Markets Are Hedging Against a Hawkish Pivot Today

2024.05.01 03:23

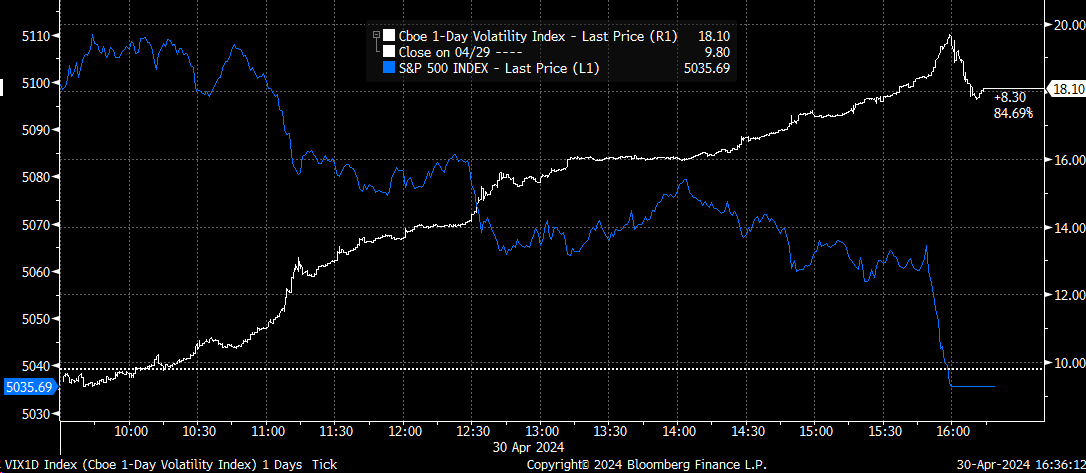

The was down about 1.6% heading into the and Quarterly Refunding Announcement today. The 1-Day was up 8.3 points to 18.10, which suggests much of the decline yesterday could have been attributed to hedging activity.

It seems likely that once we get past the , we could see that usual volatility crush at around 2:35 PM ET. That is typically when the S&P 500 rallies and everyone starts to comment about the market, with Powell having a dovish tone. Even though we know that the rally has nothing to do with Powell the passing of the event risk as the VIX 1 Day drops like a stone and heads lower.

(BLOOMBERG)

How much it could rally depends entirely on how much IV rises ahead of time and what the Fed and Powell have to say. If Powell says that the Fed is going to be staying higher for longer, that rate cuts are likely to be somewhat fewer than projections in March, and that financial conditions have eased too much. Then, any IV bump we get probably won’t last. If he talks about still thinking we will have three rate cuts in 2024, the rally could have some legs to it.

But before we get to the Fed, we will have the QRA, and we will find out how the Treasury plans to issue all of the debt. Will it be more bill issuance or coupons? I have no idea. But it will be important to know how that goes because it can determine which way the flow of liquidity goes.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

US Dollar to Move Higher?

The had a big move yesterday, given the hotter-than-expected Employment Cost Index report, which rose by 1.2% Q/Q SAAR. This led to the surging by almost 60 bps and perhaps, once again, breaking out of that bull flag, which could lead to a move up to 107 and potentially much higher than that.

Canadian Dollar Eyes Resistance Ahead of Fed

This also meant that the US dollar rallied against the Canadian Dollar as we started heading up to that all-important resistance level around 1.3860. This is the fourth test of that level, and the last three times the failed to push through, it led to an important turning point in the equity market. If the USD/CAD pushes higher this time, it will probably indicate that the equity market has further to fall.

2-Year Eyes Bull Flag Breakout

Meanwhile, the is also poking its head up above the bull flag as well. Again, if the 2-year trend starts heading back to 5.25%, it is a good signal that either rate hikes or rates are being held higher for a long time.

