Markets Pricing in an 80 Bps Move After Today’s CPI Report: What to Keep an Eye On

2024.05.15 02:29

It was a volatile trading session, with stocks having some big swings to start the day following the and then moving higher late in the day. The IV levels for shorted dated rose today, while longer-dated implied volatility fell, with the dropping and the VIX 1D moving higher throughout the day, which is what I was expecting.

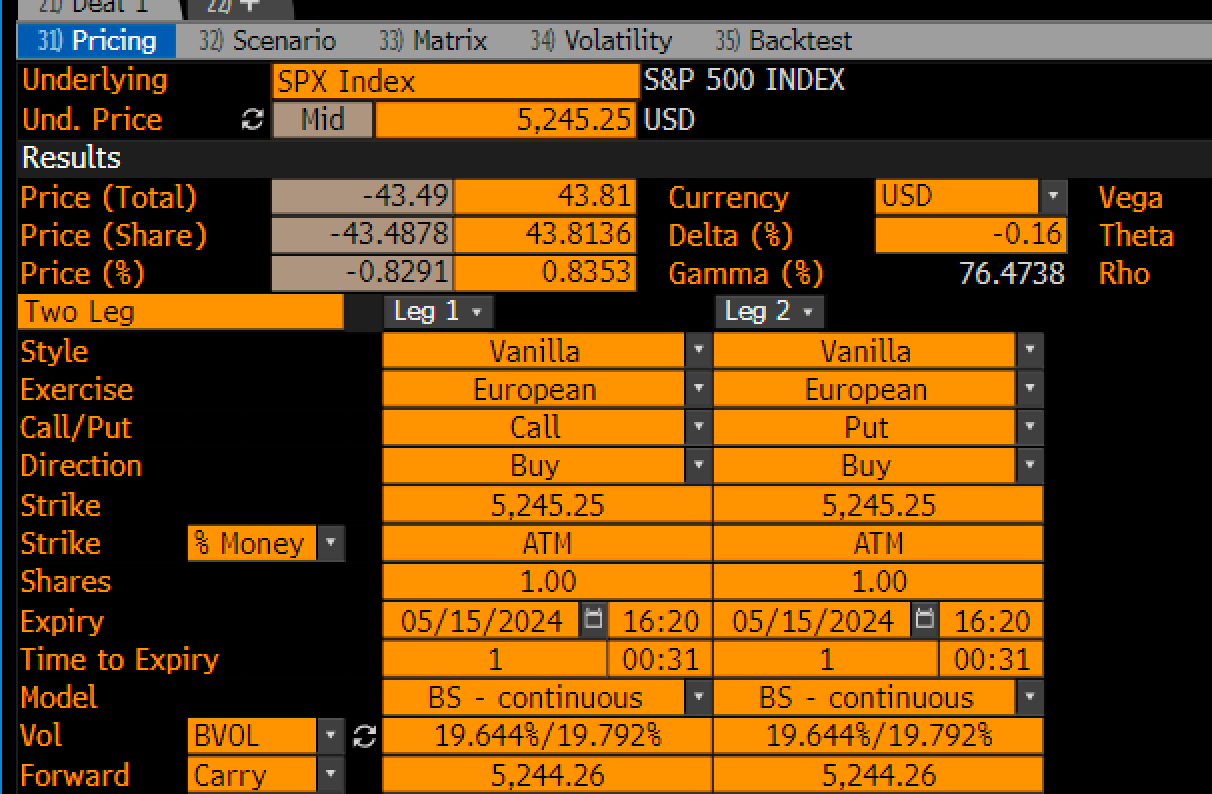

The ATM long-straddle is only pricing in a move of around 80 bps today. I don’t think that is incredibly high value for the report.

Source: Bloomberg

Source: Bloomberg

The move up yesterday in the equity market seemed odd and seemed to be driven by a large Market-on-Close imbalance of nearly $4 billion, which could have had a heavy hand in today’s price action and can explain the mysterious rally that started right around 2 PM, which of course is when the imbalances start to build, which is Information starts being released to the market.

It doesn’t seem like much, but trading volumes are not very heavy these days, and there is not much else to explain today’s strange price action. The surge also started right after 2 PM, so most of the piece seems to fit around that market imbalance driving the late-day move.

