No Need to Fight, There’s a Reversal for Everyone

2023.07.24 17:00

Reversals. Plenty of reversals. With reversal-based seasoning. , , miners, the , and even stocks – all reversed profoundly last week.

Reversals are important, but they become very important when they are based on weekly prices. If we see a reversal being confirmed in an additional market, then it becomes something that should make one really pay attention.

Last week, we saw weekly reversals in all key markets that are important for precious metals investors – it’s very rare to see a combination of signals that’s this profound.

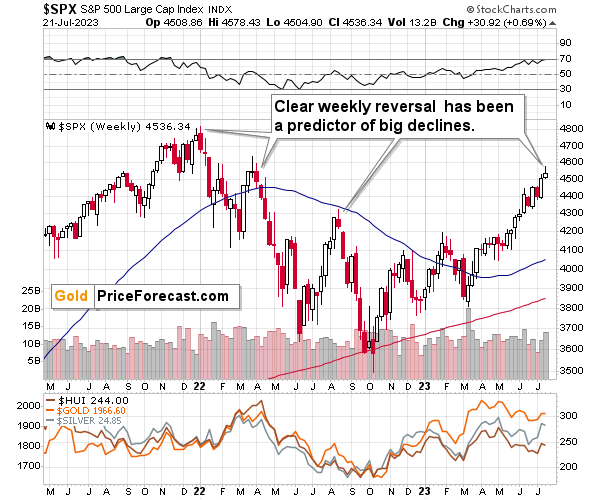

Stock Market’s Reversal

Let’s start with context. market?

SPX

It reversed.

We saw previous similar – weekly – reversals at the 2021 top and two key 2022 tops. And we saw it last week. As you can imagine, the implications are very bearish.

Oh, I almost forgot. Last week’s reversal was accompanied by one of the strongest volume readings that we saw this year. This makes the bearish implications even more bearish.

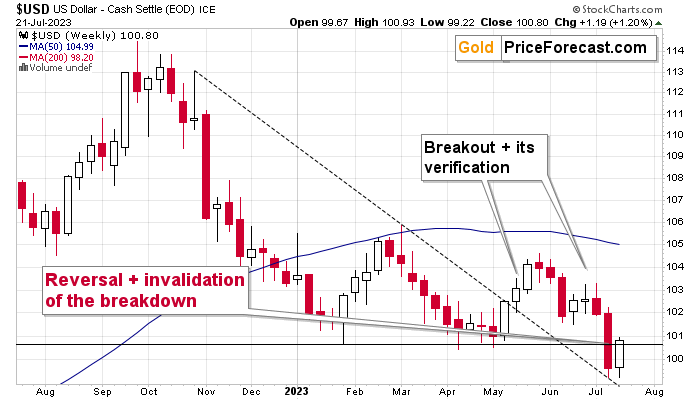

USDX’s Reversal

The ?

Here’s where the situation is extremely bullish.

- Massive weekly reversal – check.

- Invalidation of the breakdown to new yearly lows – check.

- Verification of the breakout above the declining dashed resistance line – check.

But wait, there’s more!

