Markets Week Ahead: Inflation Data and Geopolitics to Dominate Proceedings

2024.11.25 07:04

- Weak PMI data from Europe and the UK raise concerns about global economic outlook and sent the EUR and GBP tumbling.

- Escalating tensions in Russia-Ukraine and the Middle East add to market uncertainty.

- Upcoming PCE inflation data will influence Fed policy and market sentiment.

Week in Review: DXY Continues Advance, as EU and UK Growth Struggles Continue

Europe and the UK are the biggest losers this week both from a geopolitical risk and economic data perspective. Poor data across the Euro Area and more importantly its major industrial hub Germany, have left the reeling against G7 counterparts.

The UK is starting to face a similar change as stagnant growth, stubborn services inflation and a host of budgetary concerns have left the British Pound in a spot of bother. The data this week has seen market participants increase their rate cut over the next 12 months. is trading at six month lows with more losses possible if markets continue pricing in more aggressive rate cuts moving forward.

Gold () has been on a tear this week and is on course for its best week in twelve months. The rally largely driven by rising geopolitical risk looks set to continue and follows an investment note by Goldman Sachs, in which analysts predicted the precious metal will set a new record by the end of 2025.

US Indices recovered with a modicum of caution this week with the blockbuster release of NVIDIA (NASDAQ:) earnings now out of the way. The market reaction was rather mixed to NVIDIA’s earnings with the share enjoying some whipsaw price action since the earnings release. This concludes the earnings release from the ‘magnificent 7’ with attention now shifting to other areas as the festive season approaches.

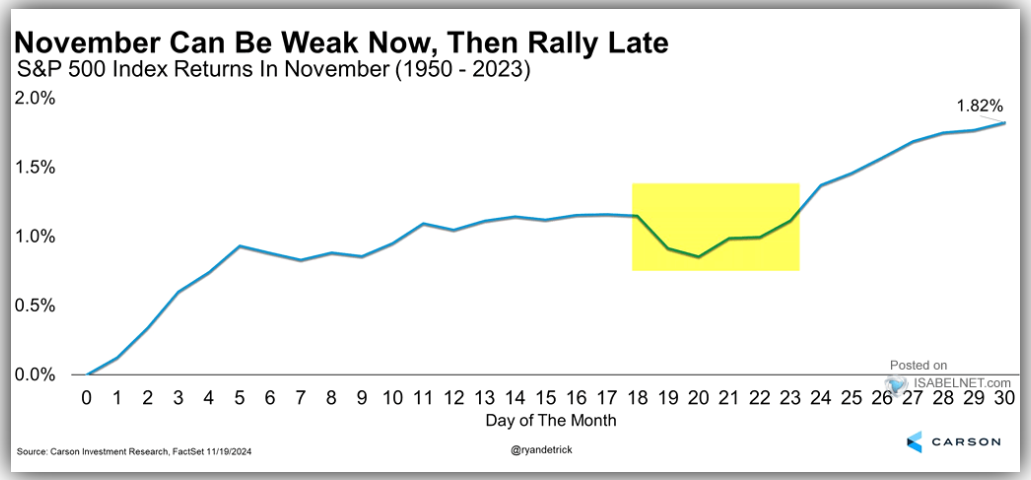

The and rose 1.4% and 1.6% respectively. Now, there is something that caught my eye recently and it was the historical performance of US stocks in November. Historically US stocks experience a strong month of November with the last week of the month experiencing a significant rise. This usually carries on in December in what is affectionately called the ‘Santa rally’.

Will history repeat itself?

Source: Isabelnet, Carson Research

Geopolitical risk is back in focus and is likely to remain so reading into the end of the year. Keep an eye on the evolving situations in both the Middle East and Russia-Ukraine. Any escalation is likely to lead to some wild price swings in the weeks ahead.

Lastly, Crypto has been the rage this week as neared the $100k handle. For more on the rise and potential move ahead read through my article:

