Orange Juice Record a Boon to Speculators, Curse to Industry

2023.02.10 07:39

- Frozen concentrated orange juice futures hit record highs at $2.67 a pound, could breach $3

- Florida’s oranges see multi whammy of storms, frost, “crop greening” and realty land grab

- After skyrocketing egg prices, consumers might find distaste for rallying orange juice

- Further retail price spikes could still be avoided with the help of Brazilian imports

Six dollars for a dozen didn’t kill the egg industry. But $3 a lb could do a lot of damage to orange juice.

— which determines shelf prices for the citrusy beverage — hit record highs of $2.67 a pound on New York’s InterContinental Exchange on Thursday.

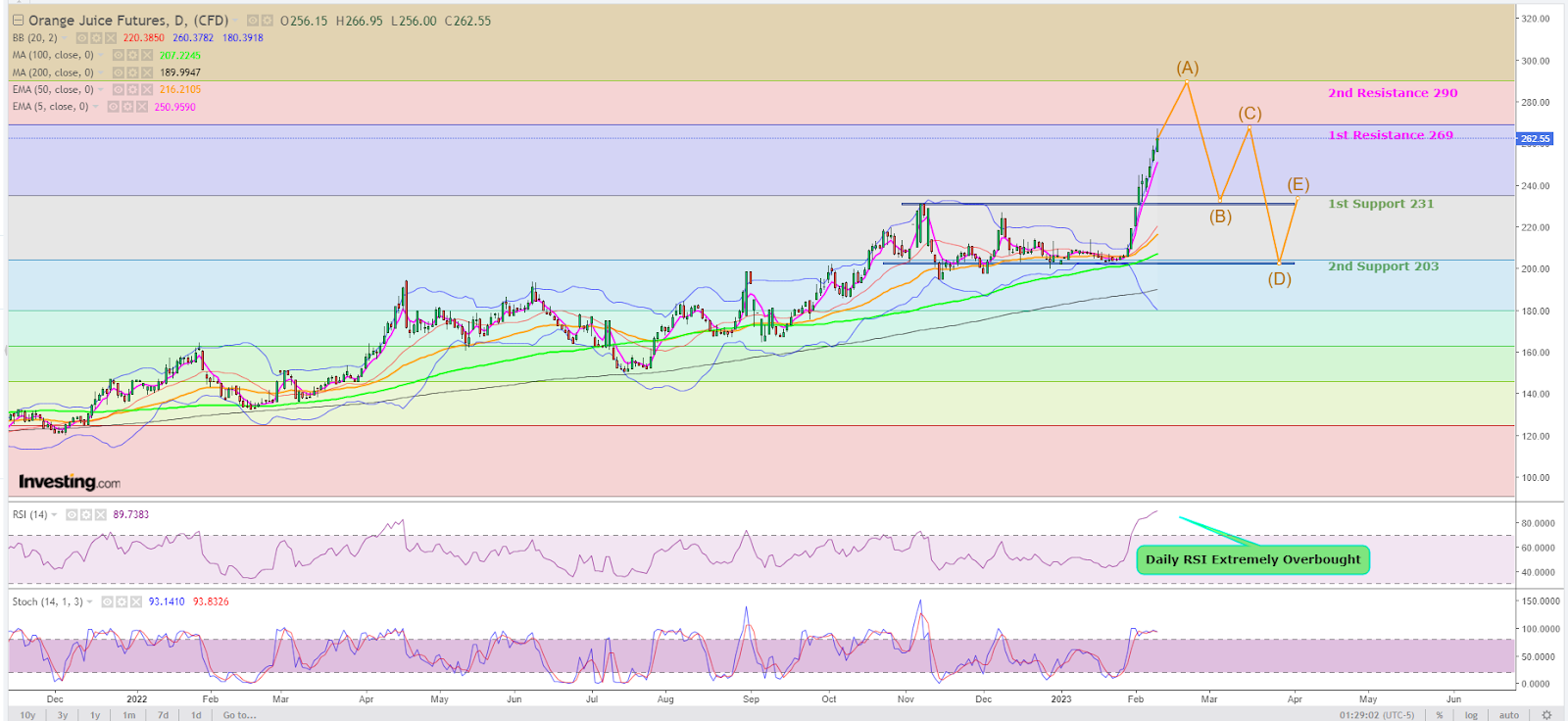

Charts by SKCharting.com, with data powered by Investing.com

The so-called FCOJ market has had this coming for a while. Two back-to-back hurricanes last year devastated the crop, while frost from each cold season retards fruit growth. Besides these, a tough-to-fight plant disease called “citrus greening,” along with aggressive residential development, helped swallow acres and acres of groves in the top orange-growing state of Florida.

The impact of all these is likely to be more upward pricing pressure that could be a boon to FCOJ speculators but a curse to orange growers, as well as juice processors and merchandisers, say those who follow both the futures trade and retail juice industry.

