Next Leg Higher Starting in Gold and Gold Stocks

2024.09.13 06:55

As the stock market sold off, gold mining stocks pulled back from resistance, and fell below the critical $29/oz level. Growing recessionary fears, stock market weakness, and the specter of the 2008 Boogeyman pressured the sector lower.

That was all she wrote.

The sector has quickly recovered and could be poised to run after the coming Fed rate cut next week.

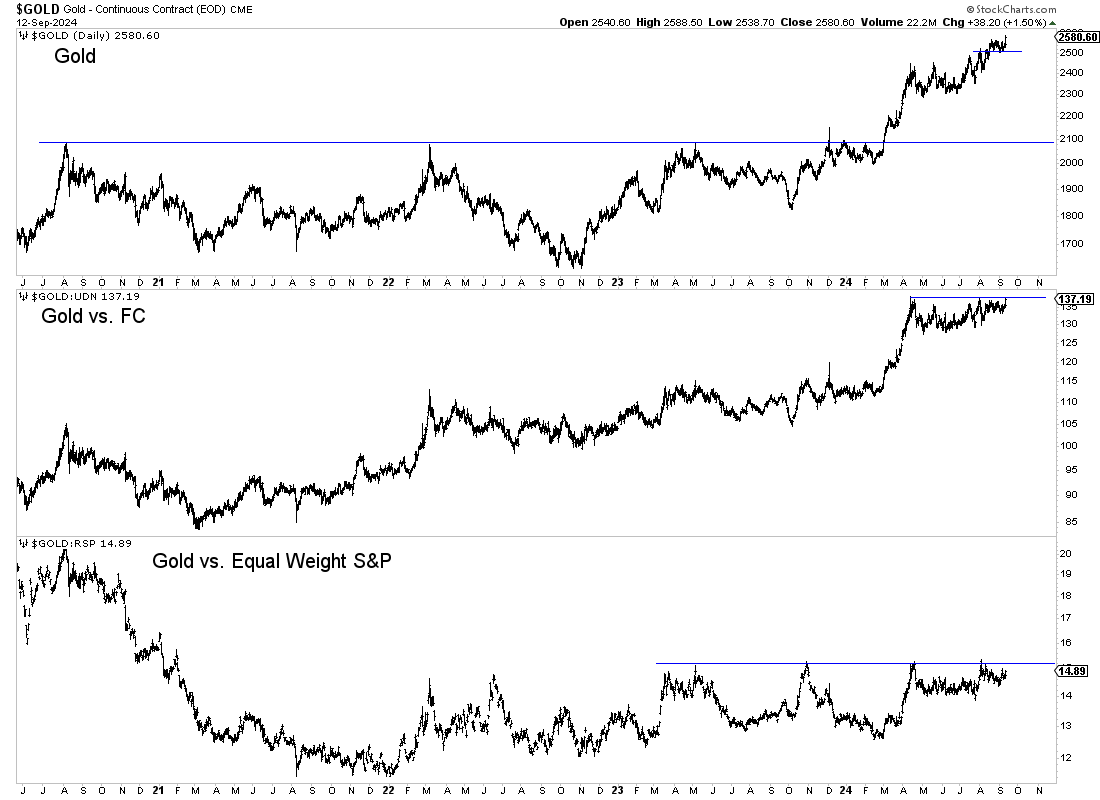

has broken again in nominal terms but, more importantly, is on the cusp of breaking out in real terms.

Gold against foreign currencies (Gold vs. FC) is breaking out from a five-month consolidation, and Gold against the is on the cusp of a new three-and-a-half-year high.

