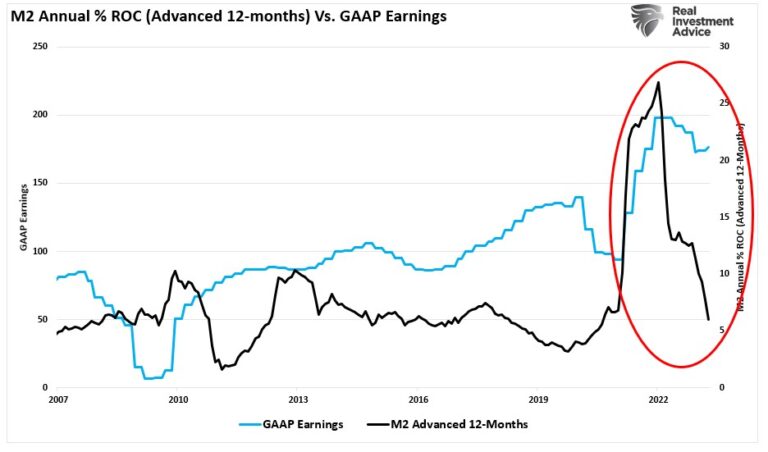

As shown below, the surge in the M2 money supply is now over. Without further stimulus, earnings should revert to economically sustainable levels.

GAAP Earnings vs M2 Growth

GAAP Earnings vs M2 Growth

While the media often states that “stocks are not the economy,” economic activity creates corporate revenues and earnings. As such, stocks can not grow faster than the economy over long periods.

This is important to investors due to the coming impact on “valuations.”

Valuations Remain A Risk

The problem with forward earnings should be obvious. Given that forward earnings estimates are almost always wrong, such means that investors overpay for investments. As should be obvious, overpaying for an investment today leads to lower future returns.

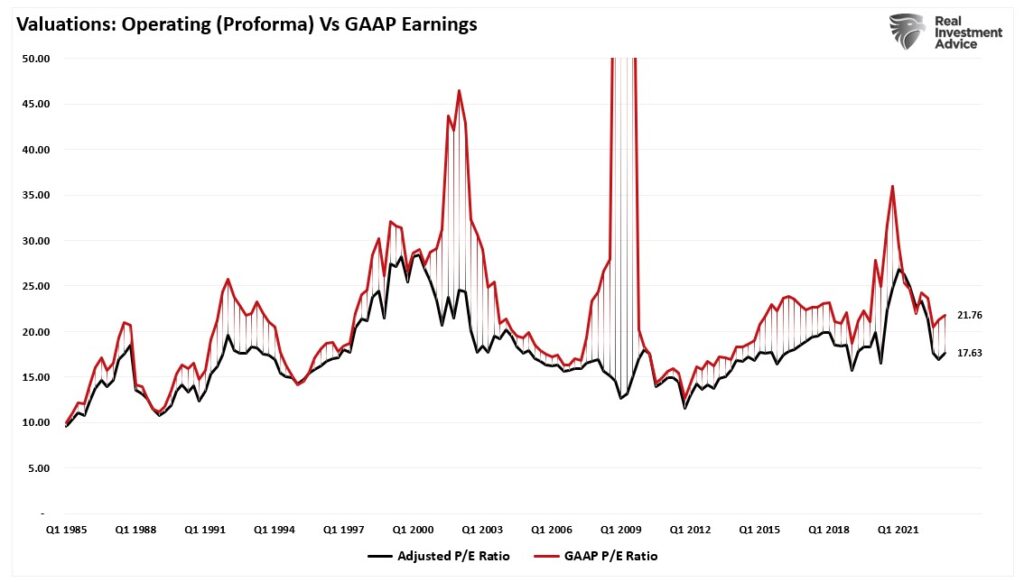

Even if earnings improve, valuations remain historically expensive on both a trailing and forward basis. (Notice the significant divergences in valuations during recessionary periods as adjusted earnings do NOT reflect what is occurring with actual earnings.)