For now, the peak in futures pricing may have just started despite the market being extremely overbought, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com. He adds:

“At a reading of 89, FCOJ’s Daily RSI, or Relative Strength Index, is highly stretched and calling for a correction towards the first support area of $2.31, followed by $2.03.

At the same time, resistance is seen at $2.69. If that breaks, it could be followed by a breach into $2.90. The simple matter of fact is that orange juice futures are trading in uncharted territory. Thus, there is room for establishing a new high further before signs for a liquidation appear. The downward move could be identified by price action that closes below the 5-Day EMA, or Exponential Moving Average, of $2.50.”

A Market Gone Parabolic

Sterling Smith, director of agricultural research at AgriSompo North America in Omaha, Nebraska, said the FJOC market “has simply gone parabolic”. He adds:

“It can lead to a lot of volatility and we could see some downdraft. But this being orange juice, it’s not the most liquid commodity. Seeing it trade north of $3 a lb would not in any way surprise me.”

So far this year, orange juice futures have risen 30%, ending Thursday with a 12-day winning streak. That’s the longest stretch in the green for the market since 1967, according to Bloomberg data. Compared with a year ago, FCOJ is up 87%, when it traded at around $1.40 per pound.

Orange juice became the world’s favorite fruit drink and a commodity due to processing, freezing, and flavoring agents. While there are other orange juice products, FCOJ is the asset used to benchmark orange juice pricing and is also the most widely traded.

But Florida’s orange production is in a dire state now, having plummeted more than 90% from the peak of the late 1990s. As supply falls and prices rise, demand for orange juice will likely also take a hit, as consumers tend to be less willing to shell out the big bucks for the citrusy beverage than, say, coffee.

Consumers have already shown their distaste for costly eggs this year after an avian flu outbreak, and the mass culling of layer hens caused prices to triple from around $2 a dozen to above $6. “Consumer demand for shell eggs continues to track lower and is below average and below the levels recorded a year ago,” the U.S. Department of Agriculture, or USDA, said in an outlook released last week.

Forecasters at the U.S. Department of Agriculture estimated that this year’s orange crop would fall to its lowest level since the 1930s after Hurricane Ian dealt extensive damage to orange groves across Florida last year, followed by Hurricane Nicole. Florida’s farmers were still recovering from the devastation wrought by Hurricane Irma in 2017 before the latest storms struck.

According to the USDA, Florida orange production will slump 61% in 2023 to 16 million boxes. The total U.S. orange harvest is expected to fall 23% to 63 million boxes. The boxes can vary in weight but are typically measured as 90 pounds to one box. In 1998, Florida produced as many as 244 million boxes.

The higher raw cost of juice could weigh on the bottom line of companies such as PepsiCo (NASDAQ:), which makes the Tropicana brand of orange juice, and Coca-Cola (NYSE:), which produces Simply orange, pressuring them to pass the higher cost onto consumers.

Said Smith:

“I suspect if you’re an orange juice provider, you’re not going to want to raise prices. You’re trying to avoid, in fact, from anything that brings attention to food inflation. But much like eggs, when you kill 40 million chickens, the price of eggs is going to go up. What’s going on with FCOJ is invariably going to reflect itself in the store price, and that’ll be something that will again hurt consumption.”

A Staple That’s Turned Into Luxury

U.S. consumption of juice has already fallen exponentially over the past two decades after doubling from 800 million gallons in 1970 to 1.6 billion in 2000. In 2019, per capita, juice consumption was at 2.25 gallons, down 40% from 2010. But in the mind of the average American, orange juice is still a breakfast drink that’s on almost every table — a myth that hasn’t helped nurture enough concern for the embattled industry in Florida.

Adds Smith:

“In COVID times, people were looking for healthier foods, so OJ got a bit of a boost. Since then, it has lost so much market share to vitamin-and-energy drinks. Orange juice is not really a breakfast staple anymore. It’s become a luxury.

Also, avoiding carbohydrates became a big thing in 2000, and orange juice went off the table. What happens is you have kids who grow up not drinking orange juice; they become adults who don’t buy orange juice. If you had a five-year-old in 2000, that kid’s 28 now. When he has kids of his own, those habits are going to get passed on. When you go to the grocery store, you can see how little shelf space is devoted to OJ compared to the vitamin waters, the soda pop and the coffee creamers. It’s just something that’s falling well out of favor.”

The only thing that has kept U.S. orange juice production — and prices — constant are imports from Brazil, the world’s largest citrus grower.

“Brazil has some rain, and conditions are rated good,” said Jack Scoville, chief crop analyst at Price Futures Group in Chicago. Compared with the crop decimation in Florida, Brazilian FCOJ production is forecast to drop only 1% from the prior year to reach 1.12 million metric tons in 2022–23.

Smith concurs about the bumper agriculture production in Florida this year.

“All the crops there are doing magnificently. They’ve had good weather for everything from sugar to coffee and oranges.”

He concludes:

“Look, the price of OJ is going to become elevated; there’s no question about that. The question is how much Brazilian imports can offset that.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.