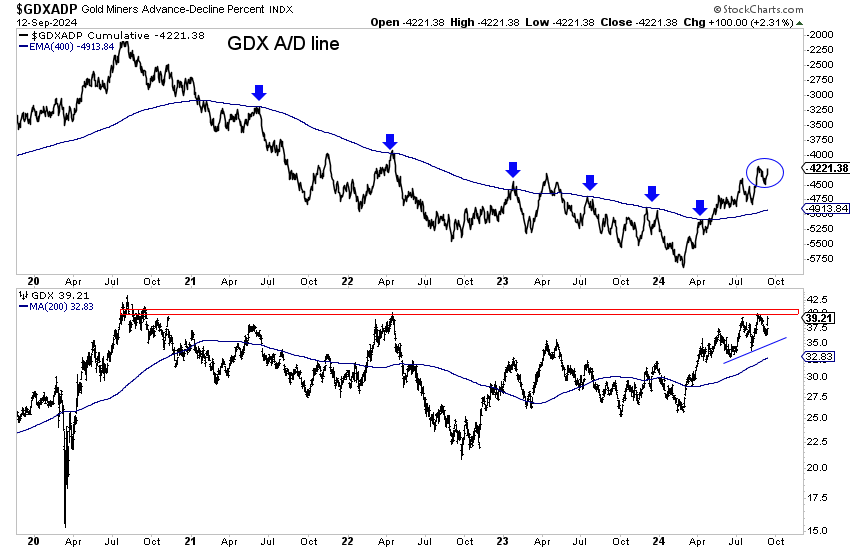

The advance-decline line, an excellent leading indicator, is in a new primary uptrend and just a smidge from another high and two-year high. This type of breadth often precedes more strength in the miners.

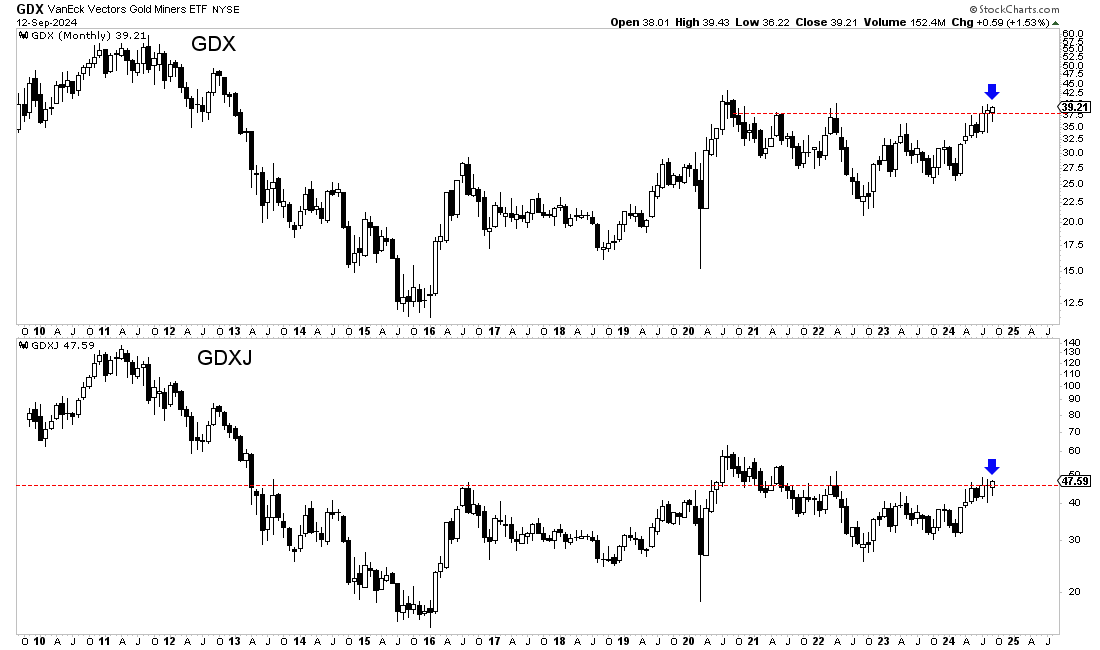

There are two weeks left in the month, but the monthly chart shows significant breakout potential if GDX and maintain their current levels.

GDX is working on a 4-year high, and GDXJ is working on a 3-year high. Furthermore, if miners can push higher from here, they will face limited overhead resistance dating back a decade. GDX is close to an 11-year high.

History does not always repeat, but gold stocks trended higher following the first rate cut in each of the last four rate cut cycles.

In 1989, they jumped 51% in nine months. Then, in 2001, they gained 41% in two months and 87% in less than five months.

Before 2008 and the global financial crisis, they gained 72% in five months. The gain in 2019 (18% in one month) was limited due to a 35% gain in the two months before the first cut.

Gold, which could test $2600 on Friday, has a measured upside target of $3000. The miners are in a position for a big breakout move.

The rebound in recent days may be the start of what is to come over the weeks ahead.