Oil Tries to Break Downtrend

2023.07.24 10:41

rebounded on Monday after four weeks of gains. Today’s rise of 1.2% to $77.7 per barrel of WTI is not remarkable in terms of momentum, but it is noteworthy for its potential impact on the technical picture.

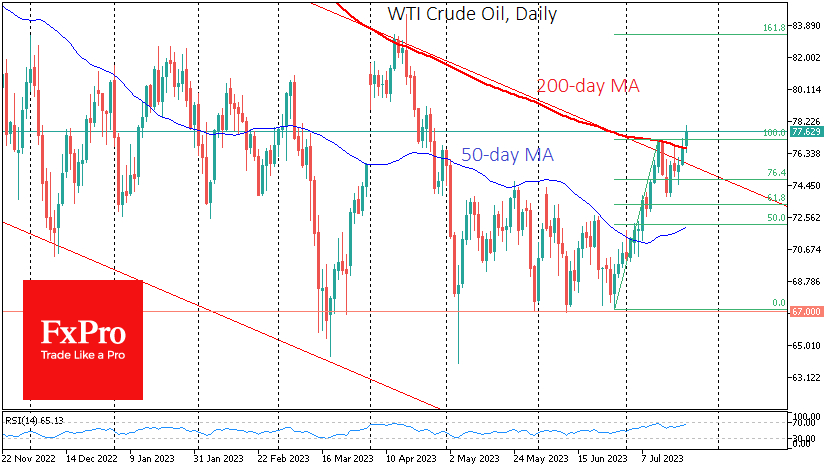

Crude Oil trying to break though the downtrend

Crude Oil trying to break though the downtrend

At the end of last week, WTI broke through the previous local highs and climbed above the descending channel’s resistance, signalling a break in the trend that oil has been following for the past twelve months. On Monday, the rally continued, and we noted a break above the 200-day moving average, which has been acting as resistance since August 2022.

If oil does not turn sharply lower in the next few days and returns to the established range below the 200-day average, the main scenario will be a rise to the $83 area, where the 161.8% Fibonacci levels from the June lows to the July 13 peak and the April reversal levels are concentrated.

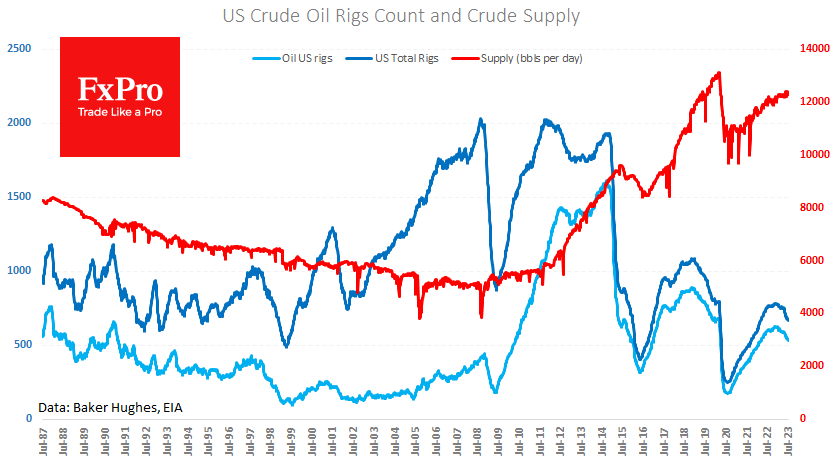

Potentially lower Crude Oil supply in the US

Potentially lower Crude Oil supply in the US

Meanwhile, data highlights the decline in drilling activity, with the number of oil production rigs falling to 530, down 12% year-on-year to the lowest since March 2022. The latest production data showed stagnation at 12.3 million BPD, with crude oil inventories now 7.2% higher than a year ago. These figures do not suggest a boom in the upstream sector. However, oil prices are falling as OPEC+ cuts supply faster than demand slows.

Oil may reject the reality of lower demand for a relatively long time, but sooner or later, the impact of the fundamentals will prevail. The odds are very high that oil is now making a false break of the downtrend and will soon return to its established range under the pressure of high-interest rates and a deteriorating economic outlook.

The FxPro Analyst Team