Markets Weekly Outlook – Rising US Job Fears, Geopolitics in the Spotlight

2024.08.05 04:34

-

US jobs data underwhelmed, triggering the SAHM rule, and signaling a likely recession.

-

The Magnificent 7 tech companies have lost nearly $1.75 trillion in market capitalization over the past 10 days.

-

Rate cut bets for the US face significant revisions with recessionary fears weighing on global markets.

-

Reserve Bank of Australia (RBA) next week. Will the RBA deliver a dovish pivot?

Week in Review: US Unemployment Rate Triggers Recession Fears

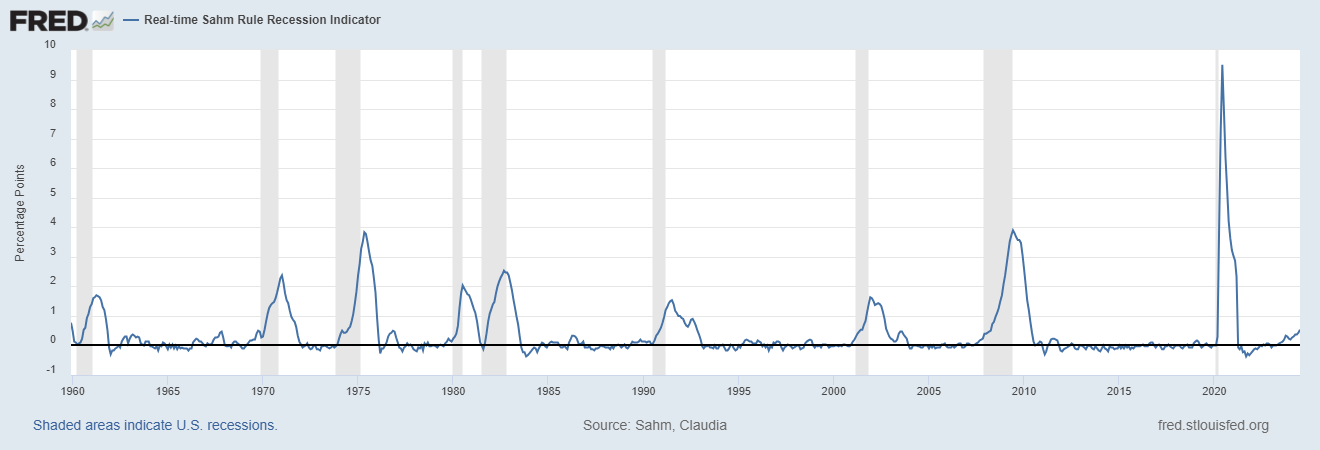

US jobs data underwhelmed on Friday triggering the SAHM rule, which is used to identify the start of a recession based on changes in the unemployment rate.

Named after economist Claudia Sahm, the SAHM rule specifies that a recession is likely underway if the three-month moving average of the national unemployment rate rises by 0.5 percentage points or more relative to its lowest point in the previous 12 months.

This metric is designed to provide an early and reliable signal of economic downturns, enabling policymakers to respond more swiftly.

As you can see from the chart below, the July unemployment rate has seen the SAHM rule triggered hinting that the US is already in a recession with a print of 0.53.

Source: Federal Reserve Bank of St. Louis.

The rate rose to 4.3% while the print missed estimates, coming in at a measly 114k with a downward revision of around 29k for the past two months. By my calculation, we have now had downward revisions in 5 of the last 6 job reports with unemployment at a 3-year high.

