Nasdaq to Hit New All-Time Highs in the Coming Months?

2023.09.04 09:26

Is there a chance the will hit a new all-time high in the coming months?

Markets appear to have abandoned the assumption that the Fed may raise interest rates yet, while the benchmark US stock market index is stable, halting what appeared to be an onset of declines.

With recent statements from Powell and Federal Reserve officials, coupled with new economic data on the way, what can we expect as a projection for performance?

The initial concerns raised by market participants after the words of chairman Powell and Federal Reserve board members from Philadelphia and Cleveland was that a further increase in interest rates would occur during the next FOMC meeting, scheduled for September 20, are no longer so founded.

Inflation data have recently shown a faster than expected decline, so there seems to be a chance that the Fed’s 2% target will be met by the end of the year.

Over the past few months, the Bureau of Labor Statistics has found that the number of job openings in the United States is declining.

This number was welcomed by the market, as it indicates a potential slowdown in the Federal Reserve’s hiking cycle.

In addition, the consumer confidence index monitored by the Conference Board fell in line with the news, pushing US stocks higher.

Data like that is essential to better understand economic health and future labor market trends.

In Europe, the conditions are different.

The Eurozone inflation has remained unchanged this month, but underlying price growth is slowing less than expected, creating a mixed picture that makes the European Central Bank’s decision to halt rate hikes more difficult, in the face of slowing growth.

I believe that in this situation it is more likely that interest rates in Europe will rise, and therefore I do not feel attracted by European indices such as the , and .

There has been a lot of talk in recent months about Dr. Burry’s bearish bet.

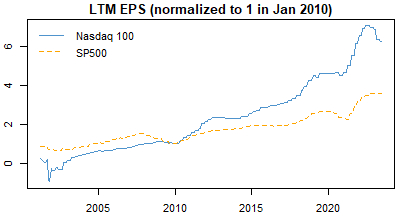

NASDAQ EPS up thanks to artificial intelligence sector

Concerning Dr. Burry’s ‘big short’, I think it is too aggressive and flawed in light of the current economic environment (improving US economy with a less hawkish Fed approach on account of falling inflation), plus a still reasonable valuation for the US market.

The price to earnings (P/E) ratio of the S&P 500 is currently around 20, which is within normal range and indicates that there is room for higher prices.

My most recent investments demonstrate my optimistic view for the Nasdaq Index with a normal P/E ratio and that I expect to new all-time highs by the end of the year. I also have in my wallet, on which I am very confident (I will talk about it in depth in the next articles) and a stock index of an undervalued country that has high potential.

The information and content provided on this site should not be considered as an invitation to invest in the financial markets. The Content is a personal opinion of Dr. Antonio Ferlito.