Markets Bet on Fed Pause Despite Hot Inflation Report

2023.09.14 08:06

US consumer rose more than expected in August, but the surprise jump hasn’t persuaded markets to abandon expectations that the will leave interest rates unchanged at next week’s policy .

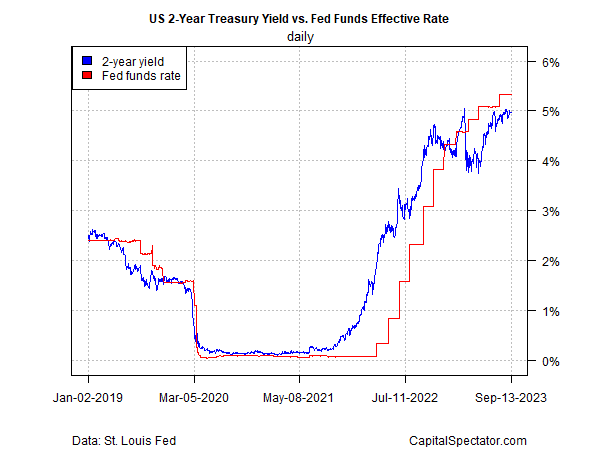

The policy-sensitive ended yesterday’s session (Sep. 13) at 4.96%, comfortably below the current 5.25%-5.50% Fed funds target rate. That’s a sign that the Treasury market expects the central bank will leave policy unchanged at next week’s FOMC meeting (Sep. 20).

US 2-Yr Treasury Yield vs Fed Fund Rate

Keep in mind that the Treasury market, based on the 2-year yield, has been consistently wrong about Fed policy this year. The 2-year rate has remained below the Fed funds target rate — widely seen as a forecast for no change or a cut in rates — despite the ongoing policy tightening.

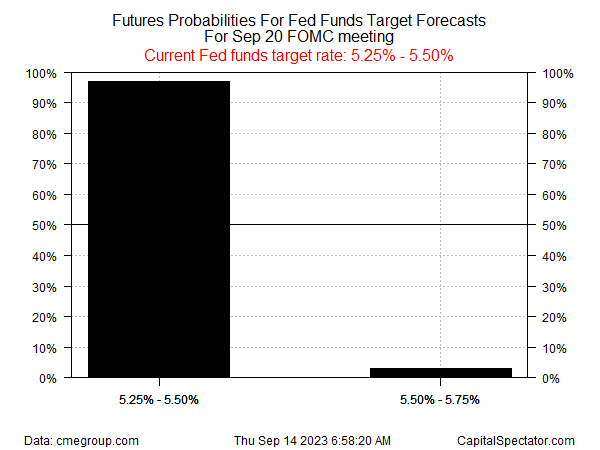

Fed funds futures, however, agree with the implied 2-year yield forecast. Traders are currently reflecting a near-certainty of confidence for no change in policy at next week’s monetary policy decision based on futures pricing.

Fed Fund Futures Probability

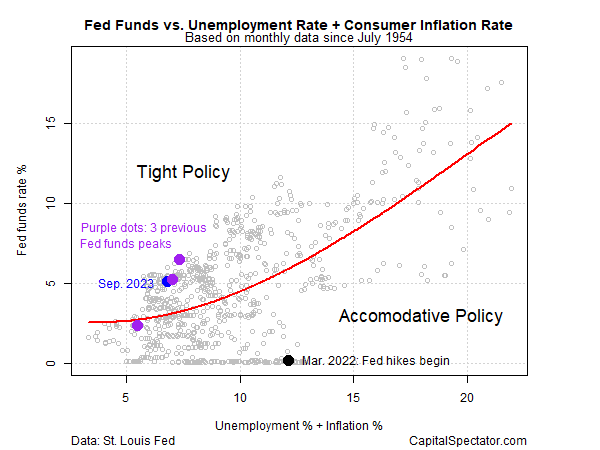

Meanwhile, the current Fed funds rate looks moderately restrictive, based on a model using unemployment and inflation. The implication: even if the central bank leaves rates unchanged for the near term, the current 5.25-5.50% Fed funds rate would reflect a policy of passive tightening – all the more so if inflation continues to ease.

Fed Funds vs Unemployment+Inflation Rate

Some analysts advise that the central bank’s active tightening efforts have ended.

“We believe that we have likely seen the last rate hike for this cycle, as the economic data that the Fed will see over the coming months will keep them on hold,” predicts Greg Wilensky, head of US Fixed Income at Janus Henderson Investors, in a research note.

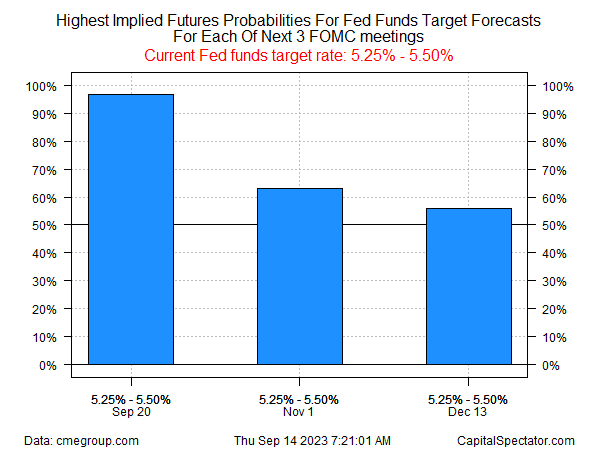

Looking ahead to the two remaining Fed meetings this year, futures are leaning toward expectations that rates will stay unchanged, but for now, confidence is low about what happens in November and December, effectively pricing in a coin flip for rate decisions. The question is how incoming economic and inflation data will change the outlook.

Implied Futures Probability