NFP Preview: Halfway Decent Jobs Report May Propel US Dollar Toward Resistance

2024.10.04 03:20

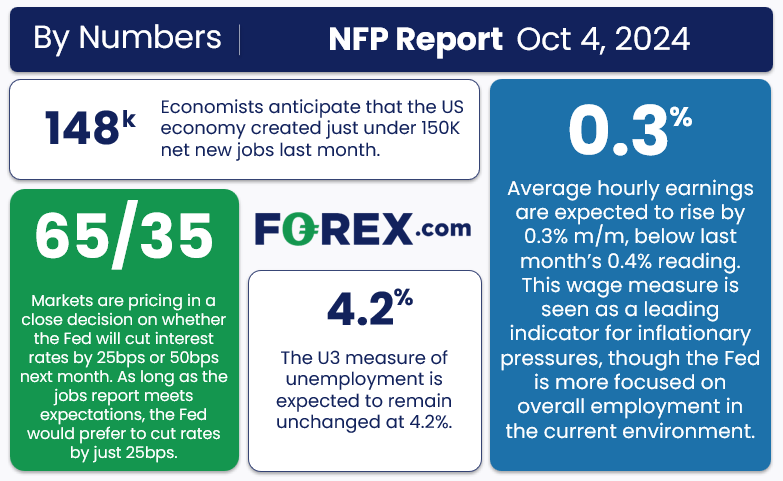

- NFP report expectations: +148K jobs, +0.3% m/m earnings, unemployment at 4.2%

- The leading indicators point to a potentially better-than-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 130K-200K range

- The US Dollar Index (DXY) has bounced back sharply, but is far from overbought on a longer-term perspective.

Traders and economists expect the report to show that the US created 148K net new jobs, with rising 0.3% m/m (3.7% y/y) and the U3 holding steady at 4.2%.

Last month, we highlighted how the NFP report could determine whether the cut interest rates by 25 or 50bps. Indeed, the weaker-than-expected jobs report (along with the downward revision to the previous month’s reading was enough to tip Jerome Powell and Company to the more aggressive 50bps reduction – despite a staggering 90%+ of economists surveyed by Bloomberg expecting a 25bps rate cut!

This month’s report is unlikely to be quite as significant, at least in terms of immediate market impact, if for no other reason than the fact that another NFP report will be released before the Fed next meets on November 7th.

That said, traders are still uncertain about whether the Fed will feel compelled to cut rates by 50bps again, and much of that uncertainty stems from the potential for US economic data (prominently including this month’s NFP report) to signal an economic slowdown.

In other words, as long as the next two jobs reports at least meet expectations and there are no other shocking economic reports, the Fed would prefer to downshift to 25bps rate cuts moving forward.

In terms of the NFP expectations, traders and economists are anticipating a slight improvement from last month’s jobs growth, with wages and the unemployment rate expected to come in roughly in line with recent trends:

Source: StoneX

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The PMI Employment component fell to 43.9 from 46.0 last month.

- The PMI Employment component dropped to 48.0 from 50.2 last month.

- The Employment report showed 143K net new jobs, up from the upwardly-revised 103K reading last month.

- Finally, the 4-week moving average of initial unemployment ticked down to 224K from 230K last month.

Weighing the data and our internal models, the leading indicators point to a potentially better-than-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 130K-200K range, albeit with a big band of uncertainty given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.4% m/m in the most recent NFP report.

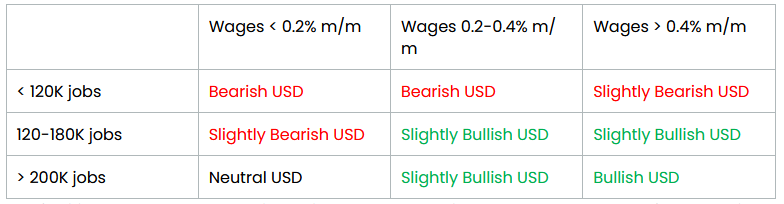

Potential NFP Market Reaction

As of writing, the is trading at a 6-week high, helped along by a safe haven bid amid the ongoing geopolitical clash in the Middle East.

Focusing only on policy, it’s likely that traders cut their bets on a 50bps rate cut on any halfway-decent jobs report, tilting the odds toward a potential modest extension of the dollar’s rally, though we may yet see pre-weekend profit-taking emerge in that scenario.

Meanwhile, a sharp deterioration in the number of jobs created (especially if accompanied by a rise in the unemployment rate) would put a 50bps rate cut firmly on the table and likely lead to a downdraft in the world’s reserve currency.