Meanwhile, following the PPI report, we haven’t seen any significant repricing in expectations around the CPI report, with analysts’ estimates and swap pricing basically unchanged from a day prior. So it is tough to walk away from the data point and think that anything significant changed or that it foretold anything.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

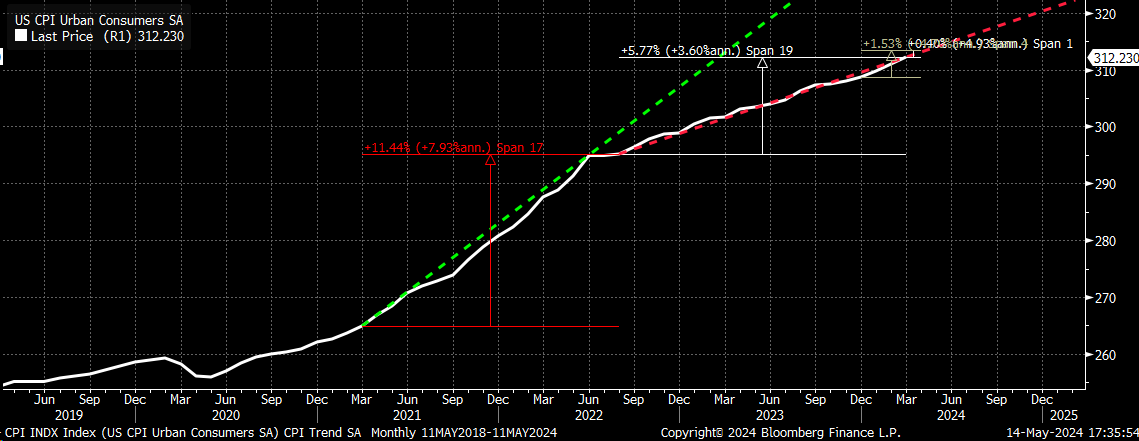

Overall, the CPI trends have been very linear, and at this point, we have little data to show that the path has changed much. Given the big move-up in , shipping rates, commodities, and other measures like ISM services, ISM manufacturing reports, and regional data points, it didn’t seem like things slowed in April, certainly not enough to alter the path lower.

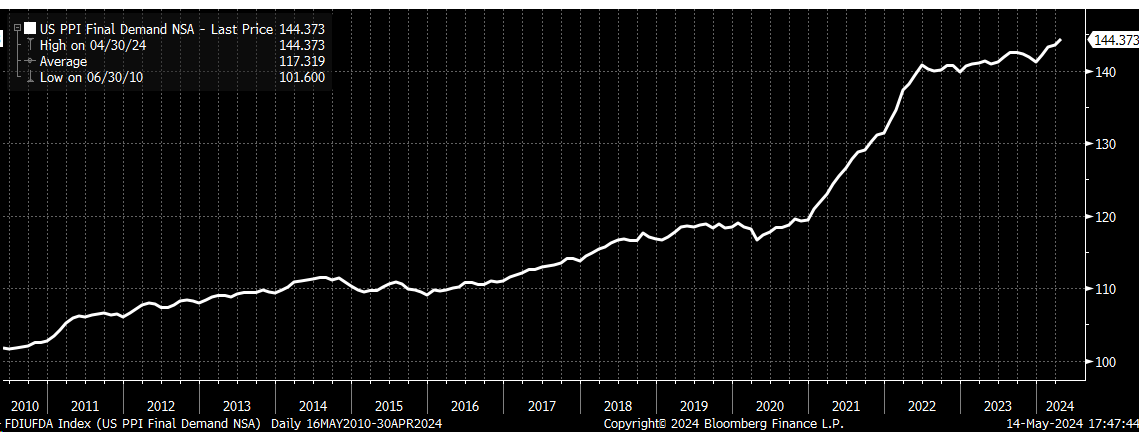

The chart of the PPI index itself certainly doesn’t look like one that is seeing inflation slowing. It looks like a chart that has broken out of a bull flag and is preparing to make another run higher. We will see what today brings. Anyone reading my free commentaries is probably very well prepared for all the different outcomes and knows how at least to interpret the meaning of the market’s response, what an implied volatility crush is, and how to identify. I have no control over everything else.

We will see what today brings. Anyone reading my free commentaries is probably very well prepared for all the different outcomes and knows how at least to interpret the meaning of the market’s response, what an implied volatility crush is, and how to identify. I have no control over everything else.

Original Post