Bitcoin Below $60,000

was crushed yesterday, falling 6.5% and dropping below the critical $60,000 level. At present, there doesn’t seem to be much support between its current price and $51,000

Gold Falls

Meanwhile, also fell 2% on the day, with support next up at $2,150. With Gold and falling sharply on the same day, it is either a dollar-related move or a move related to liquidity being removed. Given our conversation the last few days about reserve balances and the TGA, my guess is it is a liquidity thing, another way of saying deleveraging.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

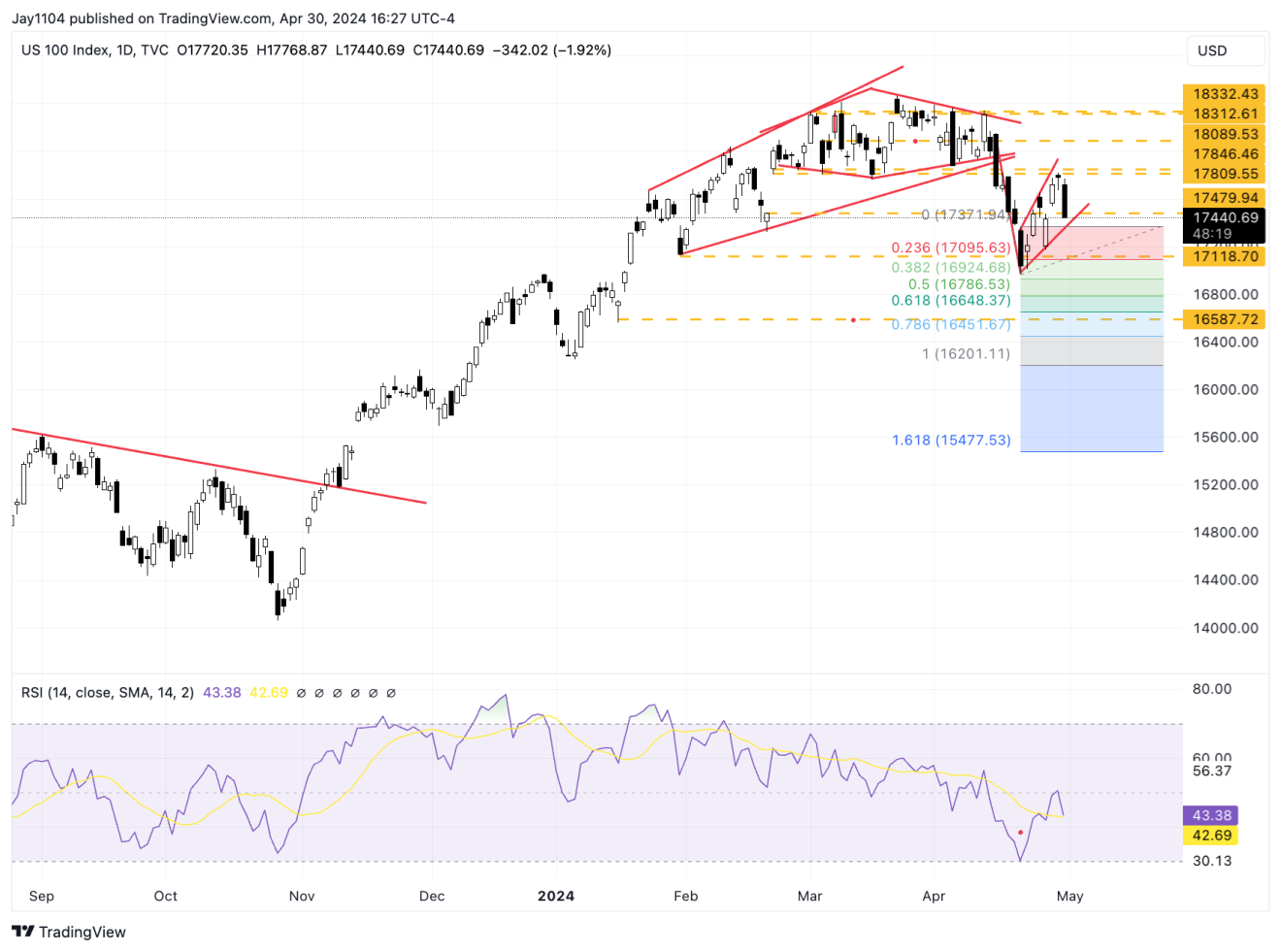

Anyway, the S&P 500 finished yesterday down 1.6ish% and is pretty close to breaking the lower bound of a bear flag formed over the last several trading sessions. If the flag is punctured today, then there is a good chance the next stop could be in the 4,700’s.