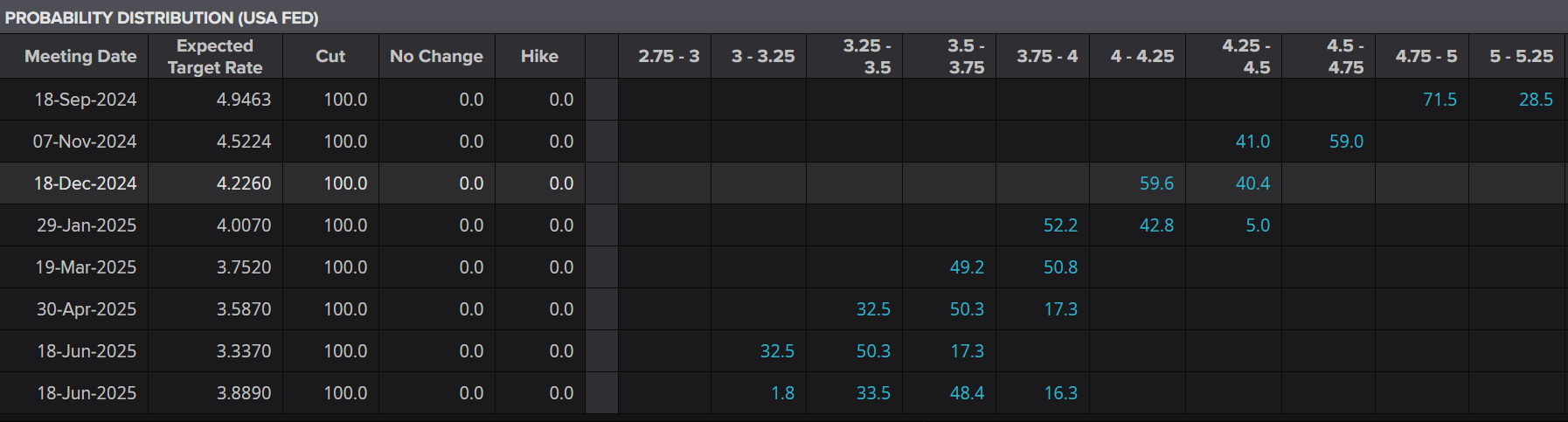

The impact of which has seen rate-cut bets for the US face significant revisions with recessionary fears weighing on global markets. Market participants are now pricing in a 71.5% chance of a 50bps rate cut in September with further cuts at November and December.

The data accelerated the early week selloff in US Equities, with both the and deep in the red for the day (at the time of writing.)

Source: LSEG

For context, the Magnificent 7 (Apple (NASDAQ:), Microsoft (NASDAQ:), Alphabet (NASDAQ:), Amazon (NASDAQ:), Nvidia (NASDAQ:), Tesla (NASDAQ:), and Meta (NASDAQ:)) have collectively shed nearly $1.75 trillion in market capitalization over the past 10 days.

To put that in perspective, this loss is almost 50% of Apple’s total market cap, the world’s largest company.

On the FX front, the finally broke below support at the 104.00 level, trading around 103.100 at the time of writing. This allowed the and to recoup some of their early-week losses against the greenback, finishing the week on a high note.

Commodities had a mixed day, with surging sharply toward the $2480/oz level following the jobs data, only to experience a significant selloff as the US session progressed.

This rally was likely driven by substantial profit-taking ahead of the weekend. With the potential for escalating tensions in the Middle East, market participants may have been reluctant to hold significant positions over the weekend.

Overall, it was not the best week for markets, with mega-cap tech shares among the biggest losers along with the US dollar. It appears that market participants correctly anticipated rate cuts, while the Fed may be slower to act on reducing rates.

This Week: Rising Recessionary Fears, Geopolitics and Asia Pacific Data

This week promises to be intriguing given the recent developments. The weekend could bring additional complications if there are signs of escalating tensions in the Middle East. Such indications may boost the appeal of safe havens, potentially creating gaps in the US Dollar Index and gold prices.

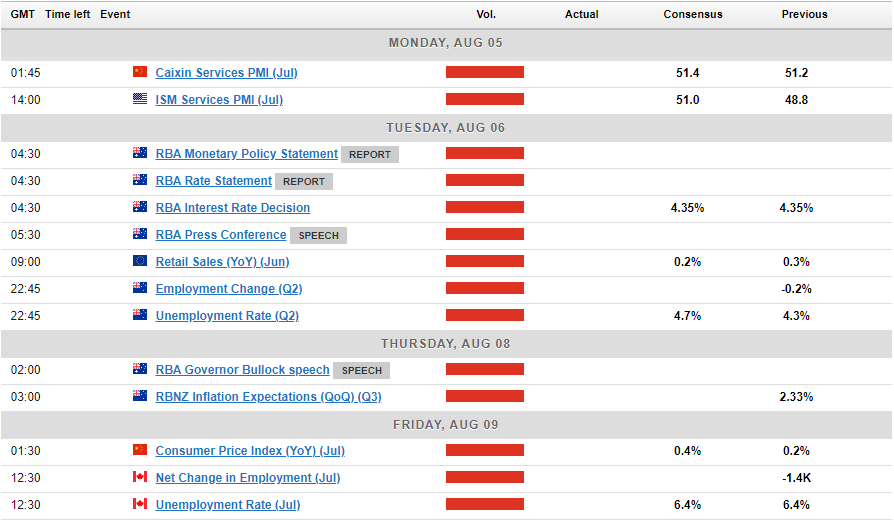

Recessionary fears combined with a broader regional conflict could be key market drivers, especially with limited data releases from both the EU and the US next week. The primary data releases will come from the Asia Pacific region.

Asia Pacific Markets

In Asia, the week has started with the release of the Caixin Services in China before the focus shifts to Australia. On Tuesday, the Reserve Bank of Australia (RBA) meeting takes center stage, particularly since the Australian central bank has been considering rate hikes at its previous two meetings.

Following this week’s rate decisions by the Bank of Japan (BoJ) and the Bank of England (BoE), market participants will be closely monitoring the RBA meeting. The possibility of a dovish pivot by the RBA remains a prominent topic of discussion.

Although the BoJ summary of opinions may not typically be a major economic release, it is expected to garner more attention than usual following the recent rate hike by the BoJ.

Market participants will be eager to hear any plans for further hikes or insights into the BoJ’s expected future policy path.

