Oil Keeps Weakening Despite Production Cuts

2023.06.13 07:48

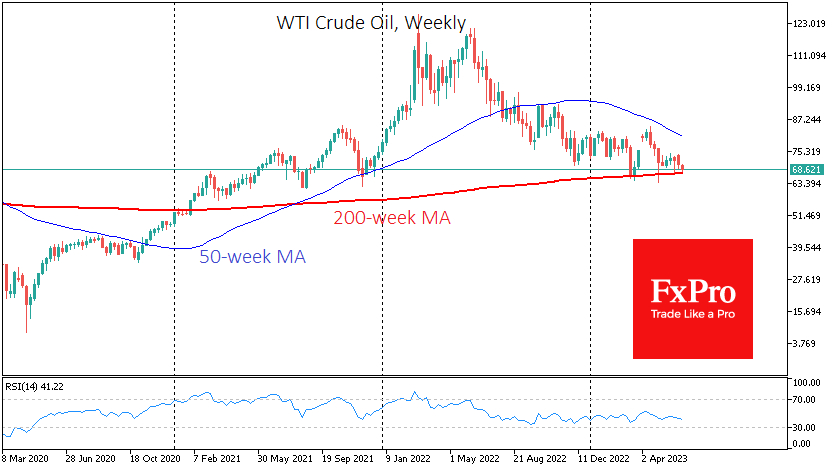

lost more than 4% since the start of Monday, retesting the lower end of its range for the last three months. WTI briefly traded below $67.0 and below $72.

WTI briefly traded below $67.0

WTI briefly traded below $67.0

On Tuesday, oil is enjoying buying at the lower end of the range, gaining more than 1.5% since the start of the day. However, there are big questions about whether the current rally can gain traction.

Over the past three months, oil has repeatedly found itself close to current levels, from which it has bounced on technical factors (accumulated local oversold conditions) and several announcements of production cuts by OPEC+ members.

Notably, the current sell-off in oil is going against the news. Prices peaked locally shortly after Saudi Arabia announced a voluntary production cut of 1m BPD and Russia’s plans to cut production from next year.

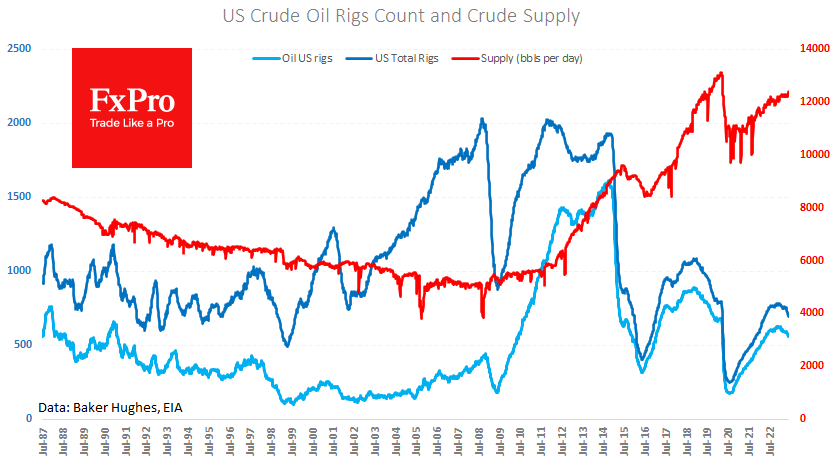

Baker Hughes saw the number of active rigs (oil + gas) fell by a further 1 to 695

Baker Hughes saw the number of active rigs (oil + gas) fell by a further 1 to 695

In addition, the US government announced at the end of last week that it would begin buying oil for the Strategic Petroleum Reserve. According to Baker Hughes data released on Friday, the number of active rigs (oil + gas) fell by a further 1 to 695.

More interestingly, the sharp fall in oil prices since mid-April has been accompanied by impressive demand for equities on the back of strong macro data.

It is no coincidence that OPEC+ is so strongly defending current levels. The $65 area has acted as an important mode switch for oil. A break below triggered a bullish capitulation that halved the price before a steady move higher in 2008, 2014 and 2020. The ability to hold higher triggered a rally that doubled the price in 2007, 2010 and 2021.

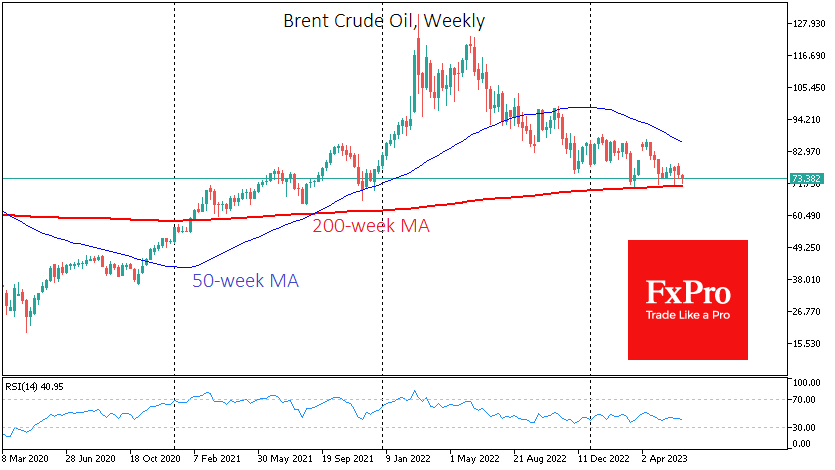

Brent Crude testing its 200-week MA

Brent Crude testing its 200-week MA

The fact that the 200-week moving average is being fought over adds to the epochal nature of the current battle between the bulls and bears. And the persistent, repeated attempts to break below this line since February is more of a bearish signal.

Graphically, it looks more like what we saw in 2008. And that is an argument for oil to head towards $30 now, although it would still be prudent to wait for consolidation below $60 to gain more confidence in a downside move.

The FxPro Analyst Team