Oil Prices Move Higher but Battle Against 100-Week MA Rages On

2023.09.04 07:07

prices are on the move once again and oil traders are feeling fairly optimistic as the message from China is loud and clear which is that they are not going to leave anything that they will not throw to revive the Chinese economy and bring it back to its glory days. The gloom and doom about the Chinese property market impacted sentiment among oil traders as they began to anticipate a slowdown is highly possible. However, the fact that Chinese lawmakers are so determined and effective in announcing the right policies and at the right time has restored confidence among oil traders.

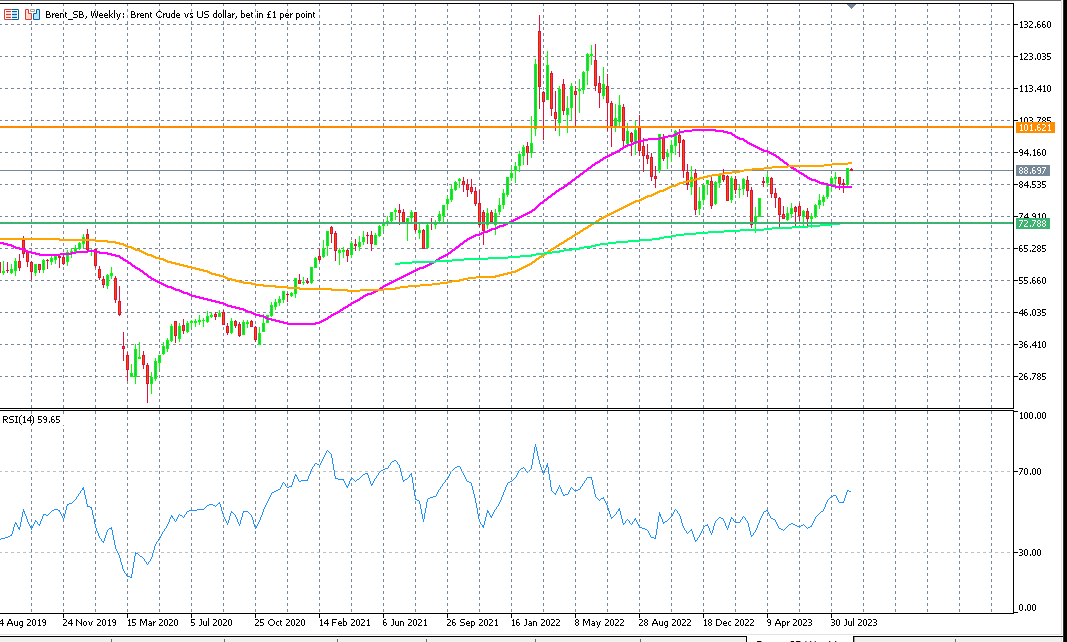

There is no doubt that there are several ways of trading oil but from a technical perspective, what matters the most is where the price is trading in relation to its moving average. On the chart below, one can see that on a weekly time frame, the price is in battle with the 100-week moving average shown in orange. But there is no doubt in saying that bulls are very much in control of the price as the price is trading above the 50 and 200-week moving averages. But the full-on rally will only occur when the price wins its battle against the 100-week moving average and the 50-week (shown in pink) will move above the 100-week moving average.