Optimism Reigns in Markets, But Volatility Risks Remain on the Horizon

2024.10.21 02:53

-

Nasdaq has broken resistance, Bitcoin gaining too.

-

Bitcoin/risk assets are scheduled for a seasonal boost.

-

(but) Volatility season is not over yet.

-

Election is set to deliver a binary corporate tax outcome (up vs down).

-

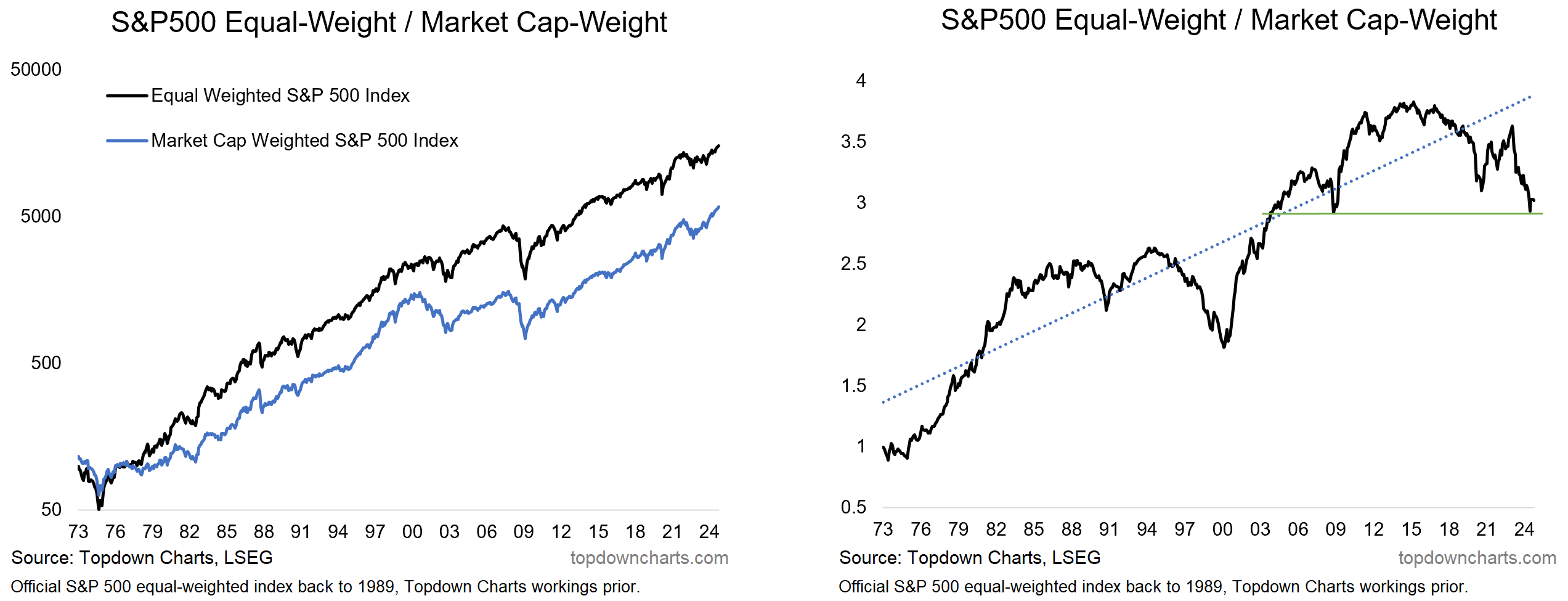

There is a generational opportunity emerging in equal vs cap weighting.

Overall, there is certainly an air of optimism in markets and a clear upshift in the speculative mood on display in the charts. And fair enough; there has so far been no major bad news, the Fed has pivoted to rate cuts, and seasonality is set to turn positive. Yet we can’t drop our guard entirely as there remains unfinished business on a number of fronts. So keep watching those charts that we discuss below.

1. Nasdaq Breaks Out

Well, it finally happened, the has broken out of it’s period of angst and consolidation — pretty much cementing the notion that it’s still in an uptrend. The only thing left to do from here is notch up a new high (and it probably will).