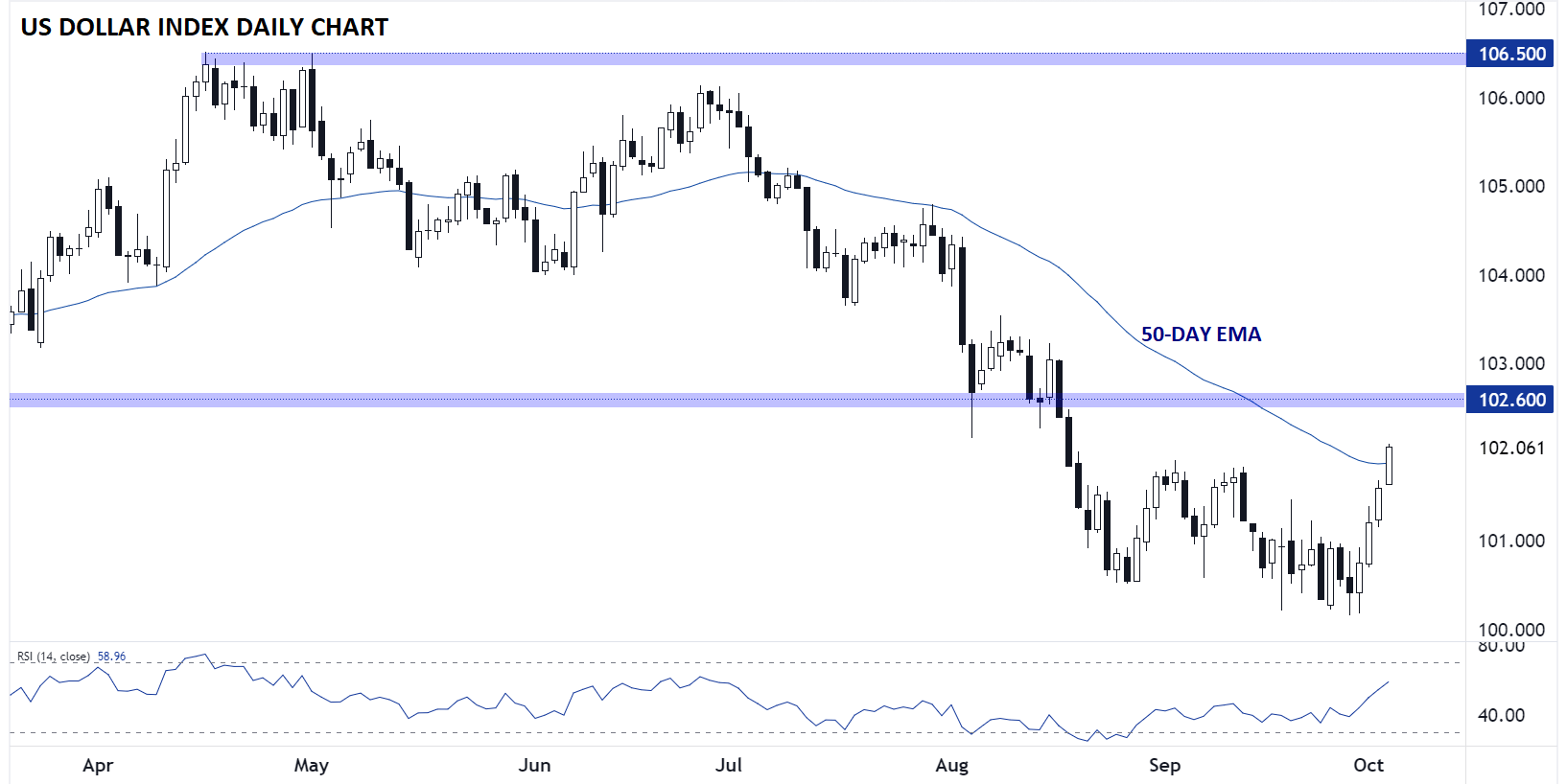

US Dollar Index Technical Analysis – DXY Daily Chart

Source: TradingView, StoneX

From a technical perspective, the US Dollar Index is testing its 50-day EMA after a strong bounce through the first four days of the week. Despite this week’s rally, the is trading far below the year-to-date peak set back in April, so it’s hard to argue that it’s particularly overbought. On a strong jobs report, bulls will look to target key previous-support-turned-resistance at 102.60, whereas a soft reading would open the door for a retracement back toward 101.00 heading into next week.

Original Post