Markets Embrace PBoC’s Bold Stimulus, Rate Cuts as Oil Prices Surge

2024.09.24 10:47

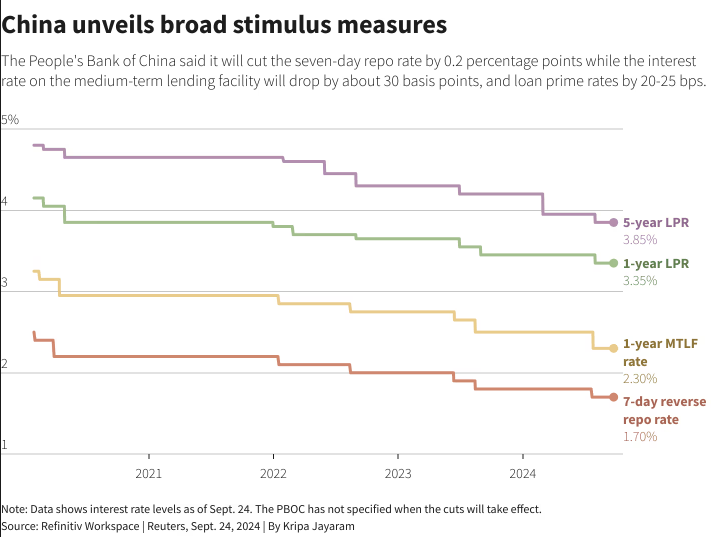

- The People’s Bank of China (PBoC) has unveiled a stimulus package aimed at boosting economic growth.

- Key measures include a cut in the 7-day repo rate, a reduction in the required reserve ratio (RRR), and support for the mortgage market and property sector.

- Asian and European stock markets have reacted positively to the stimulus as markets welcomed the news.

- Oil prices have risen as well and could benefit from the stimulus package. Will the Oil price recovery continue?

The People’s Bank of China (PBoC) in a surprise briefing this morning unveiled a massive stimulus package in an effort to reach its growth targets. The jury is out on whether these measures will suffice but the initial reaction has been a positive one.

Asian stocks rose to a two-and-a-half-year high with the rising as much as 3.2% and the blue-chip rising around 2.4%. The effect has filtered through to the European open as well with stocks in the luxury goods and mining segments in particular benefiting. Overall, this is a positive for market sentiment at an important time.

The most important announcement by the PBoC is probably the 20bps cut to the 7-day repo rate. This would make it cheaper for banks to borrow money and thus businesses and individuals will benefit as well. The idea would be that cheaper loans could help boost spending on goods and services.

The other notable measures from the PBoC:

- A 50 basis point reduction in the required reserve ratio (RRR) lowers the RRR for major banks from 10.0% to 9.5%. (This move in conjunction with the others could help spur on weakening credit activity moving forward.)

- Support the mortgage market. Outstanding mortgage rates to be cut. Second home purchases min downpayment from 25% to 15%.

- Funding support to be increase from 60% to 100% for property. Central support will increase for unsold homes.

- Will establish new monetary policy rules to support the stability and development of the stock market. Companies to have increased access to liquidity.

The property market has been a particular area of focus for Chinese authorities and global market participants. Last month’s weak property price data further exacerbated those concerns, so it is no surprise that the PBoC has made an effort to bring back stability to an important pillar of the economy.

Moving forward, it will be important to see some stability and potential recovery in property prices. Housing inventories also need to begin moving down as this will be a sign that the stimulus measures are having the desired effect. Failure of the above may lead to further concerns and affect market sentiment which would leave the PBoC in a tough spot.

Source: LSEG

Market Reaction

As we touched on earlier, the initial reaction has been a positive one with the Hang Seng and CSI 300 Index benefitting. European equities have also experienced a slight bounce at the open with the rising and individual stocks in certain sectors benefiting.

Market sentiment in general may receive a boost today following the PBoC announcement and risk assets could be the beneficiaries.

Hang Seng (Hong Kong 33) Daily Chart, September 24, 2024

Source: TradingView

From a commodity perspective, prices may be one to watch. Chinese growth has been an anchor on Oil prices of late and the move could help oil prices continue its recent rally. Tensions in the Middle East and the PBoC stimulus could be just what the doctor ordered for Oil prices to continue their ascent.

Other commodities such as , etc may also benefit from the announcement. If markets expect the stimulus to boost spending and demand this could result in an uptick across the commodity space.

Crude Daily Chart, September 24, 2024

Source: TradingView

Support

Resistance

Original Post