Natural Gas: Was That Another Dead Cat Bounce?

2023.03.09 09:37

- From $3 highs, most active gas futures are back to mid-$2 pricing within days

- Charts show that front-month gas must stay above $2.45 for sake of bulls

- Gas storage likely to be 32% higher than a year ago after last week’s draw

Whatever happens hereon in , one thing’s for sure: The winter of 2022/23 won’t easily be forgotten.

While each season has established weather cycles, temperature patterns, and market behavior, divergences are also common throughout any given year. Without those, we won’t have the volatility gas is notorious for.

In that sense, this winter surely must rank as — one of, if not — THE most bewildering season in a very long time for even the most seasoned chaps or gals in gas.

Over the last three months, I’ve lost count of the number of false starts to a rally that gas bulls had counted on. And the remarkable dead cat bounces that draw them in for another mauling each time it appears that the bears have metaphorically run out of the gas they need for a fight.

Such was the past week, when the front-month gas futures contract on the New York Mercantile Exchange’s Henry Hub gained a whopping 55.8 cents, or 22.8%, for its best percentage gain since the week ended July 31, 2020.

As this week began, the front-month contract also returned to above $3 per mmBtu, or million metric British thermal units, for the first time since late January. With just about two weeks left before the official end of winter and start of spring, it appeared that the market had bottomed for good and was making incremental progress in $3 territory.

But to the nightmare of gas bulls, many who ostensibly had plowed into new long positions on the notion that the market was going to $4, the dreaded mid-$2 level from February is back now.

Worse, there’s no telling after this if there’ll be a revisit to sub-$2 levels witnessed a fortnight ago.

Sunil Kumar Dixit, Chief Technical Strategist at SKCharting.com, said gas could not afford to slip below $2.45 for the sake of the bulls:

“As long as prices sustain above $2.55, and more importantly above $2.45, the market has potential to get back to $2.82, followed by $3.07 and $3.31.”

John Kilduff, partner at New York-based hedge fund Again Capital and a commentator across commodity markets, added:

“This year’s prime horror show in commodities must surely be in natty. With the winter script completely destroyed for the bulls, their only hope now is that there be a normal summer — or whatever normal is these days.”

Analysts tracking the market swings of the past 48 hours pin the change — again — on weather changes.

Houston-based energy markets consultancy Gelber & Associates said in a Wednesday note issued on gas:

“This 15% decline has materialized as weather forecasts are trending slightly warmer and LNG export flows have pulled back slightly, adding to the already-robust levels of domestic supply.”

NatGasWeather, another forecaster, had a similar view. In comments carried by the trade journal naturalgasintel.com, it said:

“Essentially, the weather data was solidly bullish late last week but only slightly bullish in more recent data.”

An unusually warm winter has led to considerably less heating demand in the United States this year, leaving more than initially thought.

