Natural Gas Piggybacks On Coal Rally Amid Looming U.S. Railroad Strike

2022.09.15 05:24

[ad_1]

- Railroad strike could happen by Friday, crippling coal supplies

- Gas supply might get tighter on late summer heat/cooling demand; LNG in view too

- Gas prices could target next technical range of $9.60-$9.80

- But record US gas output and limited weather support could also stifle rally

Blame it on the looming US railroad workers’ strike.

After correcting to a mid-$7 level more in line with its record production, on the New York Mercantile Exchange’s Henry Hub catapulted back to $9 within a week, as deep-pocketed hedge funds again ignored the onset of price-softening catalysts like surging output and approaching fall weather to send the market higher.

The main influencer this time was an upcoming railroad workers’ strike, which threatens to complicate coal deliveries to US utilities.

The railroad strike, which could come as early as Friday, threatens to deliver a blow to the economy by disrupting critical supply chains for commodities like and .

However, no sector stands to lose as much as the coal industry, which is almost entirely dependent on railways to move its product around. A work stoppage could reduce coal stockpiles that have already been thinned by poor rail service and the high levels of consumption caused by recent volatility in global energy markets. This could lead to electricity shortages and sky-high prices in coal-dependent parts of the country.

Enter natural gas bulls. Long-biased funds lying low from the 15% selloff of the past two weeks sprung into action on realizing the impact of the impending railroad strike, which had sent the Henry Hub to a four-week low of $7.76 from 14-year highs of almost $10. Wednesday’s settlement on the hub was $9.11.

Sunil Kumar Dixit, chief technical strategist at SKCharting,com, said at least chart-wise, the rally could continue.

“So long as support holds at $8.80, the next target for the Henry Hub is $9.60 to $9.80.”

Alan Lammey, analyst at Houston-based gas markets consultancy Gelber & Associates, noted there was another upside influencer for Henry Hub prices this week—warmer-than-average temperatures starting this weekend (Sept. 17) and forecast to linger into next week.

The Global Forecast System (GFS) and the European (ECMWF) near-term forecast models agree there will be a transition in mid-to-late September temperatures that could see Mother Nature lending some minor fundamental support to the gas market.

Tepid weather conditions have helped produce bearish daily natural gas storage injections, after a bout of mild temperatures that extended from last weekend into this week. The impending weather change, along with the railroad workers’ strike, raised risk appetites again across the Henry Hub.

Gelber’s Lammey said market longs may be a little misplaced in their faith in the weather:

“It’s important to note that this warmth doesn’t have the same sort of intensity as the record hot temperatures during July and August. The current period of warmth will be short-lived and will be mostly mitigated by a return of increased wind generation during the reflective period.”

As has been the theme for the near entirety of the summer, hedge funds piled into Wednesday’s session of the Henry Hub to buy in aggressively even as dry natural gas production wobbled at record highs of nearly 100 billion cubic feet (bcf/d).

Pulling back all of the 15% loss of the past fortnight, the hub saw an average of 3% being added in each of the past five sessions, and the climax was a 9% jump in Wednesday’s trading alone.

Matching the price action somewhat, early-cycle flow data for production eroded by 1 bcf/d to slightly over 99 bcf/d amid weekday maintenance.

Despite that, Lammey noted that “this bullish excuse is getting rather old, considering the fact that even with the pullback, production output is up by more than 6 bcf/d compared to last year.”

He added:

“At some point, the hedge funds that continue to muscle NYMEX gas futures prices well beyond the true underlying supply/demand fundamentals will be forced to throw in the towel. With this in mind, we continue to look for a sizable correction to the downside in NYMEX front-month gas futures, back down to the $6.00/MMBtu level within the next 2 to 3 months.”

Analysis of production data at hand shows that output could be knocking on the door of an all-time high of 101 bcf/d by next week. While natural gas storage inventories may be poised to start the withdrawal season with a modest deficit, the end of the refill season is likely to land at around 3.5 trillion cubic feet (tcf), with supply/demand imbalances notably looser.

But some say this week’s run-up in gas may be justified somewhat, given the prominence of liquefied natural gas (LNG) in the game. How much more gas the United States can export to Europe—the argument is that US LNG capacity for a day is only 13 bcf—has been a matter of great debate amid this year’s gas rally.

Some analysts remain bullish on LNG’s growth prospects, with those at Evercore ISI telling naturalgasintel.com on Wednesday that the market has been moving “from strength to strength” after Russian President Vladimir Putin dug his heels in by denying the West any of his country’s energy source if it keeps piling new sanctions on Moscow over the Ukraine war.

The Evercore team notes that coal-to-gas switching in the power sector continues to mount as the US steadily retires coal plants. Late summer heat is still on too, keeping up demand for air-conditioning, which will be especially high this week in the Dakotas, where temperatures in the 90 Fahrenheits have been forecast.

“We must acknowledge the strong support for both higher LNG send-outs” and “even more significantly a hot summer,” the Evercore analysts added.

Zongqiang Luo, a senior analyst at Rystad Energy, concurred, adding:

“Months of geopolitical wrangling have left the European gas market whiplashed, with volatile prices stemming from lack of supply, potential market intervention, and wider uncertainty. In the view of most experts and policymakers [the European gas market] is broken. But how it should be supported or fixed is an ongoing conversation with no clear resolution in sight.”