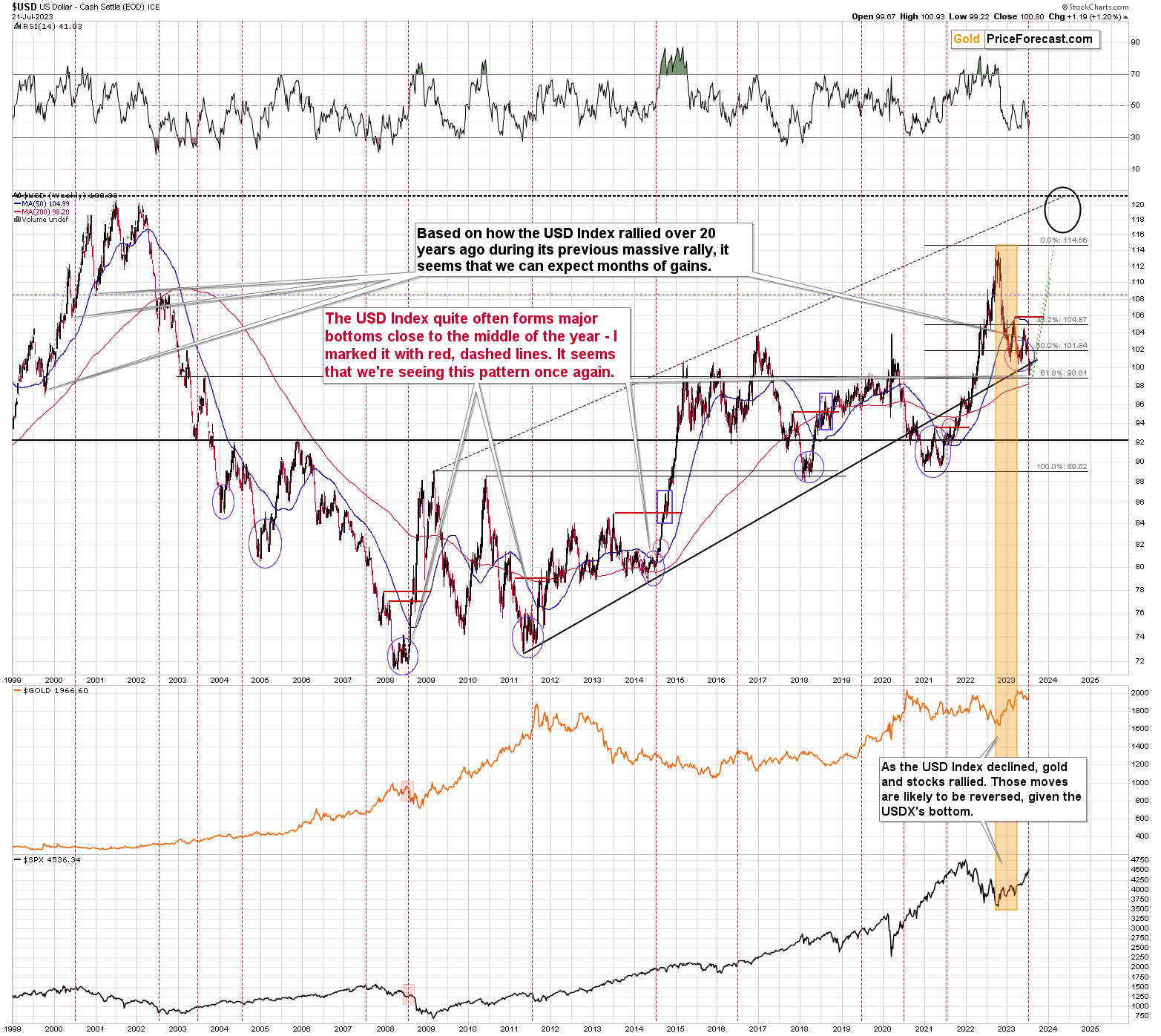

From the long-term point of view, it’s clear that the USD Index has a tendency to form major bottoms in the middle or close to the middle of the year. That happened, for example, in 2008 and in 2011 – and it’s happening also right now.

Another point for the bull team.