Valuations Forward and Trailing EPS

Valuations Forward and Trailing EPS

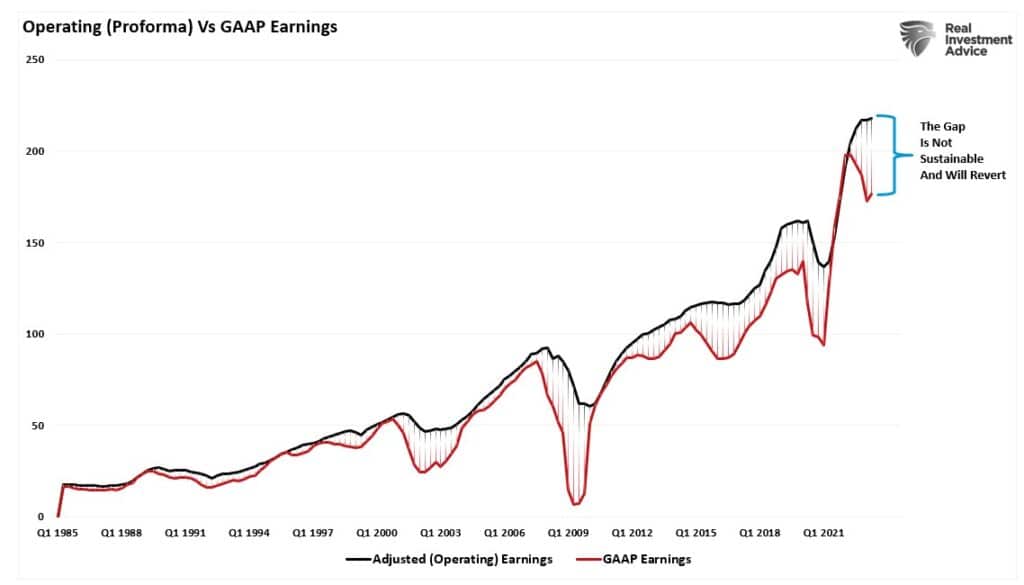

Most companies report “operating” earnings which obfuscate profitability by excluding all the “bad stuff.” A significant divergence exists between operating (or adjusted) and GAAP earnings. When a variation of that magnitude occurs, you must question the “quality” of earnings.

Operating Vs GAAP Earnings

Operating Vs GAAP Earnings

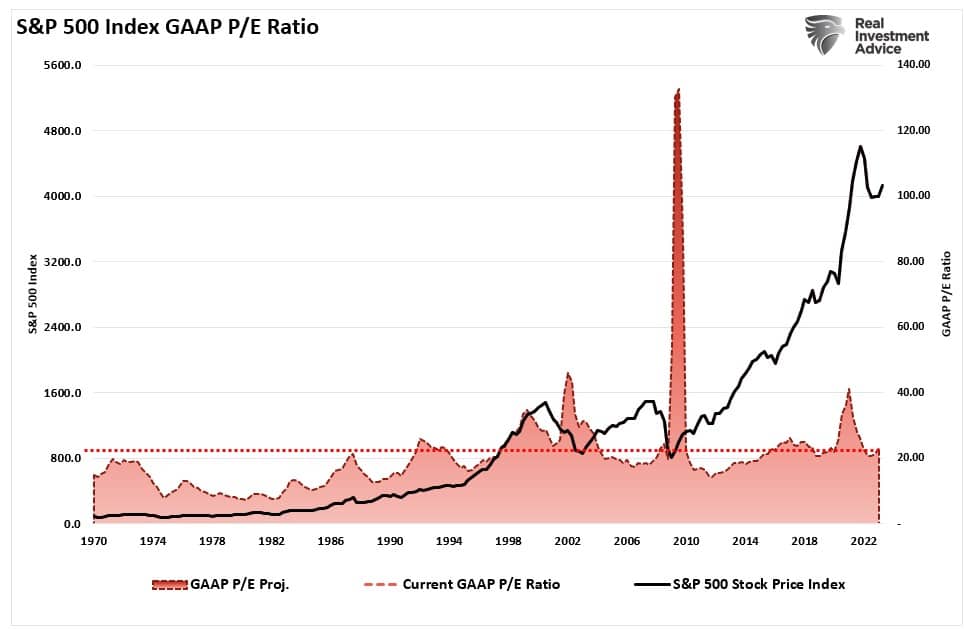

The chart below uses GAAP earnings. If we assume current earnings are correct, then such leaves the market trading above 21x earnings. (That valuation level remains near previous bull market peak valuations.)

