Muted response to solid jobs report as focus quickly shifts to US CPI

2023.04.10 06:54

- Dollar firms as May rate hike seen more certain after another healthy gain in US jobs

- Yet, overall reaction has been muted amid thin trading during long Easter weekend

- But volatility set to return as US CPI report due this week, plus the BoC decision

NFP report clears Fed path for May, still clouded thereafter

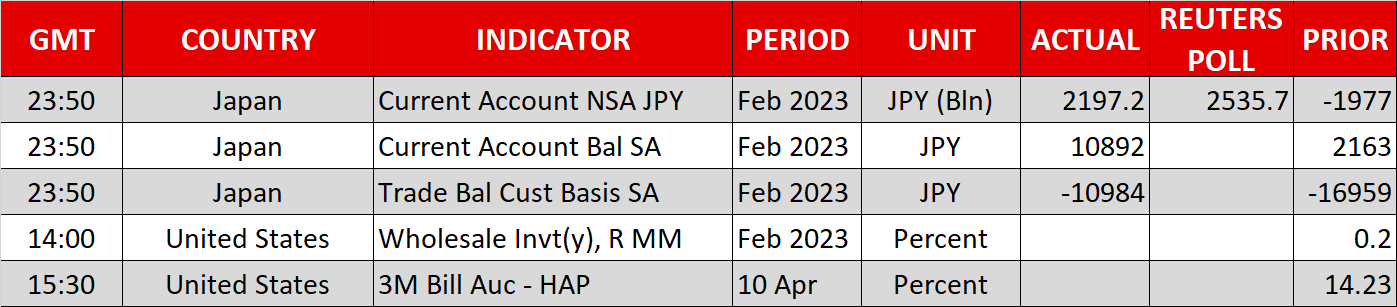

The resilience of the US labour market was once again on full display on Friday after another solid payrolls print eased heightened recession fears that came on the back of the weaker-than-expected ISM surveys in the preceding days. The American economy added 236k jobs in March, marginally below estimates, but the unemployment rate unexpectedly ticked lower to 3.5%. Average earnings moderated on an annual basis but quickened slightly month-on-month.

Whilst there certainly appears to be some cooling in the labour market after the second straight month of slowing jobs growth, there aren’t any cracks appearing just yet and this will likely give the Fed the green light to press ahead with another rate hike in May. The odds of a 25-bps rate increase next month shot up after the NFP data, but markets are still assigning only a two thirds probability and so a lot remains at stake from the upcoming CPI numbers on Wednesday.

US inflation is anticipated to have dropped substantially in March, but only due to the year-on-year comparison being flattered from the spike this time last year when energy prices soared. So the Fed will probably not be paying too much attention to the headline figures and will continue to focus on the services components. Thus, softer-than-expected CPI readings may not necessarily dissuade policymakers from hiking rates one more time.

Quiet start for equities ahead of earnings season

The bigger question is, will the Fed finally pause after May and how likely is a US recession? There is some encouraging data pointing to an easing in the banking crisis – US bank deposits increased at the end of March and lending from the Fed’s emergency facilities fell slightly last week. But the deterioration in the forward-looking ISM gauges measuring employment and new business orders is nevertheless worrying.

This uncertainty is likely to hang over equities for some time, though in the shorter-term, there is the distraction of the Q1 earnings season, which kicks off on Friday with the big banks.

For now, investors haven’t changed their minds about the Fed being forced to cut interest rates later this year, and with bond yields still wearing the scars of the banking turmoil, upside surprises in earnings results have the potential to significantly buoy stocks. US futures were little changed on Friday when cash trading was closed and are pointing to a flat open.

Trading is expected to remain subdued for today as well, as most European markets are closed for Easter Monday.

Dollar’s NFP bounce loses steam, gold slips

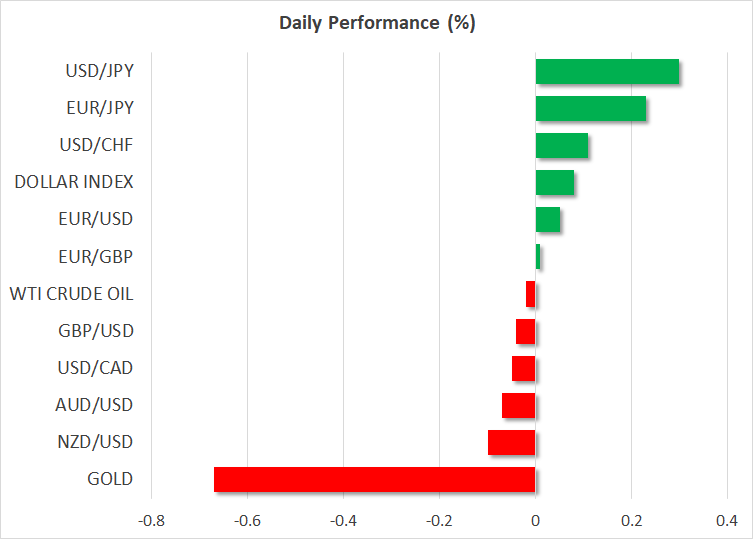

In the currency markets, the upbeat jobs report helped the US dollar to further recoup earlier losses in the week to finish higher. But the greenback is edging slightly lower on Monday against most majors, including the yen and the euro.

Yen traders will be watching new Bank of Japan Governor Kazuo Ueda’s maiden press conference at 10:15 GMT for any clues about imminent changes to monetary policy, while there’s a slew of Fed speakers on the agenda on Tuesday ahead of Wednesday’s minutes of the March FOMC meeting.

The Canadian dollar was struggling to regain the front foot following the pullback from last week’s highs and the Bank of Canada’s policy decision on Wednesday is unlikely to provide much support as the Bank is expected to hold rates again. Having said that, recent Canadian data have been somewhat more upbeat so a hawkish tilt cannot be ruled out.

Gold, meanwhile, failed to capitalize on the greenback’s lack of direction and is currently testing the $2,000/oz level, having hit a one-year peak of $2,031.89/oz last week. The slide in gold today is surprising given the ongoing geopolitical tensions over Taiwan.

China is conducting a third day of a military drill in the region in what is seen as a warning to the West. But investors do not appear to see much of a threat of a further escalation of tensions between China and Taiwan, nor between Beijing and Washington, and this is likely weighing on the safe-haven precious metal.