For now, Luo said LNG from the United States and elsewhere is at least a vital piece of the continent’s energy survival. Total LNG imports to Europe over the first eight months of 2022 were 60% higher than during the same period last year. Russian supplies a year ago accounted for roughly one-third of Europe’s gas; they now make up less than 10%.

But what does US gas storage show?

This week’s rally in US gas came ahead of another pivotal report expected from the Energy Information Administration at 10:30 ET (14:30 GMT) today.

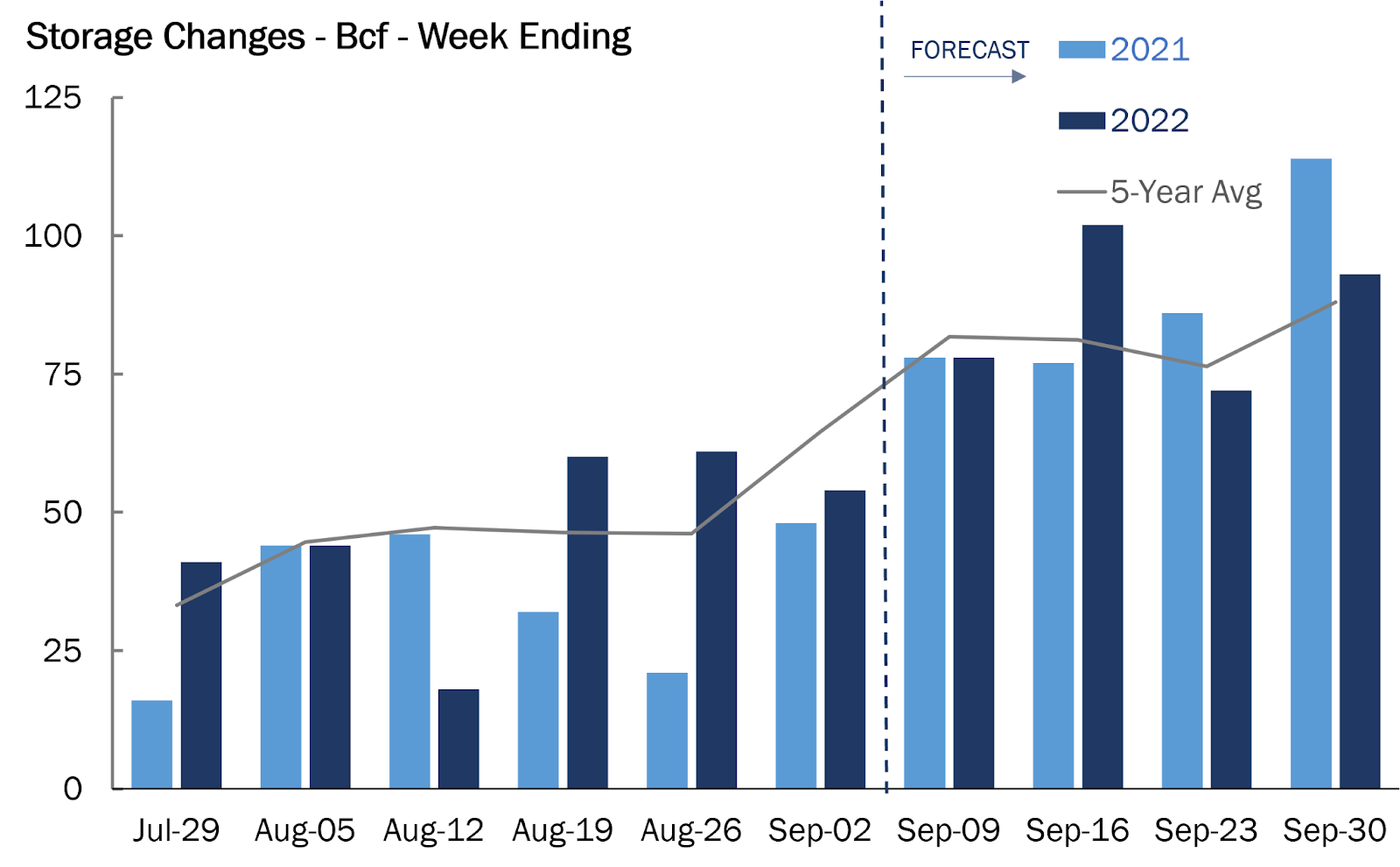

Source: Gelber & Associates

US utilities likely added a smaller-than-usual 73 bcf of natural gas to storage last week as power generators burned lots of gas to keep air conditioners humming during a heat wave, a Reuters poll showed on Wednesday.

That injection for the week ending Sept. 9 compares with a build of 78 bcf during the same week a year ago and a five-year (2017-2021) average increase of 82 bcf.

In the week ended Sept. 2, utilities added 54 bcf of gas to storage.

The forecast for the week ended Sept. 9 would lift stockpiles to 2.767 tcf, about 11.5% below the five-year average and 7.6% below the same week a year ago.

There were around 80 cooling degree days (CDDs) last week, which was much more than the 30-year normal of 65 CDDs for the period, data from Reuters-associated data provider Refinitiv showed.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day’s average temperature is above 65 Fahrenheit (18 Celsius).

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.

[ad_2]

Source link