Source: Callum Thomas using MarketCharts.com Charting Tools

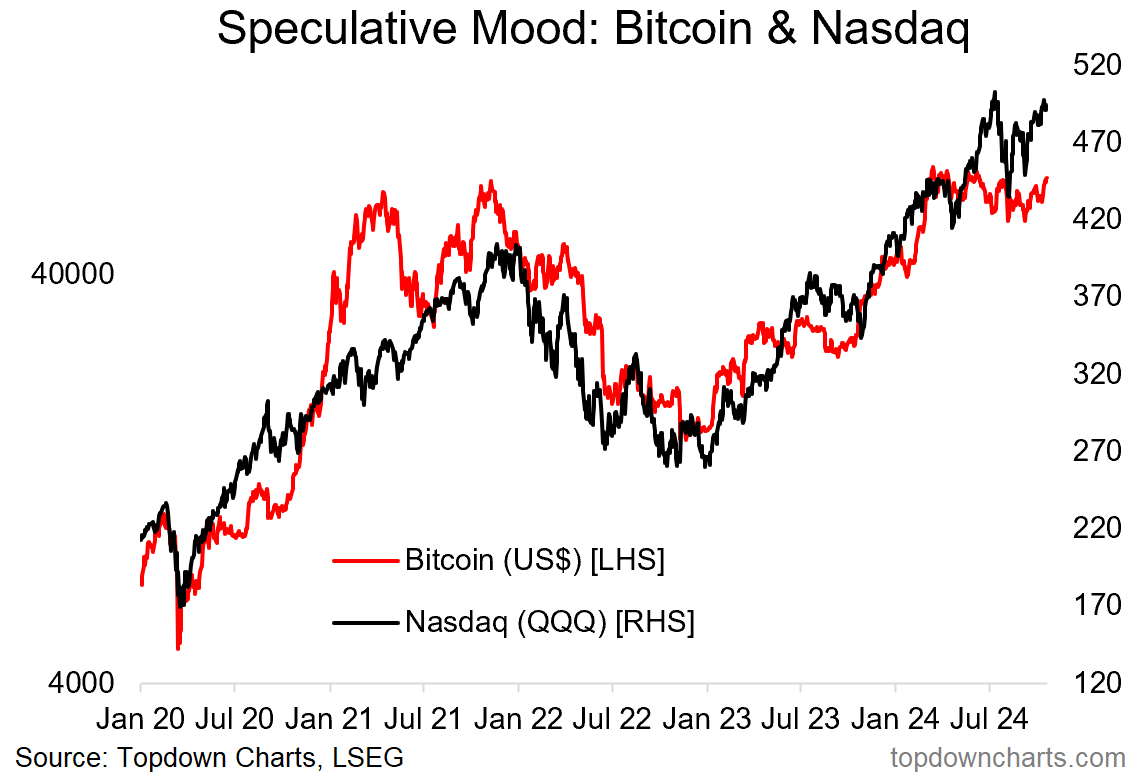

2. Bitcoin, Nasdaq – Mood Up

Looking over at the Nasdaq’s traveling companion, — there does seem also to be a broader shift in mood. Whether it’s optimism around the possible election outcome, the lack of any real bad news, or simply the Fed pivot to rate cuts the mood sure seems to be shifting to the upside after a period of what we might call a stealth bear market.

