Markets Weekly Outlook – Will Fed Rate Cut and BoJ Decision Spur Volatility?

2024.12.16 03:36

- Markets had a volatile week, with US 100 (Nasdaq 100) reaching new highs and a strong likelihood of a Fed rate cut next week.

- Major central bank meetings dominate the week ahead.

- The BoJ faces a tough decision on whether to raise interest rates, with recent data supporting a hike.

- The US Dollar Index (DXY) is at a crucial resistance level, and its performance may be influenced by the Fed’s interest rate decision and outlook.

Week in Review: Uptick in US Inflation a Concern?

An interesting week that saw swings from risk off to risk on sentiment helping to push US Equities to fresh highs.

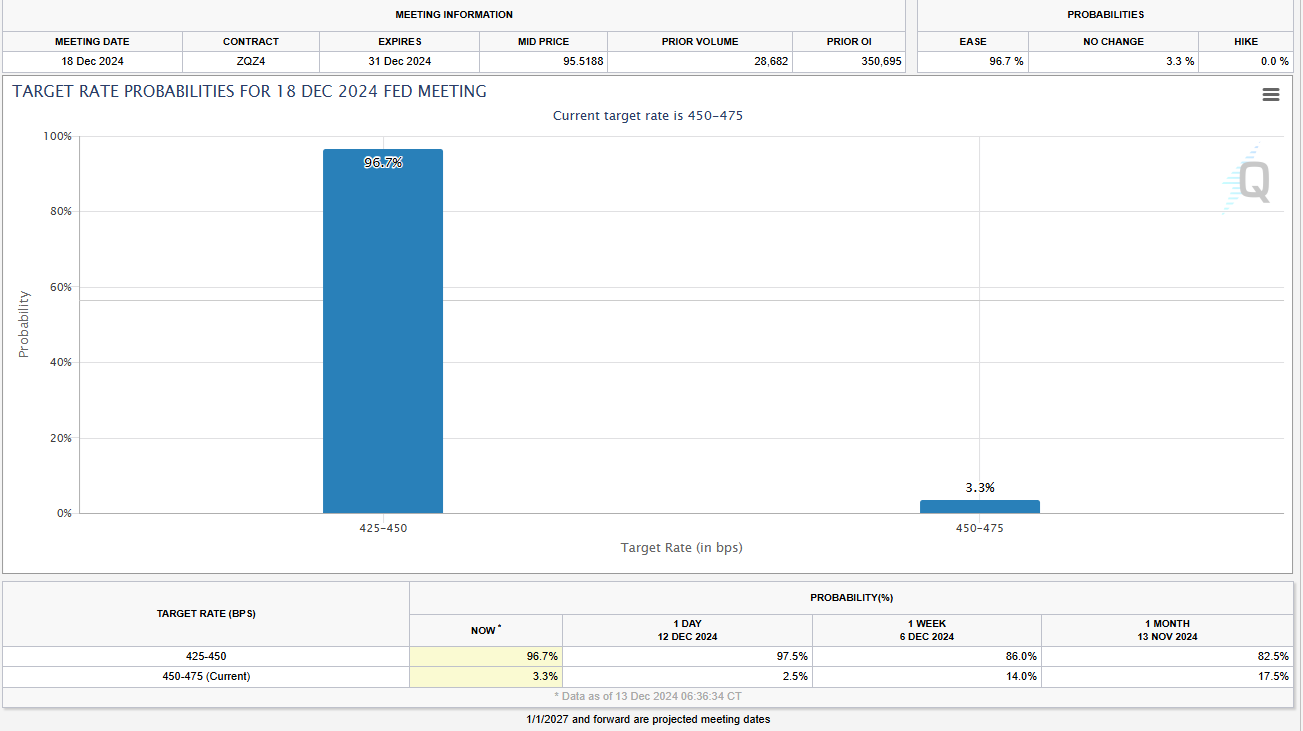

A strong batch of US Data keeps the likelihood of a Fed Rate cut next week strong and languishing above the 90% threshold heading into the weekend.

Source: CME FedWatch Tool

Recent increases in both the US CPI and PPI data have raised eyebrows regarding resurgent inflation in 2025. This comes against the backdrop of proposed tariffs by incoming President Donald Trump. With that in mind however, many believe the will strengthen due to this and it is a plausible scenario as Yields are also expected to rise.

The train of thought around tariffs has been well discussed with ING Thinks James Knightley putting it well “prices are going to rise, particularly if Trump’s tariff plans are as bold as promised on the campaign trail. And growth could rise in the short term. But timing is everything. If tariffs kick in early, and aren’t compensated for by big tax cuts, there’s going to be a real squeeze on household spending power.” I have to admit that i tend to agree with the narrative.

