Markets See End of Rate Hikes but Fed Officials Suggest Otherwise

2023.08.08 09:14

Investors continue to price in high odds that the Federal Reserve interest-rate hikes are history after last month’s quarter-point increase. But the latest comments by several central bank officials tell a different story. Adding to the uncertainty: mixed expectations for Thursday’s release (Aug. 10) of July data on US consumer .

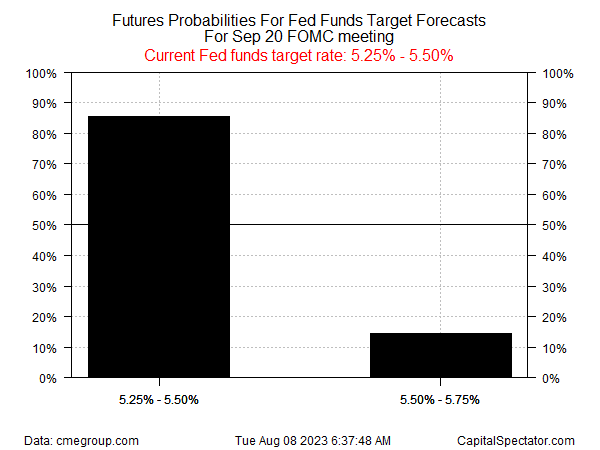

Let’s start with Fed funds futures, which currently estimate a roughly 86% probability that the Fed will leave its current 5.25%-to-5.50% target range unchanged at the next FOMC meeting on Sep. 20.

Fed Funds Target Forecasts

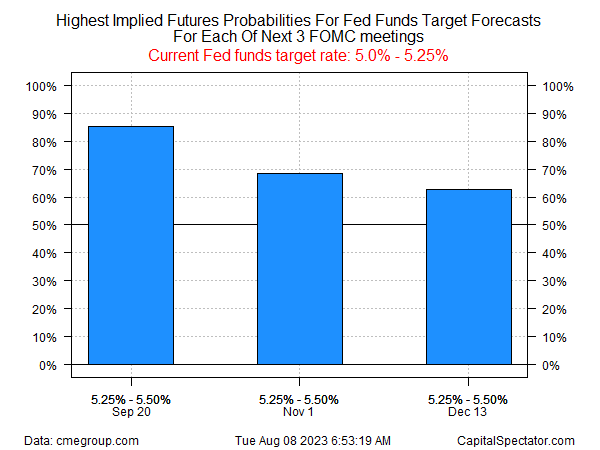

The path for Fed policy through the end of the year is also expected to leave rates unchanged, based on futures.

Fed Funds Target Forecasts

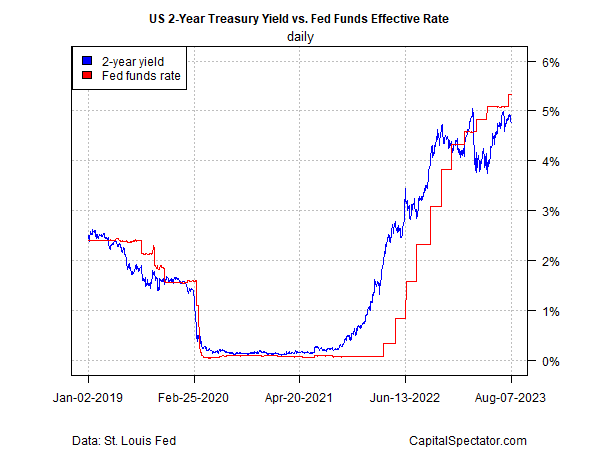

The policy-sensitive Treasury yield is pricing in the view that rate hikes are over. This maturity is widely considered the most sensitive spot on the yield curve for rate expectations and remains well below the current Fed funds target rate – an implied market forecast that rates have peaked and at some point in the near future will start to fall.

US 2-Yr Treasury Yield vs Fed Funds Effective Rate

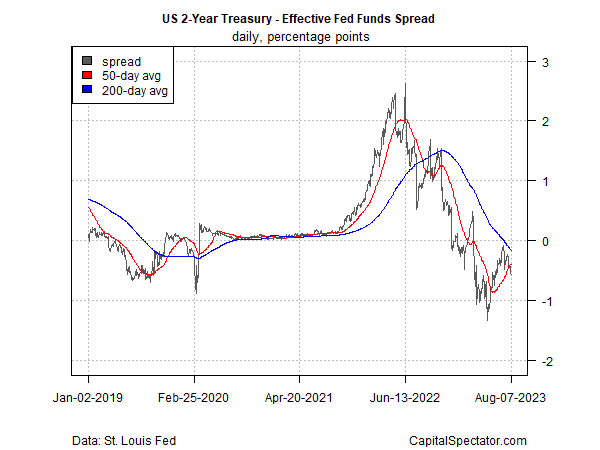

Notably, the 2-year/Fed funds spread remains negative and is trending down, a clear sign that the market is all-in on the peak rates outlook.

US 2-Yr Treasury – Effective Fed Funds Spread

But several Fed officials in recent days appear to be throwing cold water on the idea that we’ve seen the last rate hike for this cycle. Federal Reserve Bank Governor Michelle Bowman on Saturday said,

“I also expect that additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2 percent target.”

She added that monetary policy is not on a “preset course” and that incoming data will play an influential role in upcoming Fed decisions. “We should remain willing to raise the federal funds rate at a future meeting if the incoming data indicate that progress on inflation has stalled.”

New York Fed President John Williams offered a similar view last week, explaining that “Whether we need to adjust [policy] in terms of that peak rate — but also how long we need to keep a restrictive stance — is going to depend on the data.” He added,

“I expect that we will need to keep a restrictive stance for some time.”

Cue up Thursday’s CPI data, which is projected to reveal mixed data for July. The consensus point forecast sees the potential for a setback in the inflation battle brewing, according to Econoday.com. Headline CPI is expected to rebound a bit to a 3.3% year-over-year pace from June’s 3.0%. Relatively mild stuff, given the fall from 9% back in mid-2022. But if this week’s forecast is correct, the modestly firmer price trend will mark the first time in more than a year that headline CPI’s annual rate accelerated.

is expected to hold steady at 4.8%, but that’s still a substantially hotter pace and well above the Fed’s 2% inflation target.

Markets have been wrong so far in pricing in a peak rate for Fed policy. Thursday’s CPI report may help clarify if the crowd’s poised to finally get it right this time — or again learn the timeless lesson that predicting is hard, especially about the future.