Natural Gas Week Ahead: Prices May Continue to Hover Around $2.16

2024.09.04 03:58

Did you know the U.S. benchmark Henry Hub spot price was under $2.00 per million British thermal units (MMBtu) in February and March 2024? It hit a low of $1.50/MMBtu. This shows a big drop of almost $2 from October 2023. It highlights the need to understand the natural gas week ahead. We’ll look into recent price changes, forecasts, and what’s driving these shifts in natural gas prices.

The market is seeing ups and downs in supply and demand. Natural gas storage levels are key to this. They’re about 39% higher than the five-year average. This tells us a lot about future prices and how much gas will be available. Investors and stakeholders should watch for changes in demand, production issues, and global market trends this week.

Current Market Overview for Natural Gas

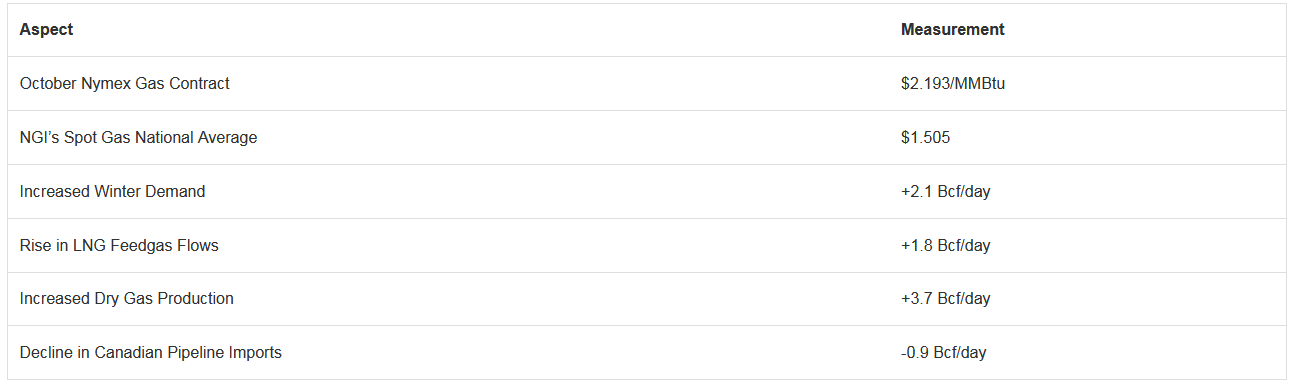

The market for natural gas is seeing big price changes and key factors that affect it. Recently, the October Nymex gas contract went up by 6.6 cents to $2.193/MMBtu. NGI’s Spot Gas National Average also jumped by 29.5 cents to $1.505. These changes show how unpredictable natural gas prices can be. They reflect the market’s ups and downs, driven by demand and supply shifts.

Recent Price Movements

Natural gas prices have been going up and down, like they often do. For example, prices can swing by 4% in a day and change by about 15% a month in North American markets. These big changes are due to many things, like the weather and the need for more gas in certain seasons. For instance, really hot weather in the Midwest made people use more natural gas to cool down.

Factors Influencing Market Dynamics

Many things are affecting the natural gas market right now. The weather, especially in the Midwest, is a big factor. There, really hot or cold weather makes people use more gas. Also, LNG exports are lower than expected because of maintenance at the Freeport LNG plant. This has made people worry about the future supply. Winter demand has also gone up by 2.1 Bcf per day from last year, and production is up by 3.7 Bcf per day too. This shows a complex situation in the market as producers and consumers adjust to new conditions.

Knowing these things helps us understand the current market. It helps people make smart choices with the changing prices of natural gas.

Natural Gas Week Ahead: Market Trends and Forecasts

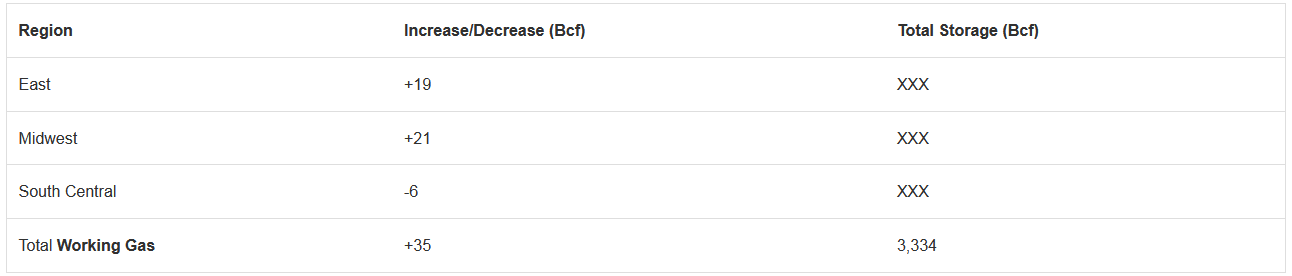

Looking at natural gas storage levels is key as the market changes. The U.S. Energy Information Administration’s latest weekly storage report shows total working gas in storage hit 3,334 Bcf on August 23, 2024. This was up by 35 Bcf. This info gives us a clear picture of how much natural gas is available.

Storage Level Analysis

Regional trends in storage increases are clear. The East region saw a 19 Bcf increase, and the Midwest added 21 Bcf. But, the South Central region decreased by 6 Bcf. This week’s underground storage analysis shows levels about 12.1% above the five-year average, showing a supply surplus.

Looking back at past years, we see big changes. Storage levels were higher than last year, showing a strong supply chain and more production in America. Even with a big withdrawal in some areas, the overall storage is ready to meet demand.

Knowing about natural gas storage levels helps us predict future prices. Gas prices are closely tied to storage and how much is used, as shown by updates from trusted sources.

Looking Ahead: Predictions for Natural Gas Prices

Experts think natural gas prices might stay around $2.16/MMBtu by the end of the quarter. They expect prices to go up to about $2.27/MMBtu in the next year. This change will be due to many things like demand, LNG exports, and how much people use it.

ICIS Natural Gas has a team of 100 energy experts. They give important forecasts on prices, supply, and demand for up to 36 months ahead. They use reliable weather forecasts too. The U.S. is expected to keep producing a lot of natural gas, about 103 Bcf/d for the rest of 2024. This could make LNG demand go up, raising prices in the future.

Understanding market forecasting helps companies deal with future changes. They need to watch out for changes in gas prices and how much people use it. Things like weather will also affect demand and the market. By looking at all these factors, companies can make better decisions and compete well in a changing market.

Source Links

- Natural Gas Forecast & Price Predictions 2023, 2025, 2030 –

- Time Traveling the Natural Gas Market : ICE White Paper –

- Natural Gas Market Indicators – March 7, 2024 – American Gas Association –

- High storage, faltering demand dampen Western US gas market outlook –

- Short-Term Energy Outlook – U.S. Energy Information Administration (EIA) –

- Natural gas –