Mixed U.S. Employment Report Leaves Dollar With Bruises

2022.11.07 07:26

[ad_1]

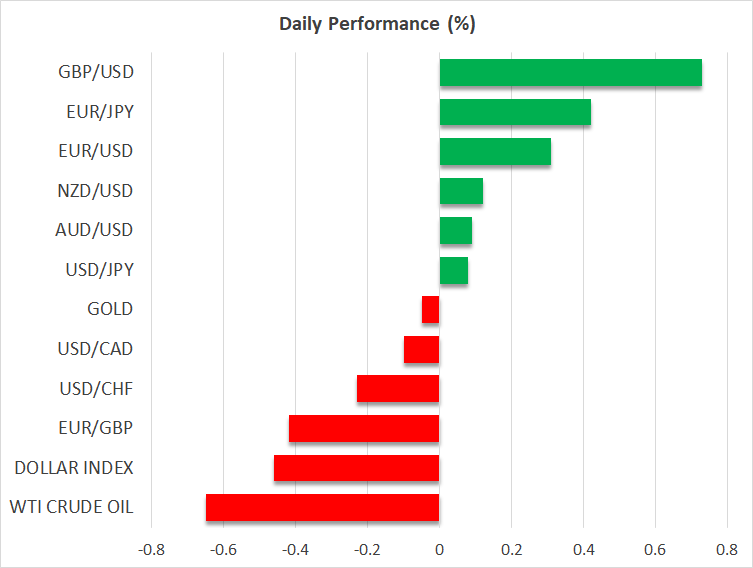

- Dollar retreats, Fed bets ease as nonfarm payrolls offer mixed signals

- Stock markets, gold prices, and risk-linked assets enjoy relief rally

- Huge week ahead, featuring US midterm elections and inflation data

Conflicting signals in US jobs report

A mixed bag of US employment numbers left financial markets in disarray on Friday. While nonfarm payrolls exceeded forecasts and wage growth came in hot, the household survey painted an entirely different picture, with the unemployment rate spiking higher even as labor force participation declined.

Depending on which of these two surveys an investor believes, the American economy either added 261k jobs or it lost 328k positions last month. Ultimately, market participants placed more emphasis on the rising unemployment rate, which dealt a heavy blow to the US dollar as bets for another three-quarter point Fed rate increase were unwound.

Euro/dollar rose by more than 2% once the payrolls dust settled and the pendulum swung back towards a half-point Fed hike as the most likely endgame in December. This is a huge move for the world’s most-traded currency pair and likely reflects how crowded ‘long dollar’ bets have become.

Dollar outlook, gold reaction

While the outlook for the dollar remains positive, we might be entering the ‘final act’ of this rally. The Fed seems ready to shift into lower gear and the fundamentals of other currencies have started to improve, with the sharp decline in European energy prices, UK fiscal nerves calming down, and the Bank of Japan opening the door for adjusting its infamous yield ceiling.

It’s still too early to call for a proper trend reversal, and the dollar could still hit new highs if the global outlook deteriorates further, but the scope for further gains seems limited from here. Chasing further dollar strength doesn’t seem attractive from a risk/reward perspective.

Gold prices rose more than 3% on Friday as the dollar and real yields cooled off. Bullion seems to have established a support base around $1615, although the metal’s inability to exceed the 50-day moving average suggests that the trend remains negative. A trend reversal would require a sustained decline in the dollar and yields, which is drawing closer, but is not here yet.

Wall Street rallies, pivotal week ahead

Stock markets cheered the prospect of a more ‘gun-shy’ Fed, with the S&P 500 gaining almost 1.4% following the mixed jobs report. Some rumors that China is considering relaxing its strict covid restrictions most likely added fuel to this move. Those rumors were denied over the weekend, with Chinese health authorities reaffirming their commitment to zero-covid.

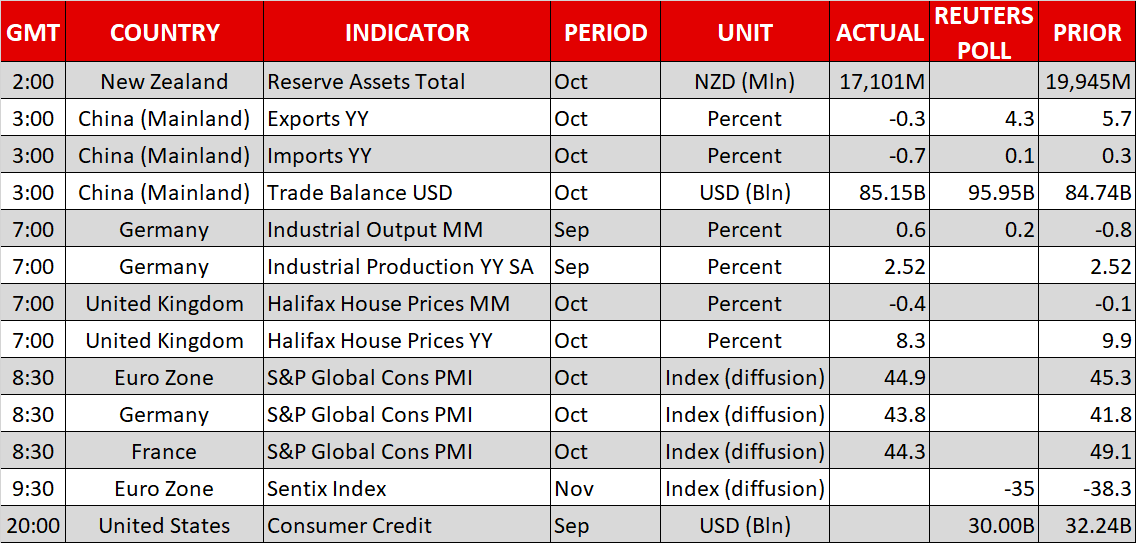

Reflecting the impact of this draconian strategy, the latest trade data from China revealed a contraction in both exports and imports, while Apple (NASDAQ:) warned that these restrictions will disrupt shipments of its most cutting-edge phones heading into the holiday season.

Another crucial week lies ahead, with the US midterm elections tomorrow and the latest inflation report on Thursday. A split Congress is by far the most likely outcome according to opinion polls and prediction markets, setting the stage for two years of political deadlock. The Republicans are favored to take back the House of Representatives, while the Senate race is too close to call.

A divided Congress would argue for a relief rally in stock markets, by limiting the scope for tighter business regulations or higher corporate taxes. Such an outcome would also cast doubt on the government’s ability to roll out new spending, which points to slower growth and softer inflation, opening the door for a pullback in the dollar. These reactions might be relatively small though, since a split Congress is already the market’s baseline scenario and wouldn’t be any surprise.

[ad_2]

Source link