Source: Topdown Charts

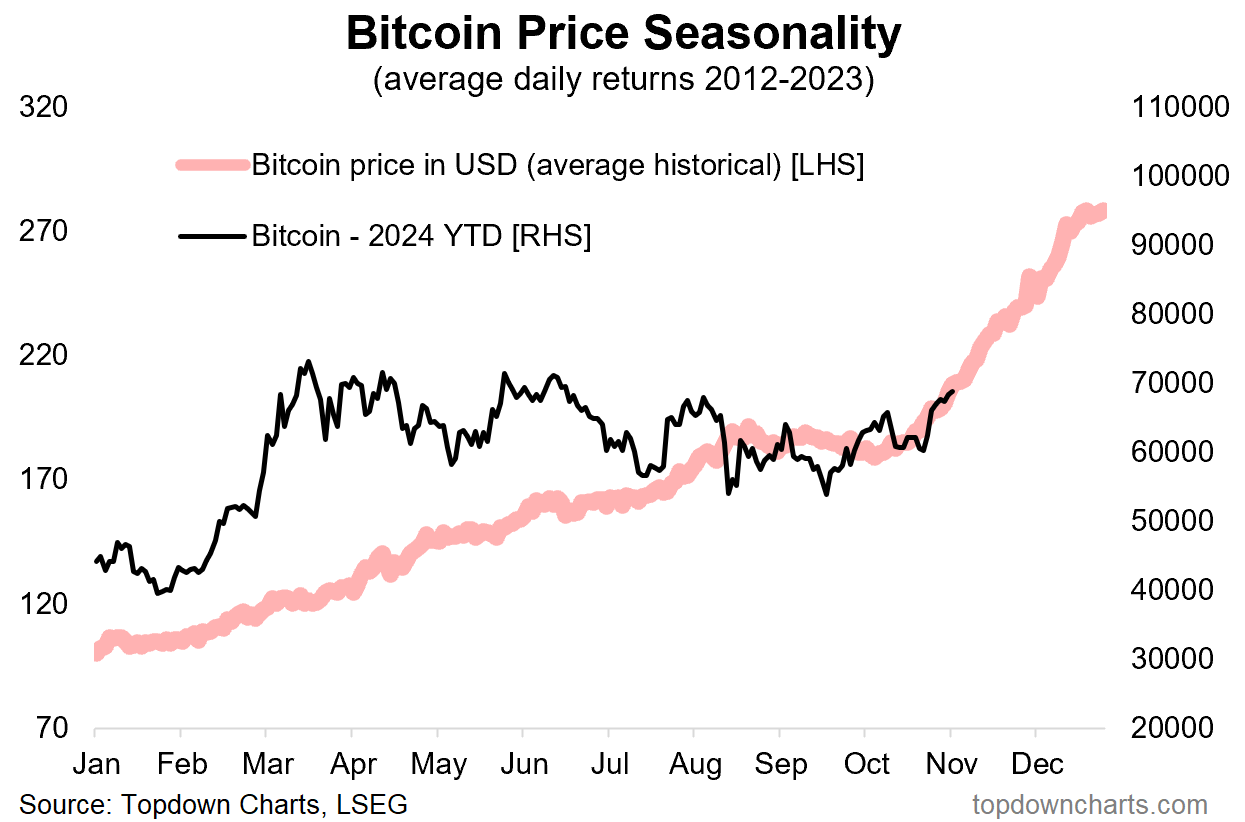

3. Year-End Rally?

And after-all, there is a clear seasonal tendency for risk assets to rally in the final months of the year, and Bitcoin is an extreme example of that. While we are still only looking at 12 years of data here, it’s still something, and the seasonality pattern (average daily movement by business day of the year) suggests a surge in Bitcoin into year-end; this *if it happens* would likely reflect and ripple across price action in stocks and risk assets in general. Very bullish chart.

