Nonfarm payrolls set to rattle deserted markets

2023.04.07 06:31

- Nonfarm payrolls report coming up, early indicators flash mixed signals

- Most markets will remain closed today, so FX is the main game in town

- Wall Street recovers after another round of soft data cements rate-cut bets

All eyes on US payrolls

Investors are in for a stormy ride today, as the latest US employment report will be rolled out into a market that is deprived of liquidity. Many traders are away from their desks for the Good Friday holiday and several markets will remain closed entirely, which can amplify any market reaction on the US jobs data.

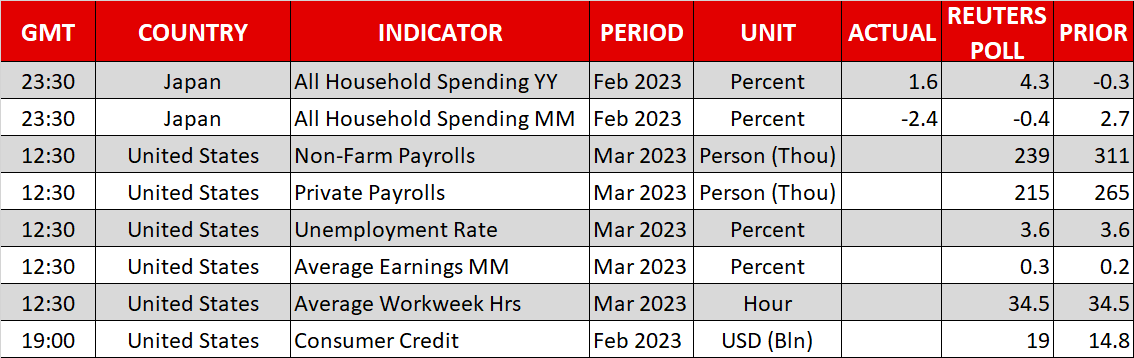

Nonfarm payrolls are projected at 239k in March while the unemployment rate is seen unchanged at 3.6%, remaining close to multi-decade lows. Wage growth is anticipated to have lost some steam in yearly terms, but nothing dramatic. It’s difficult to provide a prognosis about any potential surprises in this data, as early labor market indicators flashed some mixed signals.

The ISM business surveys painted a picture of a labor market that has started to lose steam and the rise in applications for unemployment benefits adds credence to this notion, but the S&P Global surveys instead pointed to the fastest pace of job creation in six months and intensifying wage pressures.

With the markets currently pricing the prospect of a final Fed rate increase next month as a 50-50 coin toss, this payrolls report will be instrumental in shaping those expectations and deciding the dollar’s fortunes.

Market impact and dollar outlook

Since US stock and bond markets will remain closed today, the FX arena will essentially be the only game in town and the shortage of liquidity implies that any moves in the dollar in the wake of the employment numbers might be more ferocious than usual.

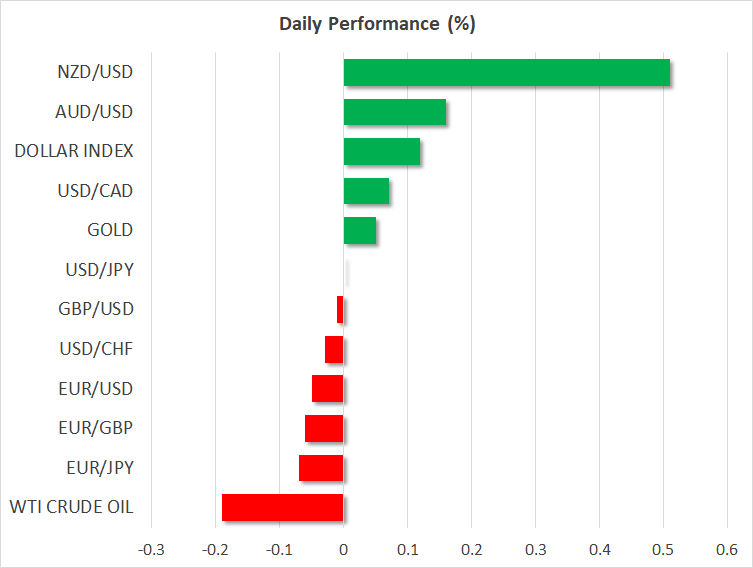

Rising bets that the Fed will be forced to slash interest rates before year-end have ravaged the dollar lately, and the cheerful mood in equity markets as the banking panic receded didn’t do the reserve currency any favors either. Still, it’s difficult to be negative on the dollar.

While the US economic data pulse is slowing and the bond market is screaming a recession is on the horizon, that’s not necessarily a death sentence for the dollar, as most major economies are arguably in worse shape. Even when a recession originates in America, it is quickly exported to the rest of the world, so there is no real refuge for investors.

The bottom line is that the dollar is down but not out. Thanks to its status as the world’s reserve currency, it can shine even when the US economy is weak as investors hit the ‘panic’ button.

Gold consolidates gains, stocks climb

Gold prices have been on a tear this week, piercing above $2000 with some momentum and managing to hold that region. Beyond speculation about Fed rate cuts, another driving force behind bullion’s meteoric ascent has been the Chinese central bank, which raised its gold reserves for a fifth consecutive month in March.

In all likelihood, the People’s Bank of China is loading up on gold to diversify the nation’s reserves away from dollars and euros, concerned that those FX reserves can be frozen in case the geopolitical atmosphere turns colder. Still, the fact such a whale is lurking in the market is a great sign for bullion, especially if recession risks and rate-cut bets remain in play.

Finally, shares on Wall Street enjoyed a solid recovery yesterday after the latest round of US initial jobless claims pointed to a labor market that is cooling, fueling speculation that the Fed is on the cusp of a pivot. Stock markets will remain closed today, so there’s likely to be a price gap when they reopen on Monday following the jobs numbers.