SP500-GAAP PE Ratio Chart

SP500-GAAP PE Ratio Chart

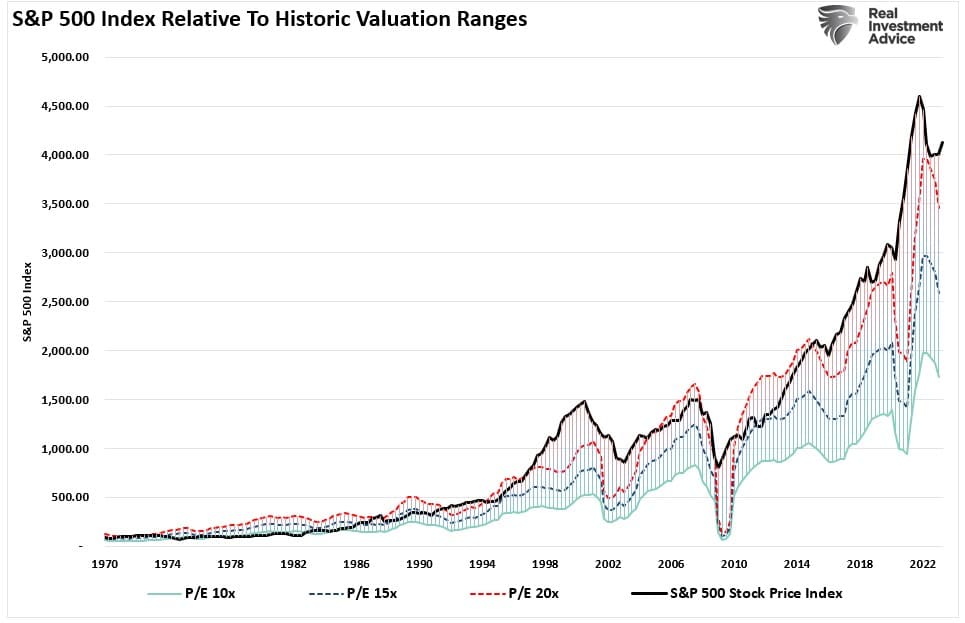

Since markets are already trading well above historical valuation ranges, such suggests that outcomes will likely not be as “bullish” as many currently expect.

SP500-PE-Ranges Vs Actual

SP500-PE-Ranges Vs Actual

Market Vs. Profits

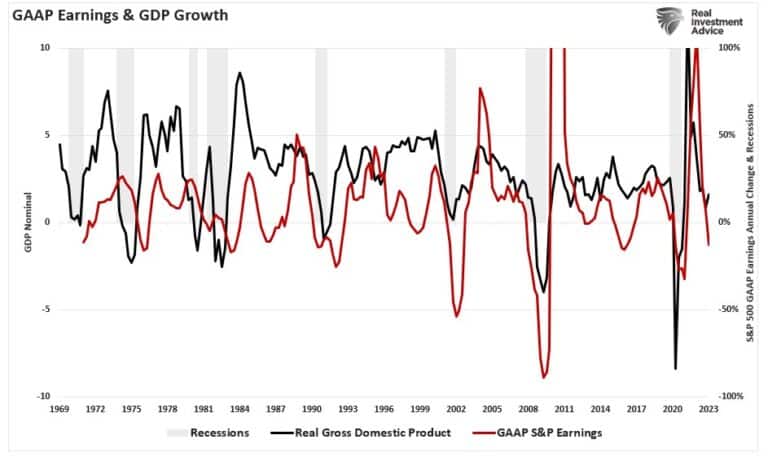

It isn’t just the economic data that historically correlates with markets. Earnings and profits also correlate with markets over the long term due to their dependency on economic growth. Earnings can not live in isolation from the economy.

Real GDP vs GAAP Earnings

Real GDP vs GAAP Earnings

It would be best if you didn’t dismiss the fact markets can and do, deviate from long-term earnings. Historically, such deviations don’t work well for overly “bullish” investors.