Source: Topdown Charts Research Services

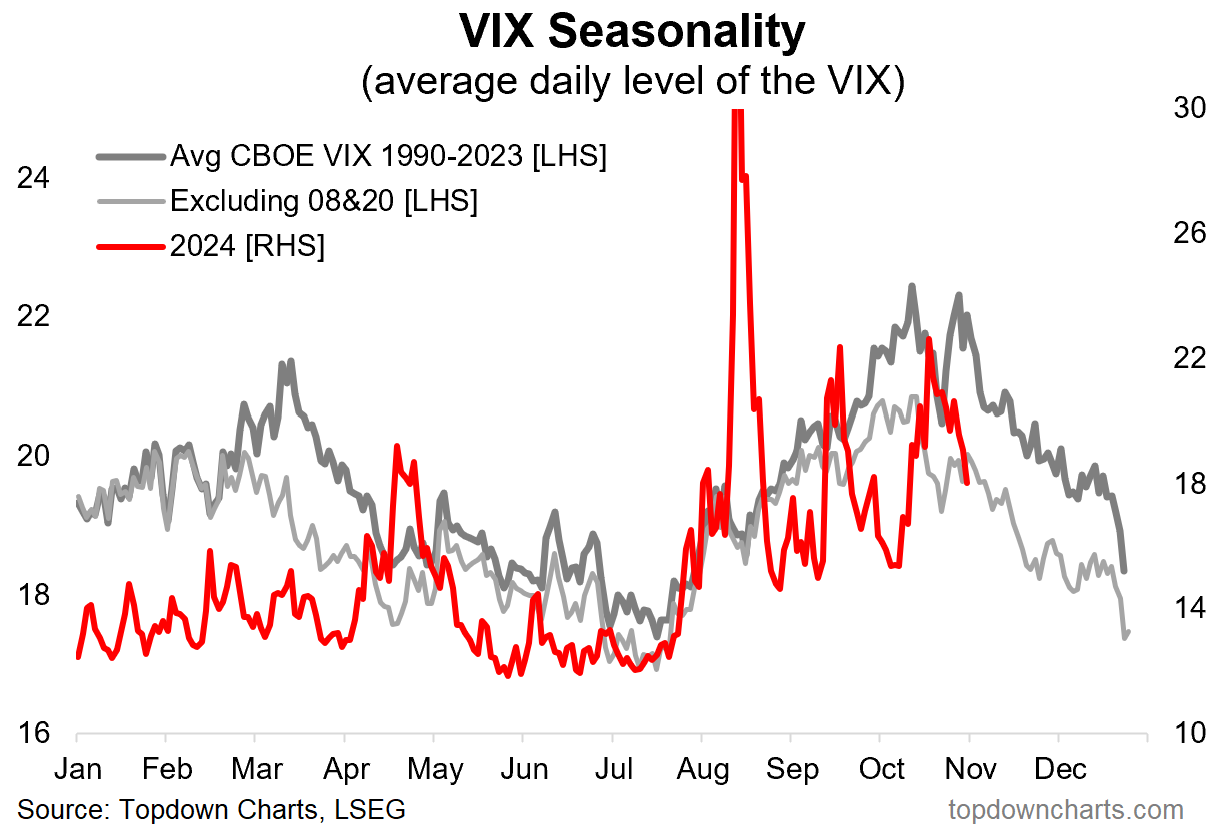

4. But Wait, There’s More!

Having said that, there are still a bunch of macro-market boogeymen lurking in the shadows (election, geopolitics, stretched sentiment/valuations, recession risk), and we are not quite out of the woods on seasonality just yet. Maybe one more spike before the year-end vol-crush and risk-on ride.

(but also, a timely point to remind folk that seasonality is just an average, and there are many exceptions to the rule! aka in the words of Ron “60% of the time it works every time”)

