Natural Gas Selloff May Not Be Over As Output, Weather Side With Bears

2022.10.06 05:49

[ad_1]

- Natgas futures up 12% from $6.305 to Thursday pre-open high of $7.06

- Rally may not have legs due to overwhelming output, bearish weather

- Dip beneath $6 likely as physical gas market also weak

A three-day run-up in might prompt bulls in the space to think of a rally with legs. But record production and signs of unseasonably warm weather between bow and December suggest more bearish times to come, with a potential snap below $6 pricing.

After hitting a June low of $6.305 on Monday, gas futures on the Henry Hub quickly jumped 12% to a high of $7.06 ahead of its Thursday open on the New York Mercantile Exchange, delighting longs in the game who may have counted on continued traction to recapture the $8-$9 highs seen between mid-July and mid-September.

Yet, the reverse could be the case, say those watching the market’s fundamental drivers versus gas charts. They believe the latter was the catalyst for this week’s rally, due to the triggering of support levels after an acute six-week tumble in prices.

Alan Lammey, analyst at Houston-based gas markets consultancy Gelber & Associates, told the firm’s clients in an email seen by Investing.com:

“The move was purely technical in nature due to near-term oversold conditions, as there is very little in the way of bullish drivers in the market to support any meaningful upside momentum. G&A is still looking for a much deeper sell-off over the next few weeks, which could result in prices tumbling to the $6.10s/MMBtu or lower.”

Lammey said while some of the influences for the rally were early-cycle pipeline production flows—there was a 1.0 billion cubic feet per day (bcf/d) decline in dry gas production under 100 bcf/d due to Appalachian region pipeline maintenance on Tuesday—production volumes were revised higher in late-cycle flow data. He adds:

“Therefore, any upside price response earlier in the day was negated. This sort of daily production volatility happened nearly every day all summer long and didn’t stop dry gas production from incrementally climbing to fresh record highs on a weekly basis.”

“It does not appear that there will be any sustained upside trend in prices as there is a bevy of bearish price-setting mechanisms that will continue to combine forces to take prices potentially notably lower in the relatively near term.”