These concerns make the upcoming PCE data more important to the Fed as we head into 2025, with my base case being a December cut and January hold.

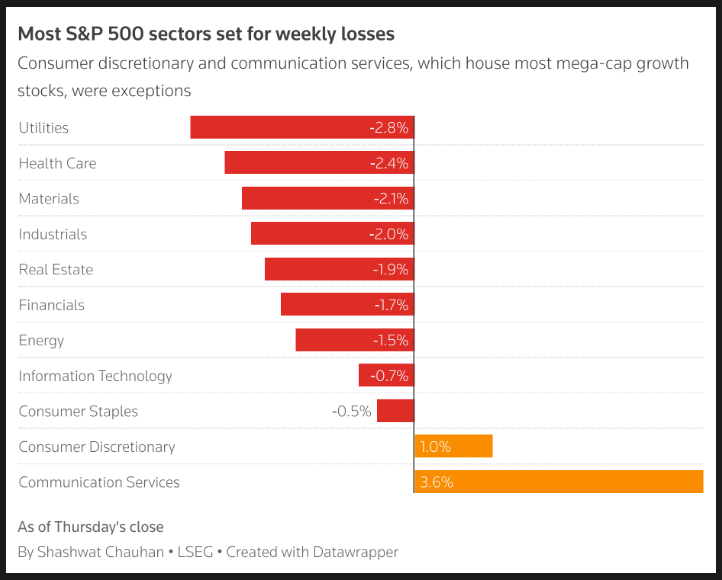

Wall Street Indexes were mixed this week with the on course for a positive finish thanks in large part to chip stocks. The Nasdaq 100 is doing better than its Wall Street peers after Broadcom (NASDAQ:) gave a positive outlook. This boosted excitement about artificial intelligence and helped raise the value of chip stocks dragging the index closer to the 22000 handle.

Wall Street indexes appear to be taking a break after recent gains and some strong economic data before the Fed’s meeting. This has put the and on track for losses this week.

Source: LSEG

prices recorded its first weekly gain in three weeks despite both OPEC and IEA downgrading their forecasts for both 2024 and 2025. Stimulus measures announced by China’s politburo for now though appear to be supporting Oil prices and keeping above the crucial $70 a barrel mark. Further sanctions on Russia and the potential for increased sanctions on Iran may be partly the reason for Oil price gains this week.

The enjoyed a positive week and as a result weighed on its G7 counterparts and many emerging market currencies as well. The early week US Dollar strength may in part have been down to haven appeal following events in Syria over the past two weeks. The DXY is languishing in a crucial area heading into a massive week and is likely to play a big role as the month and year draws to a close.

prices enjoyed a strong start to the week thanks in part to renewed haven appeal and the resumption of Gold purchases by the Peoples Bank of China following a near six-month hiatus. However, the strong PPI data and potential profit-taking on Gold ahead of a busy week have left the precious metal trading up just around 1% for the week at 2660 at the time of writing. A stark contrast from Thursday’s highs around the 2720 and ounce handle. Any further signs of instability in Syria heading into next week could be crucial in the precious metals next move as well as the outlook by the US Federal Reserve moving forward into 2025.

The Week Ahead: Fed to Cut Rates, BoE Set to Hold as BOJ Face a Tough Choice

Asia Pacific Markets

The week ahead in the Asia Pacific region sees some key economic data releases and events.