Europe + UK + US

Looking ahead to the Euro Area, the US, and the UK, the economic calendar is relatively sparse. Markets are likely to focus on any hints from Fed policymakers following the recent series of weak data releases.

In the absence of high-impact data, geopolitical tensions are expected to be a significant factor influencing markets next week.

Chart of the Week

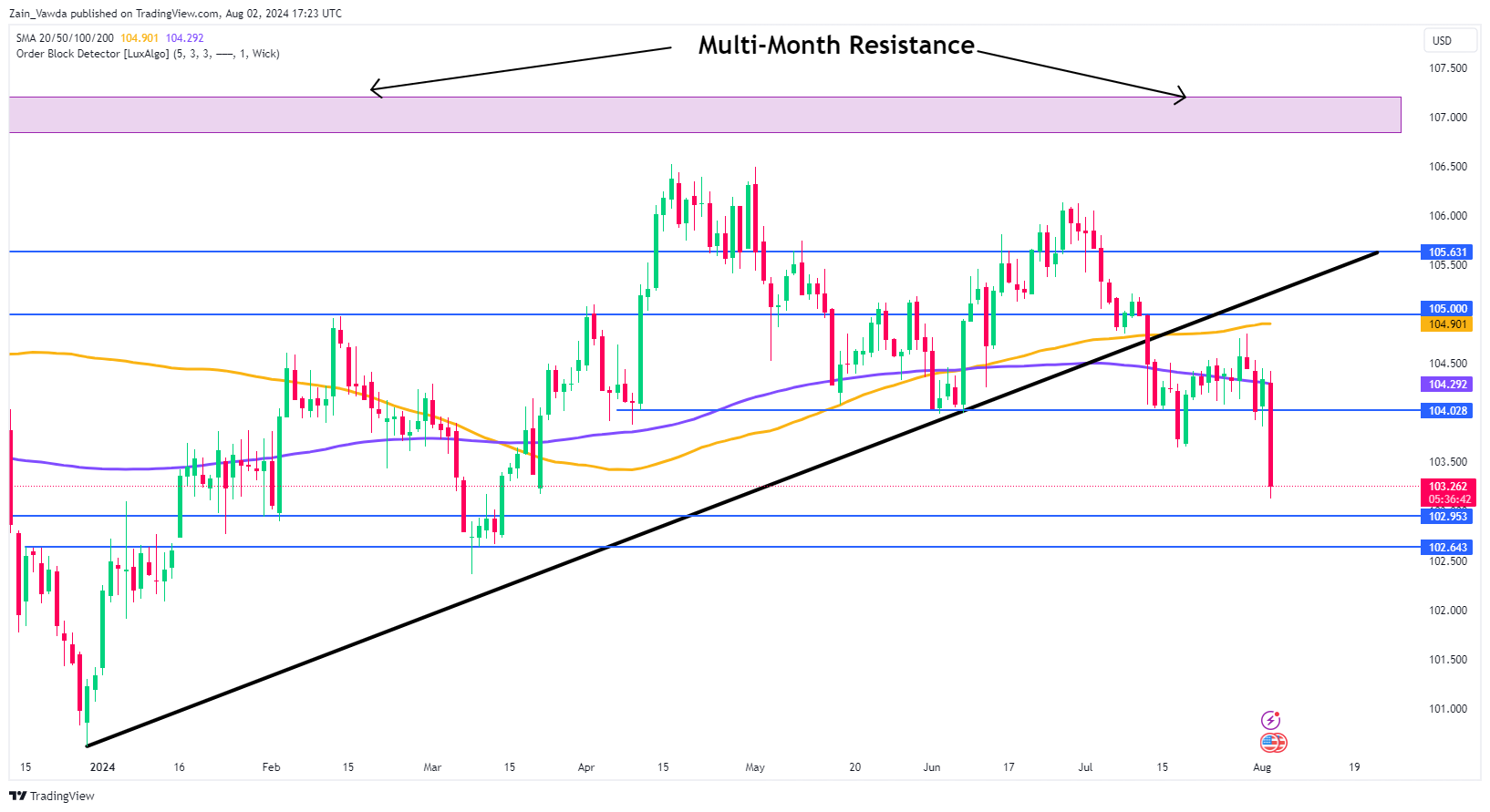

The chart of the week that I will be focusing on is the US Dollar Index (DXY). Following weak data prints and adjustments to rate cut expectations, next week could be crucial for the DXY.

Currently, the DXY is hovering just above a key support level at 103.00, with additional support around 102.64. A break below this could potentially lead to a retest of the psychological 100.00 level.

On the upside, any recovery attempt faces resistance around 103.50, followed by the 200-day moving average (MA) at 104.29. The 100-day MA is positioned just below the key psychological level of 105.00.

US Dollar Index (DXY) Daily Chart – June 28, 2024

Source:TradingView.Com

Key Levels to Consider:

Support:

Resistance:

Original Post