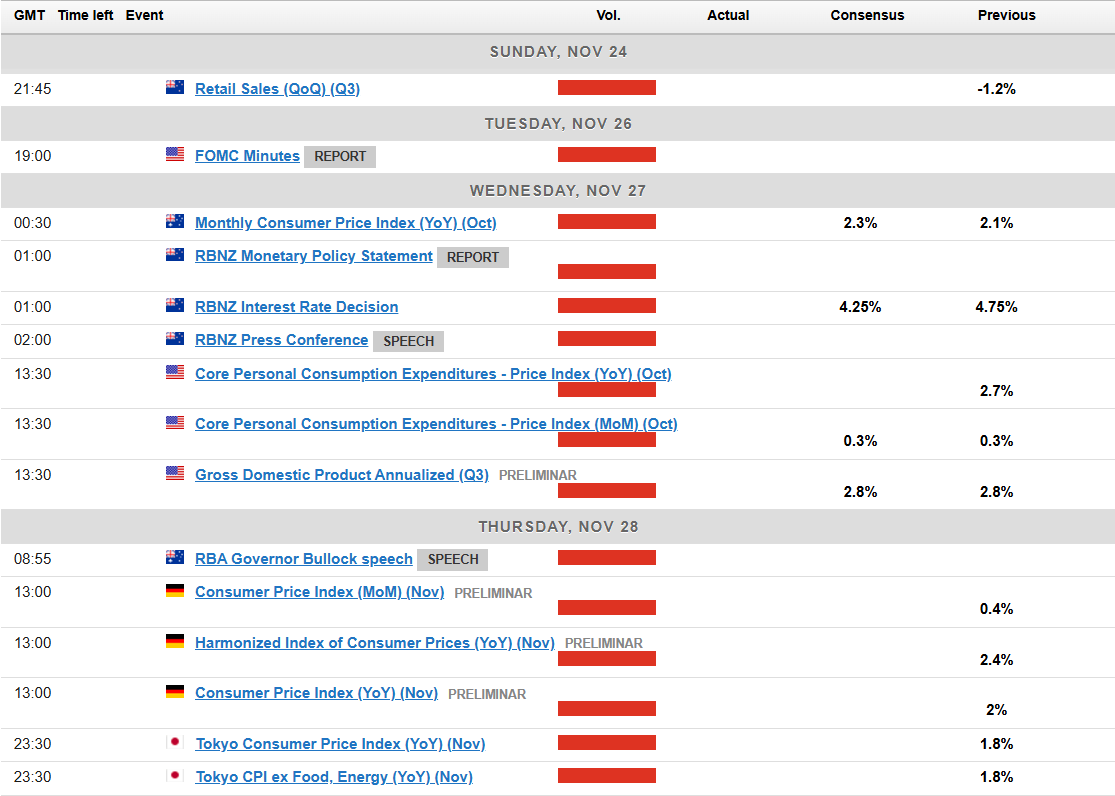

The Week Ahead: Muted Week in APAC, PMI Data Rules

Asia Pacific Markets

The week ahead in the Asia Pacific region sees an uptick in economic data releases.

In China, a quiet week is expected with the main event on the docket being the medium-term lending rate. The People’s Bank of China () is expected to keep the medium-term lending rate steady at 2.0% when it announces its decision on Monday. On Wednesday, attention will shift to industrial profits data, as investors look for signs of improvement after two months of steep declines compared to last year.

In Japan, labor market data will be in focus this week. The job market is still strong, so the is likely to stay about the same as last month. Production and retail sales are expected to do well, as issues like earthquake warnings and safety scandals are no longer affecting activity.

In Australia, market focus will shift to the inflation data. Australia’s economy is expected to grow slightly in October. The job market remains strong, and prices for services are still rising. However, overall inflation is likely to stay within the 2-3% target range.

Europe + UK + US

In developed markets, inflation data takes center stage next week coupled with geopolitical risks as the Russia-Ukraine conflict heats up.

In the Euro Area, inflation data will be released on Friday and will be a key release after the poor PMI data released this past week. Inflation is expected to rise further, mainly due to comparisons with low figures from last year.

Market participants began to see some hope for the Euro Area in recent weeks but the PMI data release and geopolitical cloud will no doubt have serious repercussions moving forward. At the October press conference, Christine Lagarde gave a gloomy economic outlook which may have been seen as pessimistic at the time. I still expect inflation to drop in the coming months which should help but if growth remains subdued the ECB may have to be more aggressive with rate cuts moving forward.

Another key release next week will be the release of the Euro Areas economic sentiment survey, which will provide more details on how businesses feel about the current economy, their pricing strategies, and hiring plans.

In the UK, there is a pause on high-impact economic data releases. The PMI data from the UK sent the Pound tumbling last Friday. For now, rate cut expectations have increased from 72 bps to 77 bps of cuts through December 2025.

The US awaits the Feds Preferred inflation gauge next week with the release as market participants are expecting an uptick in inflationary pressure in the coming months. Following a hot and print this month, the PCE release will be even more intriguing.

The PCE measure combines data from both the CPI and PPI reports, and current data suggests a 0.3% month-on-month increase. For inflation to settle at the Fed’s 2% annual target, monthly increases need to average around 0.17%, so 0.3% is still too high for the Fed to feel fully comfortable.

However, jobs data still is the key at the moment. When it comes to the Federal Reserve December meeting, the jobs data on December 6 is likely to still hold the key.