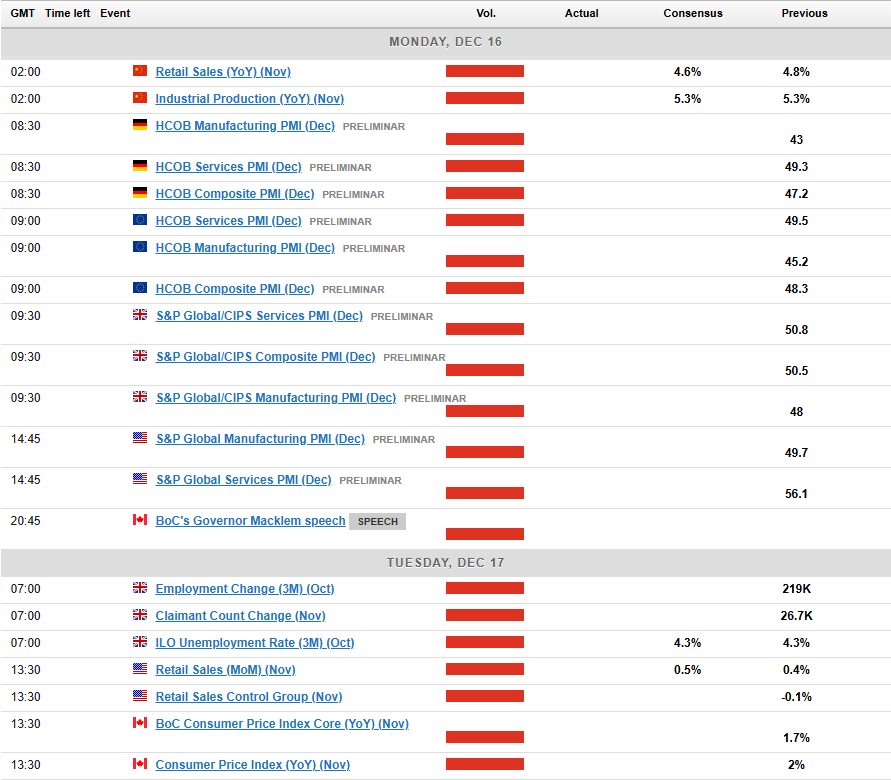

In China, the final data report of the year will come out next Monday. Key economic indicators are expected to show modest improvement. Industrial production may grow by 5.6% compared to last year, retail sales are likely to speed up to 5.1% growth year-on-year, and fixed asset investment could stay steady with a small increase to 3.5% year-to-date.

Stimulus announcements by China last week adds another layer of intrigue around China. Market participants are hoping that the announcements over the past week will finally lead to a surge in demand.

In Japan, the Bank of Japan is meeting on Thursday. There are expectations for an interest rate hike next week, although it might be a close decision. Recent data, like strong wage growth, higher-than-expected inflation, and improved GDP figures, back the idea of a hike.

However, one local wire in Japan reported that there is a growing view that a premature rate hike should be avoided unless there is a significant risk of inflation rising. This may give the BoJ some food for thought.

Europe + UK + US

In developed markets, the focus moves back to Central Banks with both the Federal Reserve and the Bank of England (BoE) interest rate decisions.

The Federal Reserve is expected to reduce rates by another 25 basis points on December 18. Inflation hasn’t moved much closer to the Fed’s 2% target recently. However, the Fed also monitors the job market closely. Signs like slower job growth and rising unemployment support the decision to adjust rates closer to a neutral level. That said, the rate cuts are likely to slow down in 2025 unless inflation improves significantly or the job market weakens much more.

The Fed’s preferred inflation measure, the core PCE deflator, is expected to be around 0.2%, based on recent data from the CPI and PPI reports.

In Europe the week is a bit quieter with the biggest data release being PMI data. Given the struggle with growth the Euro Area is experiencing, this is a key release and one that could stoke volatility and the probability of potential rate cuts from the ECB. There is also a speech by Christine Lagarde at the start of the week which may shed more light on this past week’s rate cut.

In the UK we have a busy week with labor data kicking things off. The unemployment rate has been quite unpredictable due to well-known data issues. However, there are clear signs that the job market is slowing down. Despite this, wages haven’t been affected yet and might even rise slightly next week because of unusual comparisons with last year’s numbers.

Headline inflation is expected to increase more than the Bank of England predicted, partly due to a small rise in services inflation. This measure, which is important to the BoE, is likely to stay around 5% during the winter. This is mostly because of stubbornly high costs in areas like travel and rents, which the Bank doesn’t seem too concerned about.

The Bank of England (BoE) appears comfortable with reducing rates every other meeting. Since rates were cut in November, I don’t think there will be another cut before the February meeting.

Chart of the Week

This week’s focus is back to the US Dollar Index which is once again in the key area around the 107.00 handle.

I thought this may be a prudent time to look at the performance of the US Dollar post the 2016 US election for a historical perspective.

After both the 2016 and 2024 elections, stocks and the US dollar went up. However, in 2017, the dollar lost strength, entering a downward trend that lasted most of the year. This weakness in the dollar helped support a steady rise in U.S. and global stock markets.

Looking at where the US Dollar Index is currently resting in a key area of resistance. Will the recent uptick in inflation be a driving force for the US Dollar moving forward or will the Fed succeed in keeping things on an even keel?

The DXY has struggled to find acceptance above the 107.00 handle, will this time prove to be different?

A rejection here may lead to a retest of support at 106.50 and the 106.00 handle respectively.

A breach of 107.00 will need to prove that it has found acceptance above this level before i will be convinced of a sustainable move. The Fed interest rate meeting could be the catalyst for this especially if they taper rate cut expectations for 2025.

US Dollar Index (DXY) Daily Chart – December 13, 2024

Source: TradingView.Com

Key Levels to Consider:

Support

Resistance

Read More:

Original Post