It is the same look in the , with the next stop potentially in the 16,000’s.

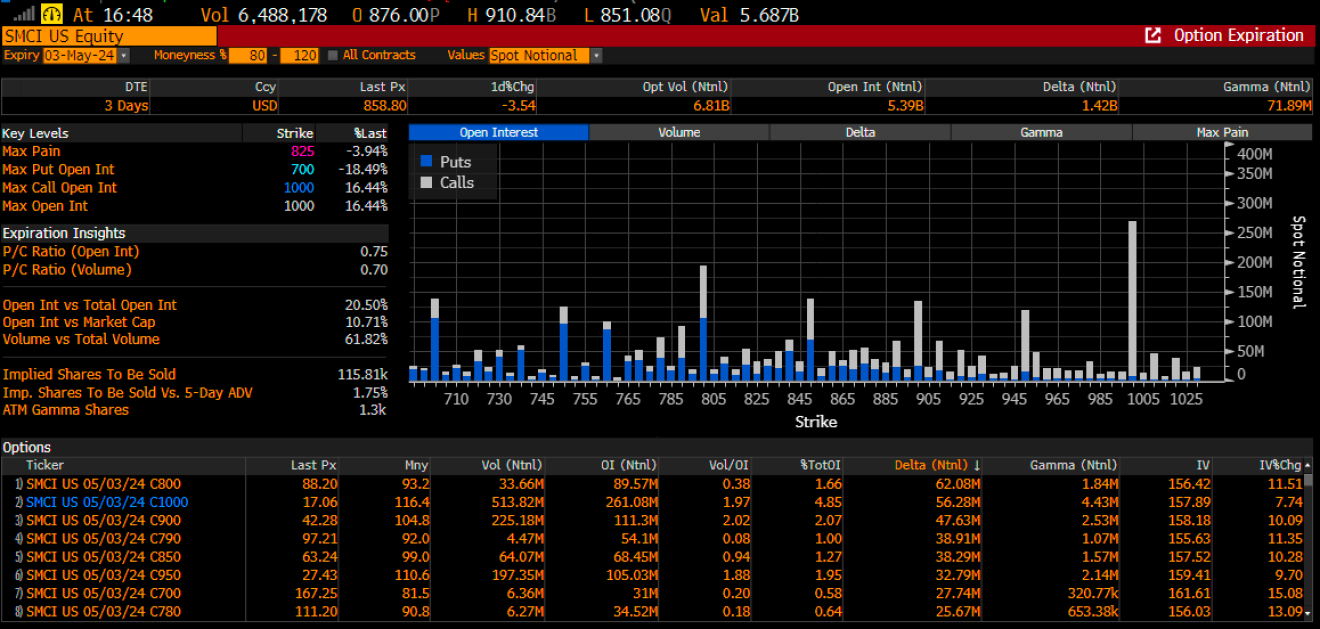

SMCI Misses Revenue Estimates

Finally, now that the ) is in the S&P 500, its results tonight could impact the market. The stock is down about 8%, following the results. The market was pricing in a nearly 13% move in either direction. The company actually missed revenue estimates, coming in at $3.85 billion versus estimates for $3.864 billion. I know it’s minor, but still, that’s not what you expect with a stock that has moved like it has.

Then, the company issued full-year guidance at $14.7 billion to $15.1 billion, versus estimates for $14.6 billion, which doesn’t sound that impressive to me, again, given the runup. It also sees 4Q revenue of $5.1 billion to $5.5 billion versus estimates of $4.7 billion, which sounds good. Still, with an implied move of 13%, an IV for this week’s expiration in the 150s, and lots of positive call delta that will lose lots of value today, I can’t see this stock going higher. But I guess we will see what happens today.

(BLOOMBERG)

It seems like everything has lined up for a more significant market drop at this point. Will it happen?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Original Post