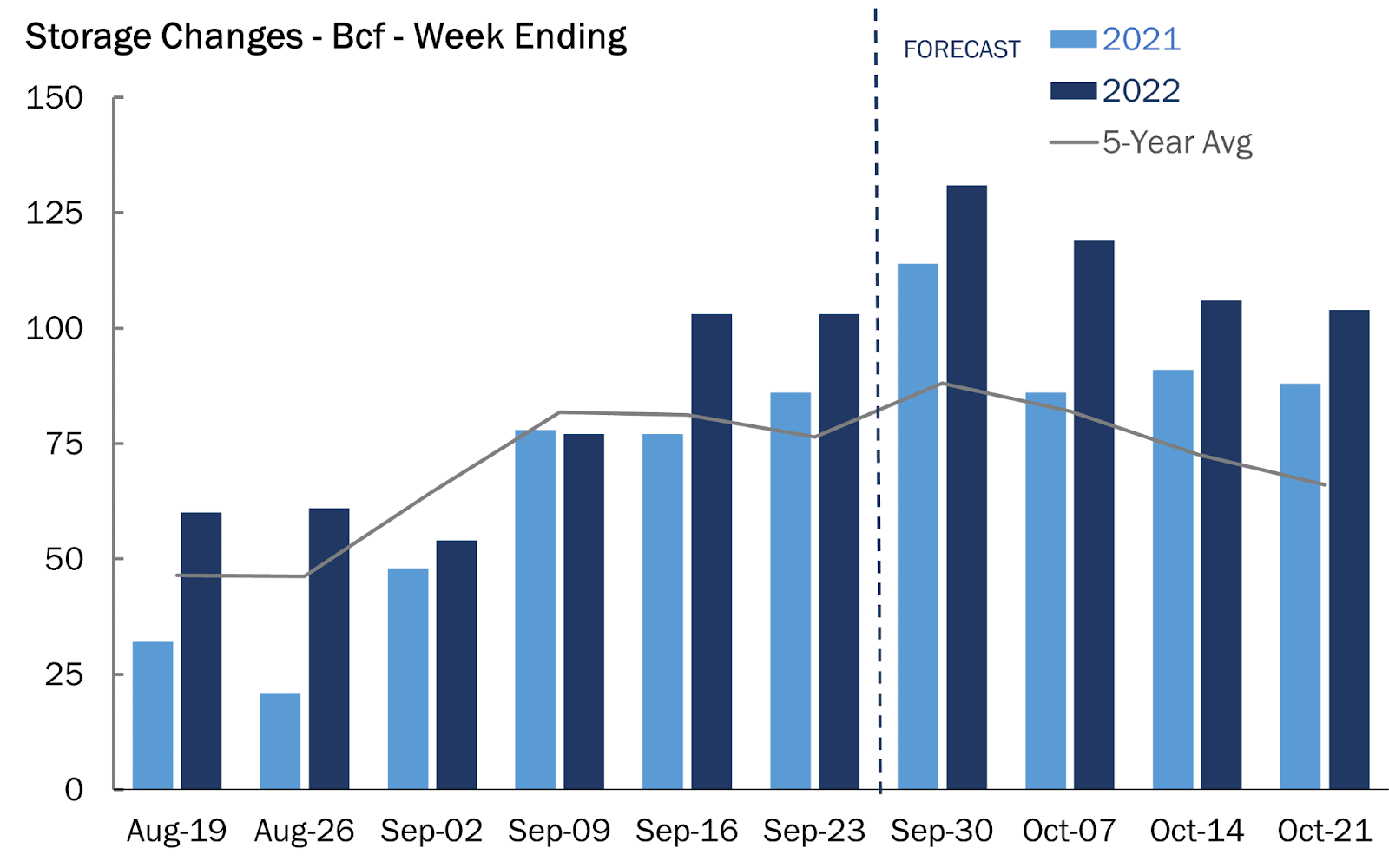

This significant increase in dry gas production, which became much more robust this year than the market had projected, has played a major role in loosening the underlying supply/demand imbalance. It could also have a hand in producing multiple triple-digit storage builds over the next few weeks, which might send end-of-refill season gas storage inventories closer to 3.6 trillion cubic feet per day as of the first of November.

For affirmation of how true this was on the physical market, cash/spot prices for the Oct. 5 flow date were getting truly hammered, with very little demand across the United States. Spot prices at the Henry Hub averaged near $5.41, which is under the screen by a whopping $1.48. The Katy Hub and Houston Ship Channel each averaged near $5.02. Virtually, all regions were averaging under $5.40, with some like the Rockies averaging near $4.95.

The temperature outlook for the months of October, November, and even the first half of December, meanwhile, look bearish for now. Some of the longer-range models suggest that the near entirety of the 2022-23 winter could come in unseasonably warmer over prolonged stretches, not only in the United States but also in Europe.

It’s still very early in the day for winter, but…

If this dynamic stays, it could drastically alter the winter situation for the EU and Vladimir Putin’s apparent plan to weaponize Russian gas supplies to the hilt in the coming months.

European gas storage is at least 90% full now, with some countries reporting that storage inventories are already at 100% capacity. We have also seen additional supporting data that there is a bottleneck in LNG cargo ships stacking up in Europe due to the complexity of offloading logistics as storage capacity brims in Europe. This situation could potentially reduce the volume of exported LNG out of the US in the weeks ahead and mitigate the possible November return of the Freeport LNG export terminal. We have heard that Freeport may also be delayed in terms of becoming fully operational again in November.

Source: Gelber & Associates

For the just-ended week to Sept 30, US utilities likely added 113 bcf to versus the previous week’s injection of 103 bcf, according to analysts tracked by Investing.com ahead of the Energy Information Administration’s weekly storage report on the same due at 10:30 ET (14:30 GMT).

If next week’s storage builds exceed more than 120 bcf, and should the mild November forecast come to fruition, it wouldn’t be out of the question to see storage builds continue well into early November.

The bigger picture is that the fundamentals of the US gas market have become exceedingly bearish and could be setting up to see a dump in NYMEX front-month gas futures prices well below $6. If the bearish fundamentals don’t relent, it’s not entirely out of the question that prices could even fall below what most market participants expect this fall and early winter.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.

[ad_2]

Source link