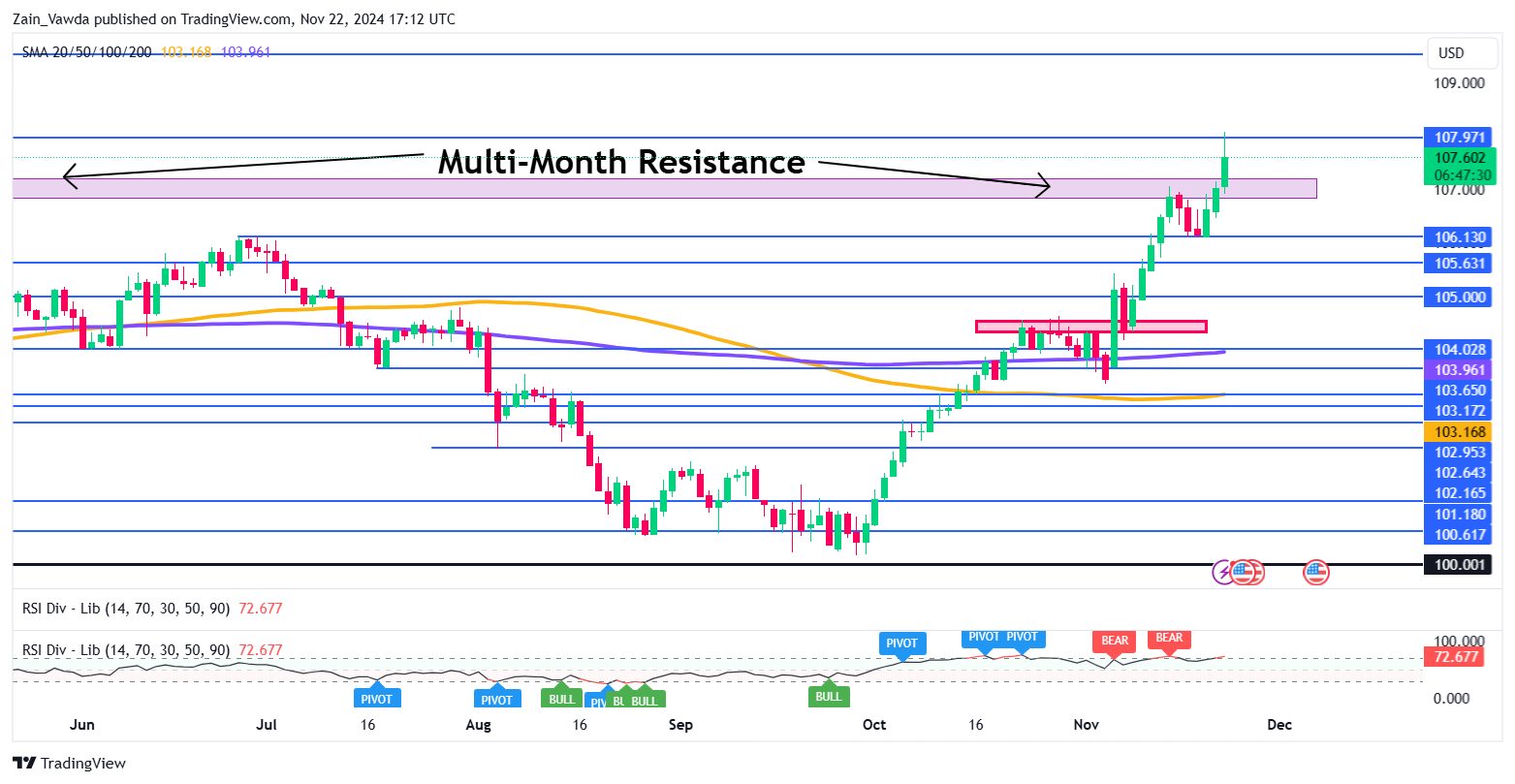

Chart of the Week

This week’s focus remains the (DXY), which has taken out a key multi-month resistance level at the 107.00 handle rising to a high of around 108.00 before a pullback.

The DXY rally seems unstoppable at present with rising geopolitical risk also underpinning the greenback. The DXY is back in overbought territory on the daily chart below based on the 14 period RSI. However this is of course no guarantee that a drop will materialize but it is worth paying attention to.

Given the geopolitical dynamics at play and the optimism around a Trump return to the White House, the potential for a drop in the DXY remains slim. Any pullbacks are likely to be met with buying pressure and thus capping the downside potential. A significantly lower PCE print than expected may help weaken the DXY, but whether such a move would be a sustainable remains up to debate.

Looking at immediate support and the purple block on the chart below around the 107.00 handle is key if bulls are to continue the recent rally. Below the 107.00 handle support rests at 106.130 and 105.63.

Looking at the upside and immediate resistance rests at the 108.00 handle with 109.00 and the 110.00 psychological level next in line.

US Dollar Index Daily Chart – November 21, 2024

Source: TradingView.Com

Key Levels to Consider:

Support

Resistance

Most Read:

Original Post