Mr. Market Keeps Looking for Risk-On Signals to Rally

2023.01.11 14:29

[ad_1]

Mr. Market doesn’t explain himself but drops clues about preferences. Interpretation is mostly art, but it can be worthwhile when there are clear signs of trend changes. One approach for monitoring such events is comparing ETF pairs.

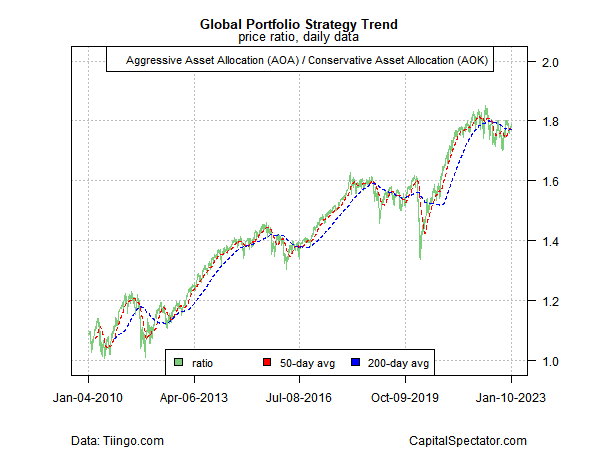

Let’s start with the big picture via a set of aggressive () and conservative () asset allocation ETFs.

Based on data through yesterday’s close (Jan. 10), this pair suggests that the risk-off bias rolls on, although there are hints that a consolidation phase is replacing a bear-market phase, which may be a set-up for a return to risk-on in the near future.

Global Portfolio Strategy Trend

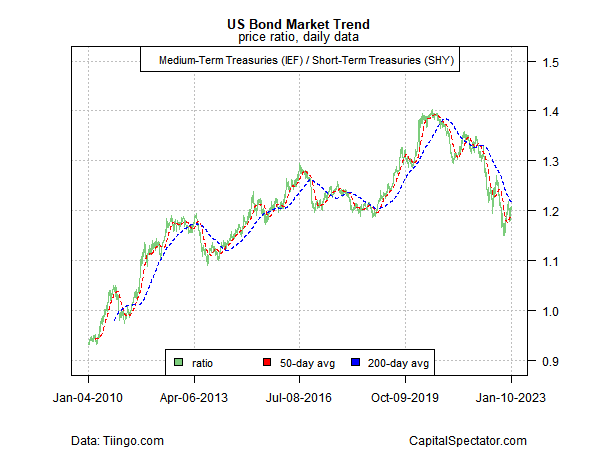

For the US bond market, however, the trend still looks conspicuously risk-off via medium- () vs. short-term () Treasuries.

US Bond Market Trend

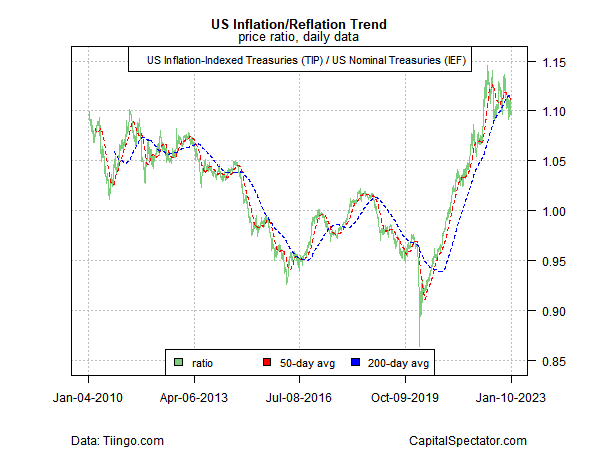

On the other hand, the reflation trend appears to be peaking, based on the ratio for an inflation-indexed Treasuries ETF () vs. nominal Treasuries ().

US Inflation/Reflation Trend

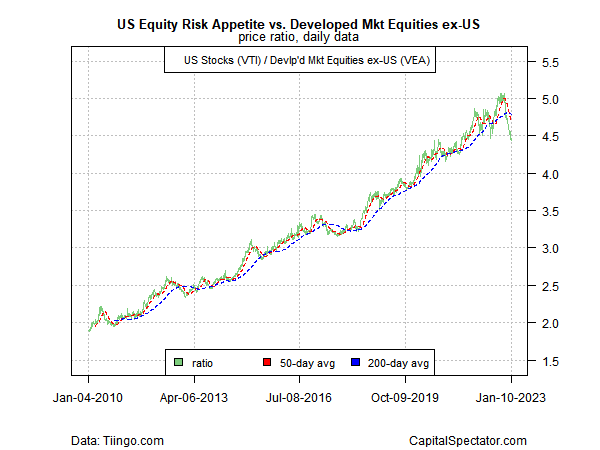

Meanwhile, there’s been a sharp change lately in favor of developed-world equities ex-US () vs. American shares (). Is this an early sign that foreign equities are due to play catch-up to US stocks?

US Equity Risk Apetite Vs. Developed Market Equities Ex US

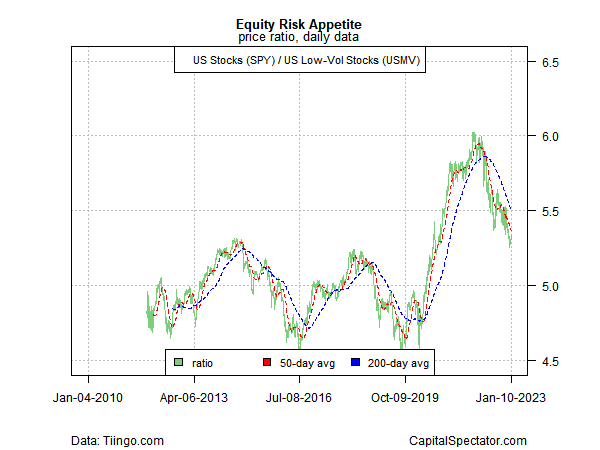

Within the US equities market, risk-off shows strong persistence in terms of the broad market () vs. low-volatility stocks ().

Equity Risk Appetite

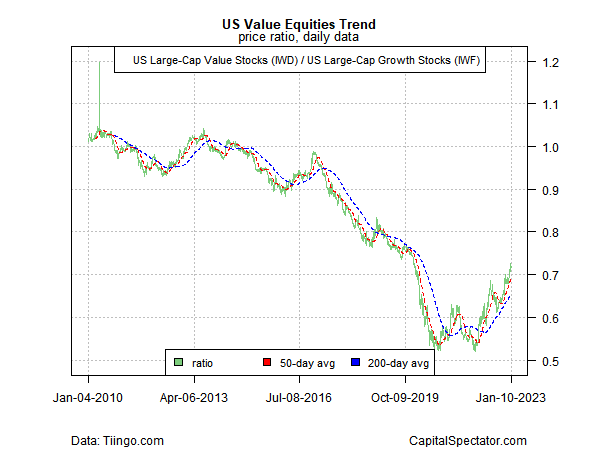

Finally, US value stocks () continue to rebound relative to growth stocks (), reversing a long-running dry patch for shares that trade comparatively lower valuations.

US Value Equities Trend

[ad_2]