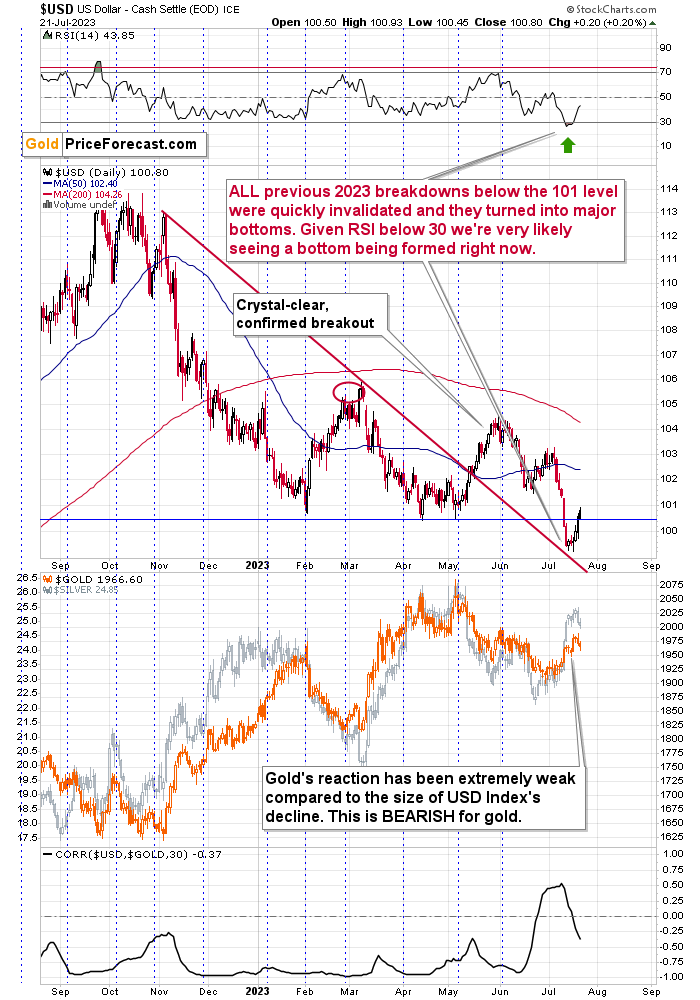

Also, did I mention that the USD Index was more oversold than it’s been in many months (as the RSI proves)?

This is really as bullish as it gets.

And on top of that, please note how weak the gold price’s reaction was – it’s in the lower part of the above chart. While the USD Index moved briefly to new 2023 lows, gold wasn’t even close to its 2023 highs. It didn’t even correct half of its decline from its 2023 highs.

Gold & Silver Reversals

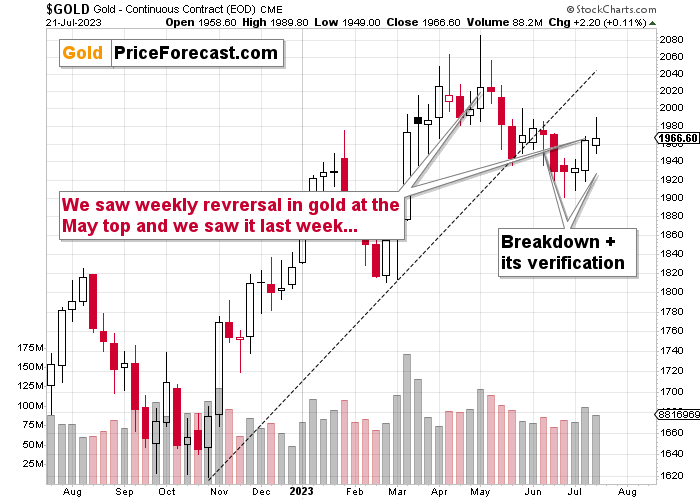

Speaking of gold, it reversed, too!

And it reversed similarly to how it had reversed at its 2023 top. Can we all agree that this is a clearly bearish analogy and move to silver?

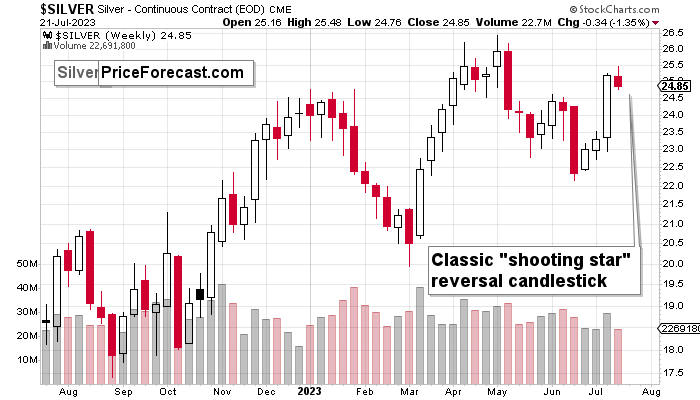

Silver price reversed in a crystal-clear manner, forming a shooting-star reversal. It’s not the only bearish thing that happened on silver, either. The way silver outperformed gold during the previous part of the month is also a bearish sign, especially since mining stocks underperformed at the same time.

