Modest U.S. GDP Growth Expected in Q4 as Recession Risk Lurks

2022.12.22 11:09

[ad_1]

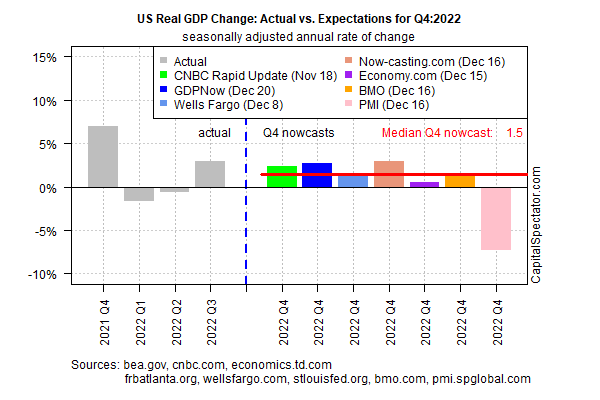

Economic output appears on track to post a second quarterly increase, based on the median nowcast for a set of estimates compiled by CapitalSpectator.com. At the same time, recession risk is elevated, according to several estimates of business-cycle activity. The conflicting signals suggest the potential for sharp upside or downside surprises in economic updates in the weeks ahead.

The latest numbers paint a modestly upbeat profile for Q4 economic activity. Today’s median nowcast indicates a 1.5% increase in GDP (seasonally adjusted annual rate) for the final quarter of 2022.

The nowcast marks a downshift from Q3’s (recently updated) . The official Q4 data from the Bureau of Economic Research is scheduled for release on Jan. 26.

US Real GDP Change

Although growth appears set to slow, today’s 1.5% Q4 nowcast is unchanged from the on Dec. 6. The steady nowcast implies that recent data still supports the case for modest growth in the current quarter.

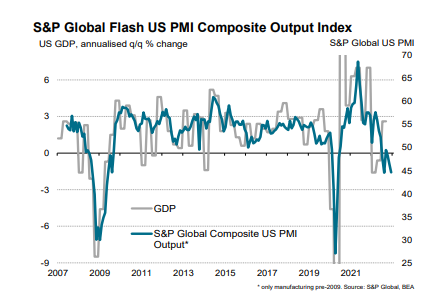

There are several caveats, including the outlier GDP nowcast, based on the survey data via a regression model that analyzes history. The S&P US , a GDP proxy, continues to reflect a sharp downturn in business activity through December.

The PMI tumble this month (matching the slide in August) marks the deepest decline since May 2020. As shown in the chart below, the alternative method cited by S&P to estimate GDP via PMI paints a brighter picture: a 1.5 annualized gain for GDP.

S&P Global US Composite PMI

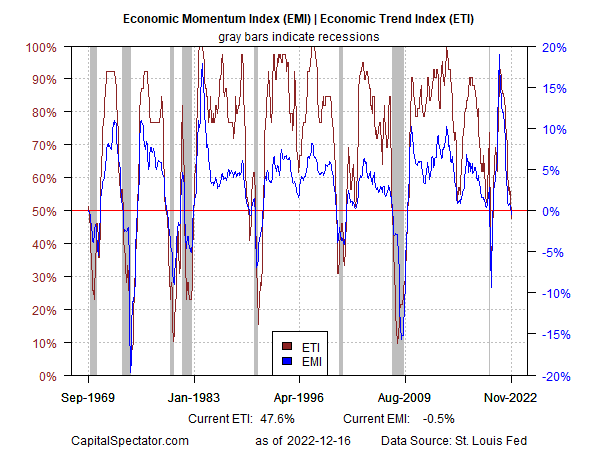

Meanwhile, this week’s edition of The US Business Cycle Risk Report continues to show that a mild NBER-defined recession started in November, based on current estimates for the Economic Trend Index (ETI) and Economic Momentum Index (EMI). Both indicators fell slightly below their respective tipping points, that signal declining economic activity.

Economic Momentum Index vs. Economic Trend Index

The main counterpoints to the recession call: and have been relatively resilient. True, although the November data fell, posting a surprisingly steep slide. It’s unclear if this is noise or the start of a new run of stumbling consumer spending.

Payrolls, however, continued to increase at a solid, if slowing, pace through last month. The key risk factor to monitor in the weeks ahead is the lag effects of rising interest rates, which are expected to take a rising toll on growth.

Christian Lundblad, a professor of finance at the University of North Carolina, said,

“There’s a pretty good consensus among economists, market participants, and others, that the Fed is going to keep interest rates elevated to slow down the inflation pressures we’re seeing and that it will have no choice but to create a recession,”

[ad_2]