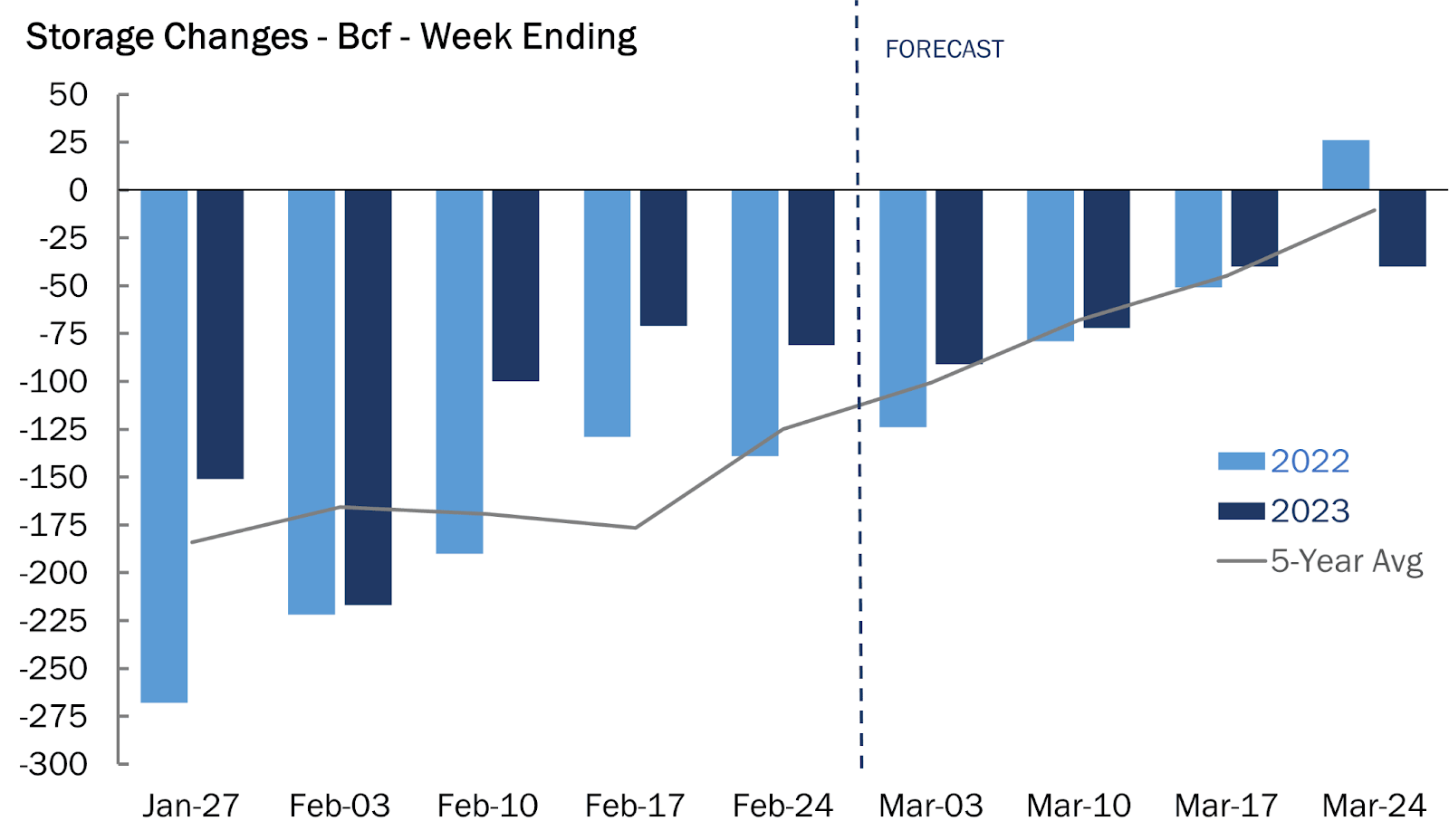

Source: Gelber & Associates

Source: Gelber & Associates

Storage of gas stood at a total of 2.114 tcf, or trillion cubic feet, as of Feb. 24 — up 27% from the year-ago level of 1.66 tcf and 19% higher than the five-year average of 1.77 tcf, the EIA, or Energy Information Administration, reported.

In response to the warmth and lackluster storage draws, gas prices plunged from a 14-year high of $10 per mmBtu in August, reaching $7 in December before hitting a 2½-year bottom of $1.967 in late February.

Since then, the market has rebounded on an anticipated rise in U.S. heating demand over the next two weeks from colder-than-normal weather conditions. Daily production of gas has also fallen to below January highs of above 100 bcf, or billion cubic feet, per day.

Another upside for gas bulls had been the improving feed demand for liquefied natural gas, with the steady pickup in volumes going into the Freeport LNG terminal in Texas. The plant has been slowly getting back to normal operations after a fire in June. Freeport had been a rock-solid base of 2 bcf, or billion cubic feet, of gas demand a day until it was knocked out.

Notwithstanding these bullish elements, weather shifts since late Monday pointed to even less heating demand in the winter twilight that would put more pressure on storage.

Said EBW senior energy analyst Eli Rubin in comments carried by naturalgasintel.com:

“Simply put, for current surpluses of 350 Bcf to be erased or meaningfully reduced, it will take a prolonged period of stronger-than-normal temperature driven demand, as well as a much tighter balance.”

Ahead of Thursday’s storage update from the EIA, or Energy Information Administration, for the week ended Mar. 3, analysts tracked by Investing.com are calling for a draw of just around 80 bcf for heating and power generation purposes.

That would be smaller than the 126 bcf consumption during the same week a year ago and the five-year (2018-2022) average decline of 101 bcf. During the prior week to Feb. 24, utilities pulled 81 bcf of gas from storage for heating and power generation.

If correct, the forecast for the week ended Mar. 3 would cut stockpiles to 2.034 tcf, leaving stockpiles about 32% higher than a year ago and 22% above the five-year average. There were around 135 HDDs, or heating degree days, last week, which was less than the 30-year average of 156 HDDs for the period, according to data provider Reuters-associated data provider Refinitiv.

HDDs measure the number of degrees a day’s average temperature is below 65 degrees Fahrenheit (18 degrees Celsius) to estimate demand to heat homes and businesses.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.