Natural Gas And Oil: Frisky Friday Could Be Decisive For The Weeks Ahead

2022.10.07 04:06

[ad_1]

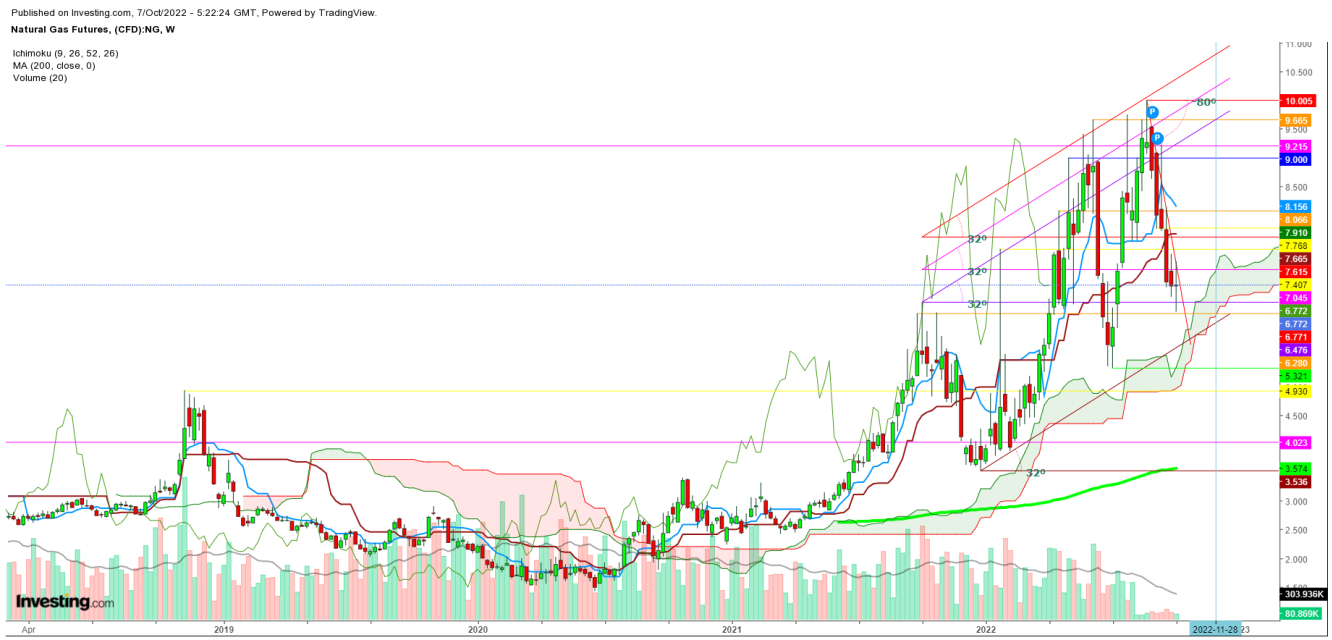

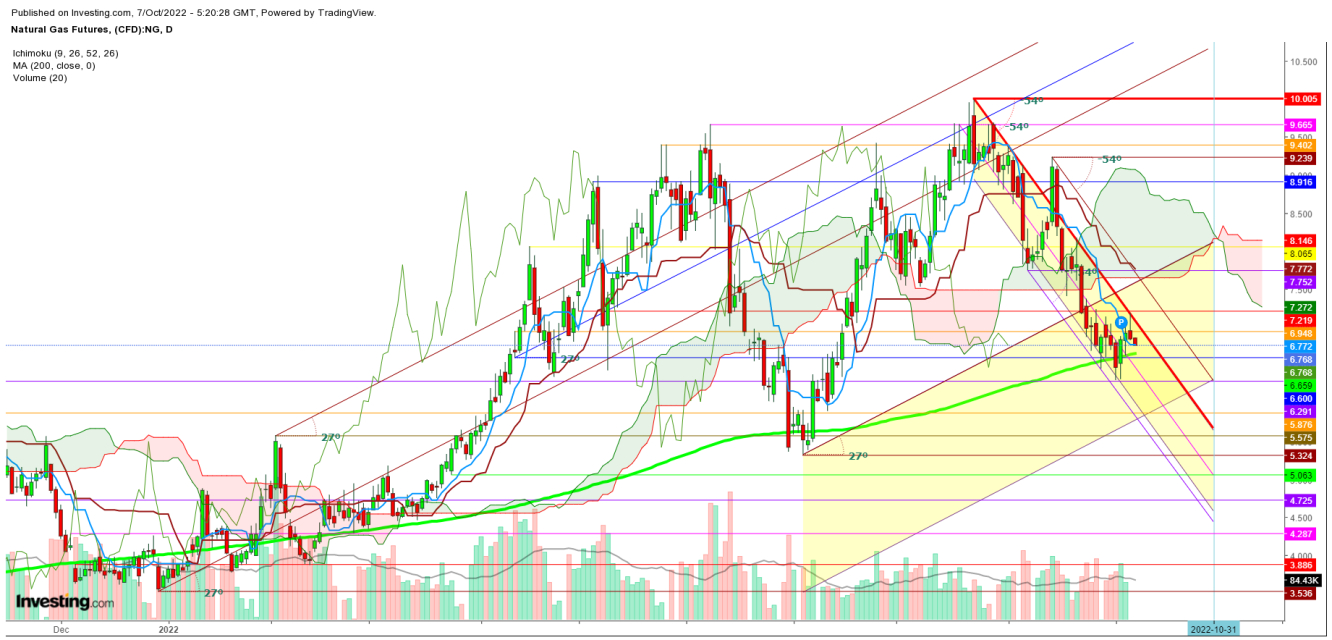

futures are showing weakness since Thursday’s announcement of the build-up of 129 bcf and that may continue during the coming week. The formation of an ‘Exhaustive Candle,’ on Thursday is likely to get confirmation with Friday’s bearish move.

Natural gas futures weekly chart.

Natural gas futures weekly chart.

The weather could remain quite supportive for natural gas bears during the weekend as an early season cool shot will exit the Northern Plains and sweep across the Great Lakes, Ohio Valley, and Northeast this Friday-Sunday with showers and chilly lows in the upper 20s to 40s. Much of the US will see highs of the 60s to 80s again next week aside from the cool Northern Plains.