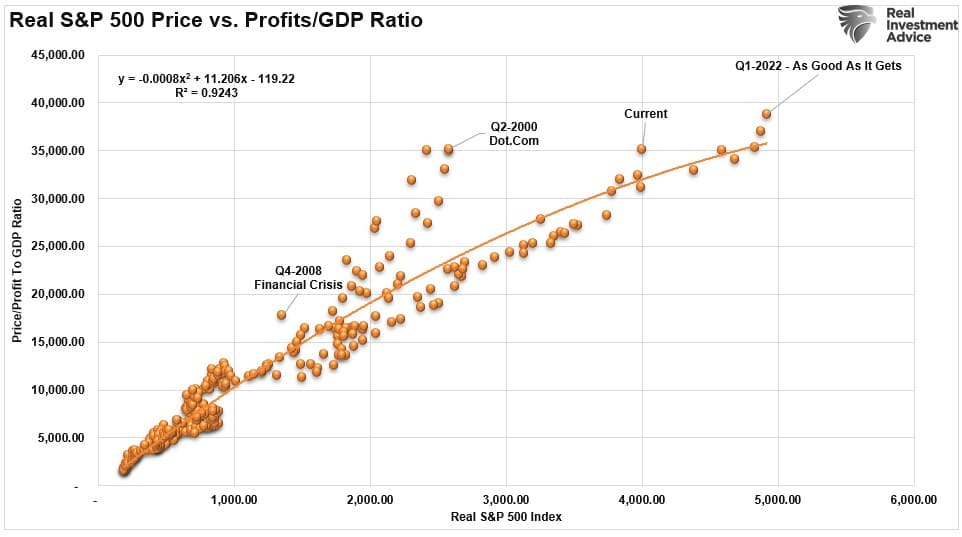

The correlation is more evident in the market versus corporate profits to GDP ratio.

Why profits? Because “profits” are what gets reported to the IRS for tax purposes and are much less subject to manipulation than “earnings.”

Real SP500 Index vs Profits To GDP Ratio

Real SP500 Index vs Profits To GDP Ratio

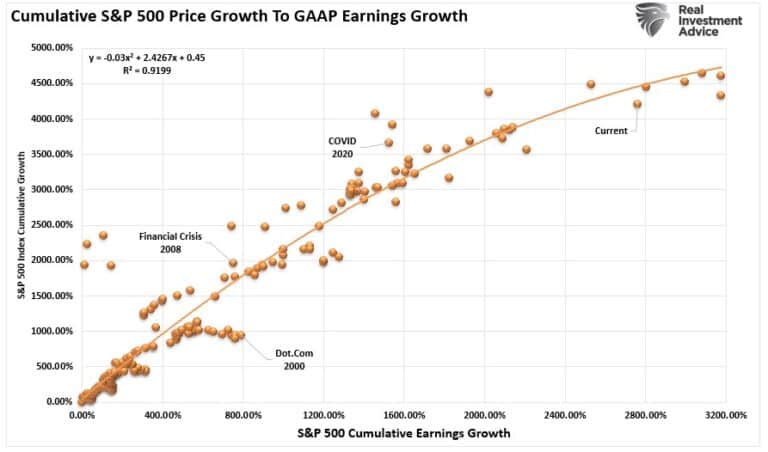

We can see the same excess when comparing cumulative price growth to GAAP earnings growth.

SP500 Cumulative Price To GAAP Earnings Growth

SP500 Cumulative Price To GAAP Earnings Growth

With correlations at 90%, the relationship between economic growth, earnings, and corporate profits should be evident. Hence, neither should the eventual reversion in both series.

Trojan Horses

The hope, as always, is that earnings will rise to justify the market’s overvaluation. However, when earnings are rising, so are the markets.

Most importantly, analysts have a long and sordid history of being overly bullish on expectations of growth which fall well short.

Such is particularly the case today. Much of the economic and earnings growth was not organic. Instead, it was from the flood of stimulus into the economy, which is now evaporating.

Overpaying for assets has never worked out well for investors.

With the Federal Reserve intent on slowing economic growth to quell inflation, it is only logical earnings will decline. Prices must accommodate lower earnings by reducing current valuation multiples if such is the case.

When it comes to analysts’ estimates, always remain wary of “Greeks bearing gifts.”