Miners’ Reversal

Speaking of miners…

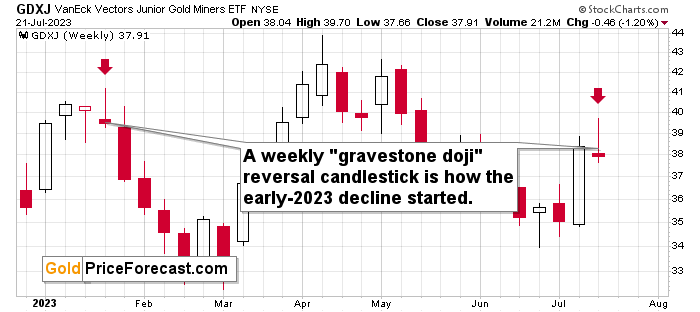

Guess what? They reversed, too!

They formed a gravestone doji reversal candlestick in weekly terms – the same kind of pattern that we saw at the early-2023 top. Just like back then, miners also closed the week lower. Please note that gold didn’t, which means that junior mining stocks just underperformed gold on a weekly basis.

Zooming in allows one to see that the VanEck Junior Gold Miners ETF (NYSE:) also declined back below the rising red resistance line.

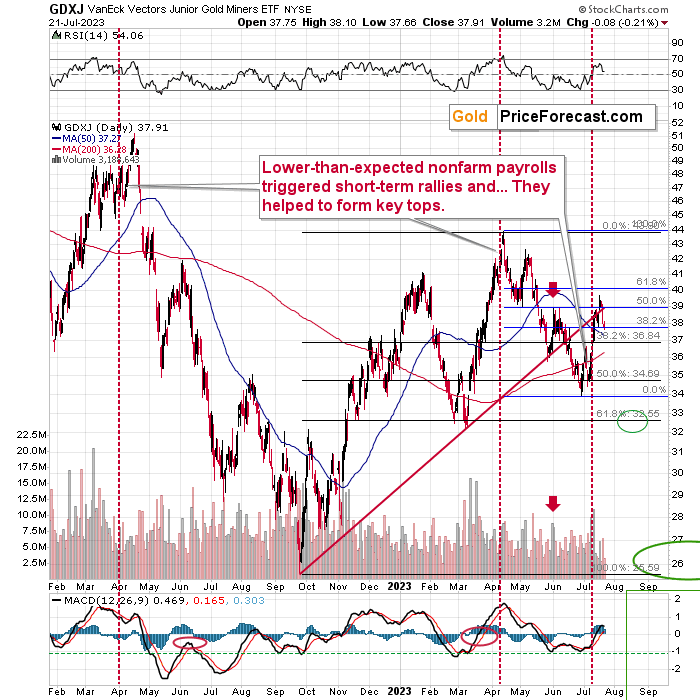

Most importantly, though, the above chart shows that the current situation is exactly like it was after the previous surprisingly bad (low) non-farm payroll reports.

You see, there were just three cases in the recent past when the job statistics were below expectations, and I marked all of them with red, vertical lines. See anything in common?

While the immediate-term aftermath could have been positive or relatively neutral, the medium-term implications are clear. Junior miners are likely to slide.

The most bearish thing about this analogy is the most recent rally.

“Huh, how can a recent rally be bearish?” – one might ask.

The point is that based on the recent rally, the clearest analogy is now to the 2022 top, the rally, and the report that preceded it. Well, what happened after that top? Buying GDXJ then wasn’t a good trading strategy, as GDXJ’s value was approximately cut in half over the next several months.

And all that is on top of all the weekly reversals that I mentioned throughout today’s analysis.

Just a repeat of that would imply a move to about $20 in the GDXJ. Let nobody tell you that a move to “just” the 2022 low in the medium term is excessive – that’s actually just a part of what’s likely based on what GDXJ already did in the past.

What does it all mean? In short, the counter-trend corrective upswing is likely over, and huge declines are likely just beginning. The huge profits that we recently reaped in the FCX recently are likely to be joined by massive profits from the current short positions.