On Friday, natural gas is showing exhaustion at the start of the session which may continue to prevail until the close.

Natural gas futures daily chart.

Natural gas futures daily chart.

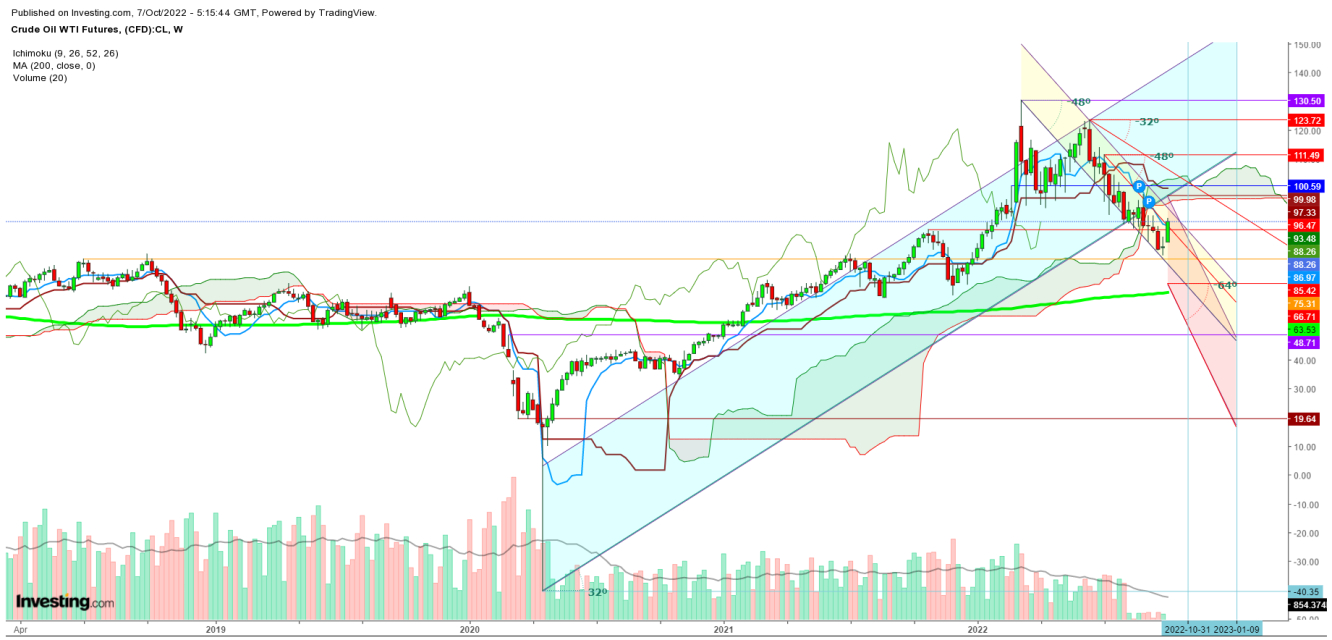

Crude Oil

OPEC+, which groups members of the Organization of Petroleum Exporting Countries and allies, including Russia, agreed on its deepest cuts to production since the 2020 COVID pandemic at a in Vienna on Wednesday.

prices rallied for four straight sessions, recovering sharply from eight-month lows hit earlier as markets positioned for much tighter supply conditions this year. The reduction of 2 million barrels per day was even below the 3.5-million-barrel daily shortfall in the group’s previously announced output target.