Source: Chart of the Week – Volatility Season

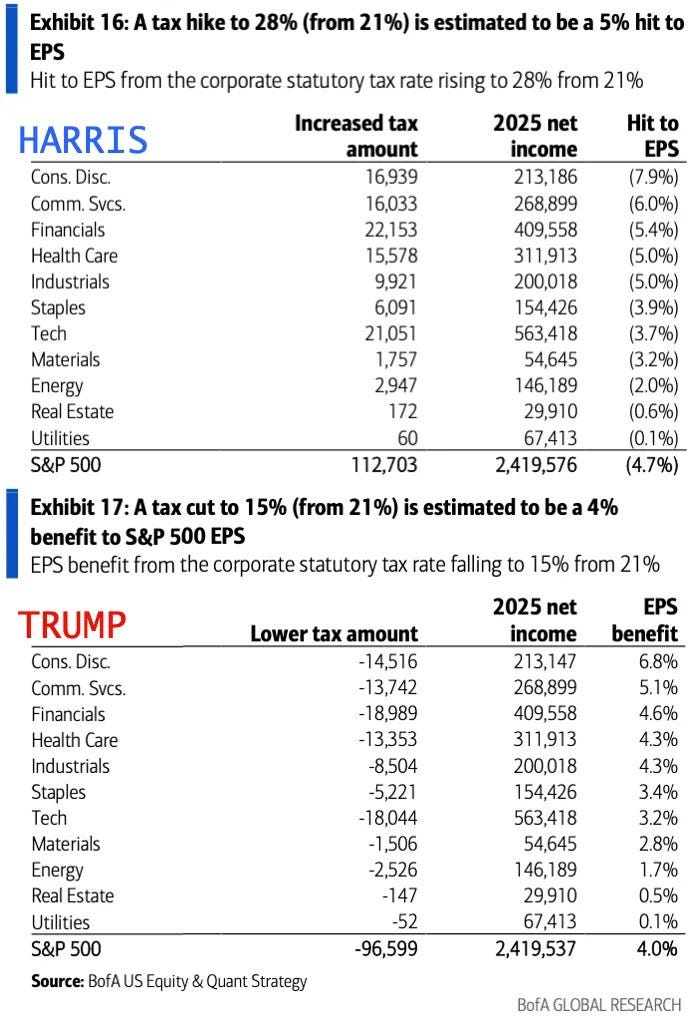

5. Binary Tax Take

As for just plain volatility, here’s reason enough for uncertainty to linger for stocks at least for the next couple of weeks — as far as we can tell, Harris and Trump want opposite things when it comes to the corporate tax rate. Ignoring everything else, higher corporate tax rates are bad for stocks (and lower good) — the table below shows the potential impact in detail across sectors (aka: “it’s the earnings, stupid”).

Source: @dailychartbook Daily Chartbook

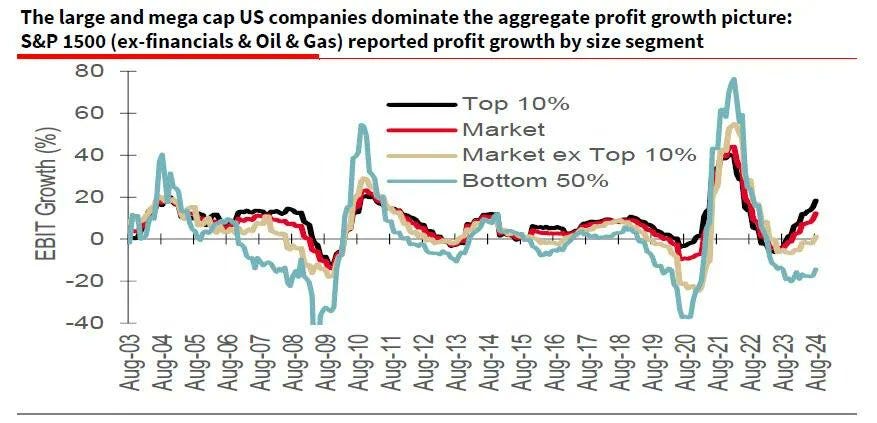

6. Earnings Rorschach

So the bad part of this chart is the bottom 50% seeing earnings contracting but the arguably good part is that the green (teal?) line is turning up — maybe playing catch-up (and catalyzing stock price catch-up?).

The other point would be if Harris gets in and hikes taxes quickly (not a given) that would probably take some wind out of the sails of the larger ones, and put further downdrafts on the bottom 50%’s earnings recession.

Source: @albertedwards99 via @jessefelder

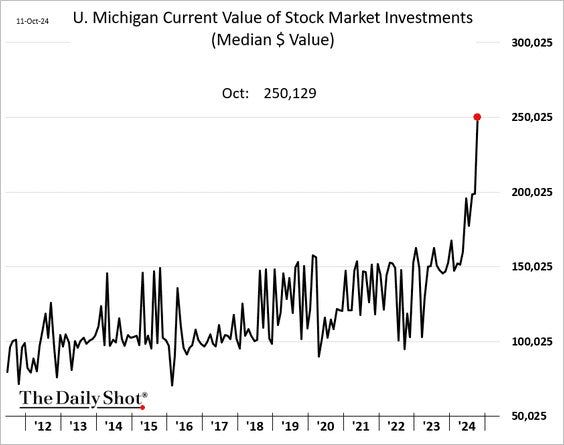

7. Get Rich Quick?

Another glass half-full vs half-empty chart, on the upside folk seem to be getting rich (or at least those who have stock portfolios), which is good and nice, and also likely sees a real economy boost via wealth effects. The downside would be that it is just another reflection of stretched sentiment and valuations, and an unsustainable late-cycle signal.

Source: @SoberLook

8. Accounting for Accountants

Kind of interesting —and similar to the trend in equity analysts I noted a couple of weeks ago— accountants and auditors are on the decline. Maybe it’s just a tech-disruption thing (and/or outsourcing), maybe there are better opportunities elsewhere for accountants (+oldies retiring), or maybe actually there are not enough accountants and reports/audits are at risk of quality loss (pure speculation).

