Natural Gas: Bulls at the Bay

2022.12.23 00:37

[ad_1]

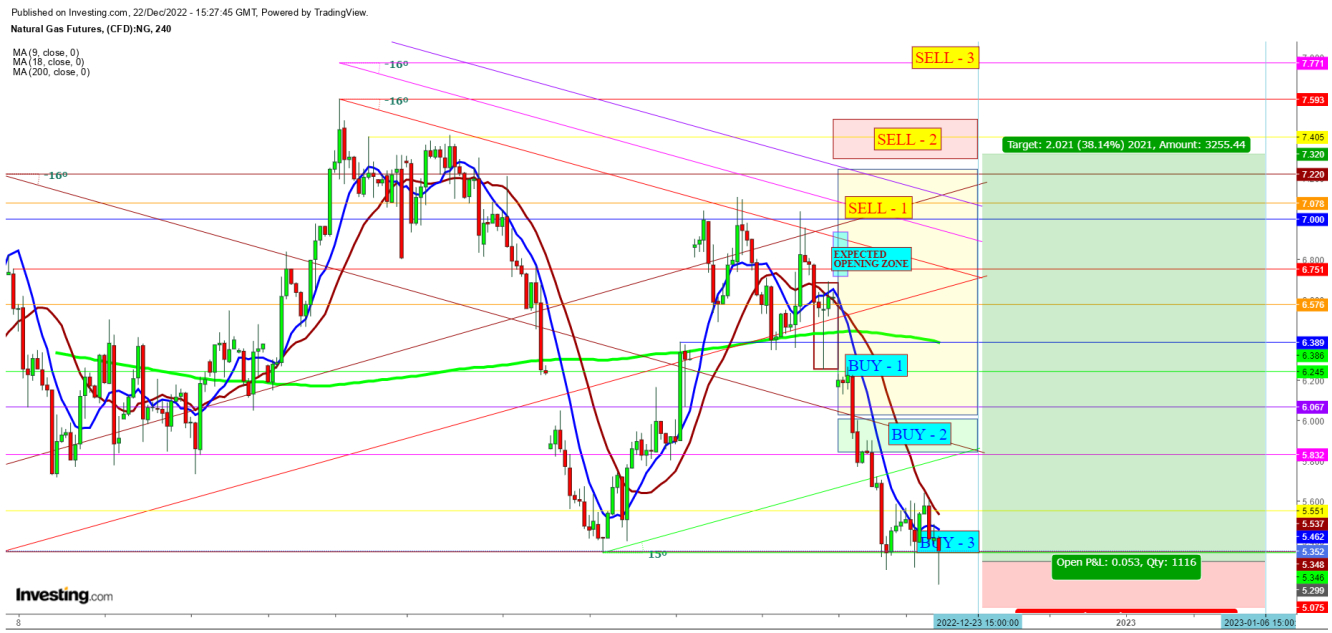

Movements of the during the last 4 hours indicate a thick presence of the bulls below $5.2 look too eager to sweep all the shorts as official advent of winter today could be supportive for the bulls.

Natural Gas Futures 4 Hr. Chart

Natural Gas Futures 4 Hr. Chart

In a 4-Hr. chart, the formation of a bullish hammer could confirmation-candle during the post-inventory period today if the natural gas futures find a gap-up after today’s stock announcement in a few minutes.

Undoubtedly, a sustainable move above $5.712 in post-inventory session will be the first confirmation amid wild price swings.

In case of an upward move, the natural gas futures could find stiff resistance at $6.067, second at $6.386 where an upward swing above 200 DMA could encourage bears to trigger shorts.

Only a breakdown below $5.167 will lead to a downward trend during the upcoming week due to the changing weather pattern could support the bears after Dec. 30, 2022.

Undoubtedly the weekly closing level will define the further direction, but long weekends could remain quite decisive in deciding the directional moves of the natural gas prices during the upcoming week.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.

[ad_2]