WTI Crude Oil Futures Weekly Chart.

WTI Crude Oil Futures Weekly Chart.

US President Joe Biden indicated in a White House statement that he would respond to the OPEC+ move by releasing even more oil from the US Strategic Petroleum Reserve (SPR). The Biden administration has already drawn SPR stockpiles down to their lowest since 1984 and seems game to do more in a tit-for-tat with OPEC+.

Undoubtedly, wild price swings could continue as Goldman Sachs has raised its oil price forecast for this year and 2023. It expects the 2 million barrels per day output cut to be “very bullish” for prices going forward.

In a note on Wednesday Goldman Sachs said that if the latest reduction in output by OPEC+ is sustained through December 2023, it will amount to a $25 per barrel upside to their forecast, with potential for price spikes even higher should inventory fully deplete.

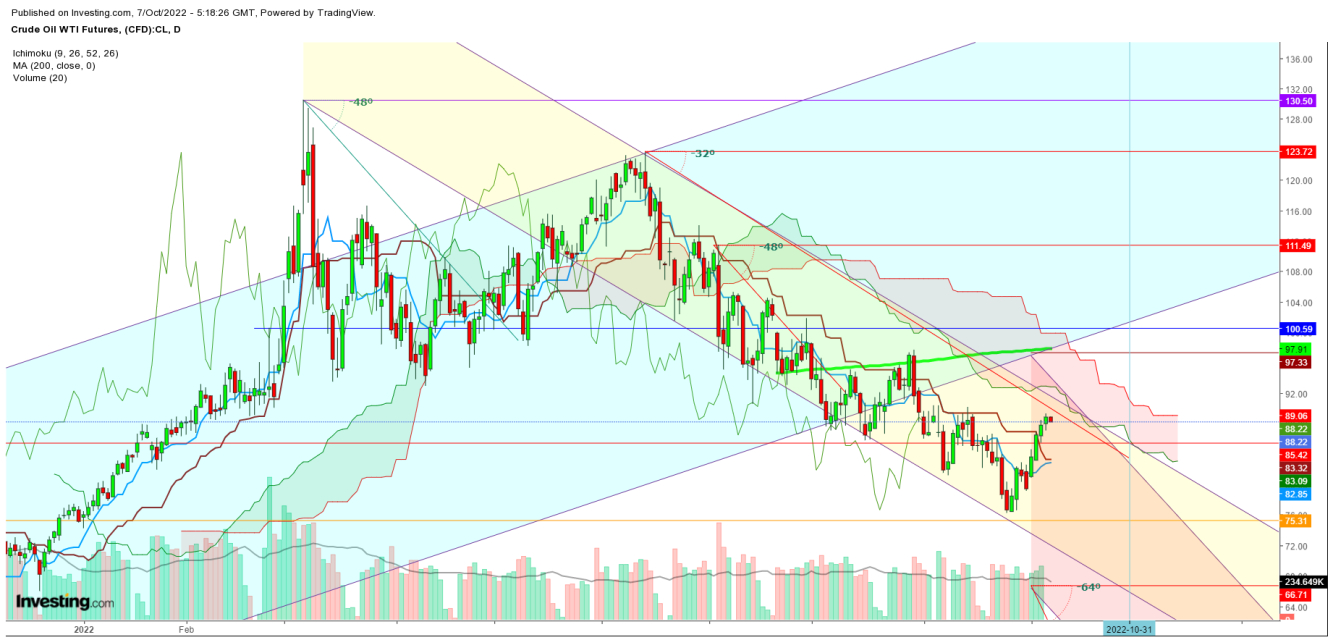

WTI Crude Oil Futures Daily Chart.

WTI Crude Oil Futures Daily Chart.

Oil futures showed weakness on Friday as the traders started to care about the changing equations on the recovery front. The increasing inflationary pressure could keep commodity prices higher and delay the process of economic recovery amid recession fears.

Disclaimer: The author of this analysis does not have any position in Natural Gas and WTI Crude Oil futures. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.

[ad_2]

Source link