Source: @MikeZaccardi

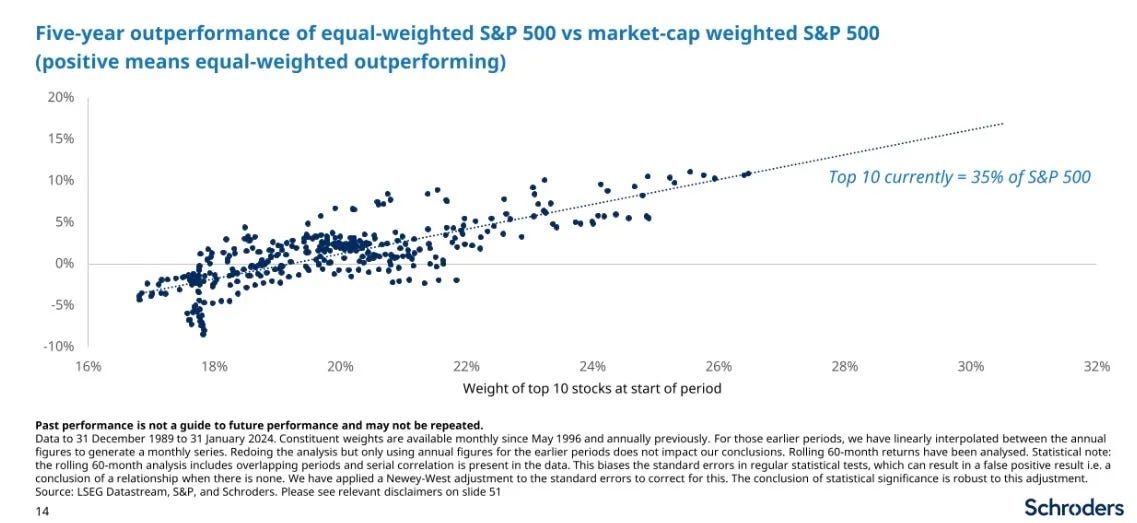

9. Do NOT Concentrate

When it comes to stock market performance the more concentrated the index becomes, the more attractive it is to sail in the opposite direction of cap-weighted strategies and go for . Probably a lot of this is the result of the dot com bubble and early-1980’s oil boom, but it’s not the only analysis on this issue.

Source: Schroders (LON:) via Snippet Finance

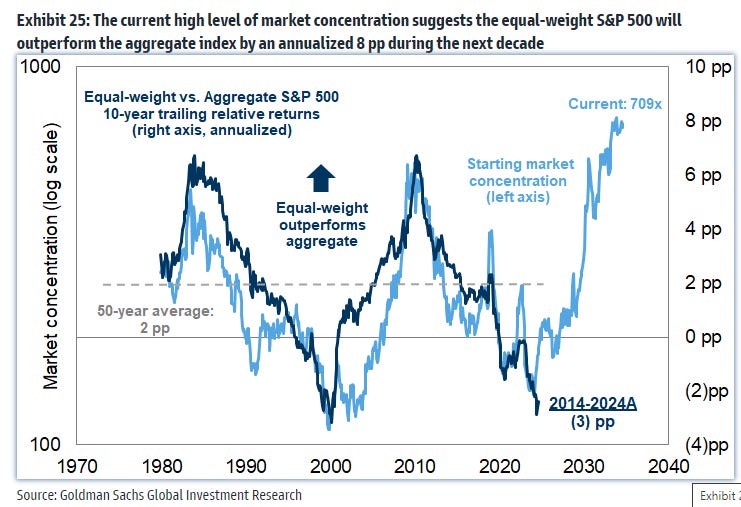

10. No Cap (weight)

Another way of looking at it — time series chart showing market concentration indicator in the light blue vs equal-cap weight relative performance in the dark blue. Same deal, higher concentration points to higher future relative performance of equal vs cap weighted

Source: GS via @MikeZaccardi

Equal vs Cap Weight in Perspective: taking it a step further, over the long-run it’s actually more normal for the equal-weighted index to outperform the cap-weighted index. And as of right now the equal/cap weight relative performance line is very stretched to the downside vs trend and has bounced off the 09 low point.

And it kind of makes sense that cap-weighted strategies over-weighted yesterday’s winners, and underweighted the laggards (often value plays, due for a turnaround) new arrivals (tomorrow’s growth stocks). So it’s another reason to rethink just buying the cap-weighted passive index as everyone else does, and certainly food for thought for stock pickers. Maybe even some info on overall market timing too!

Original Post