Markets Adjust to the Revised Fed Rates Outlook

2024.12.19 07:43

- Fed cuts rates, dents easing expectations for 2025.

- Dollar benefits but risk sentiment suffers.

- BoJ keeps rates unchanged, yen weakness continues.

Market Reset Underway After the Fed Meeting

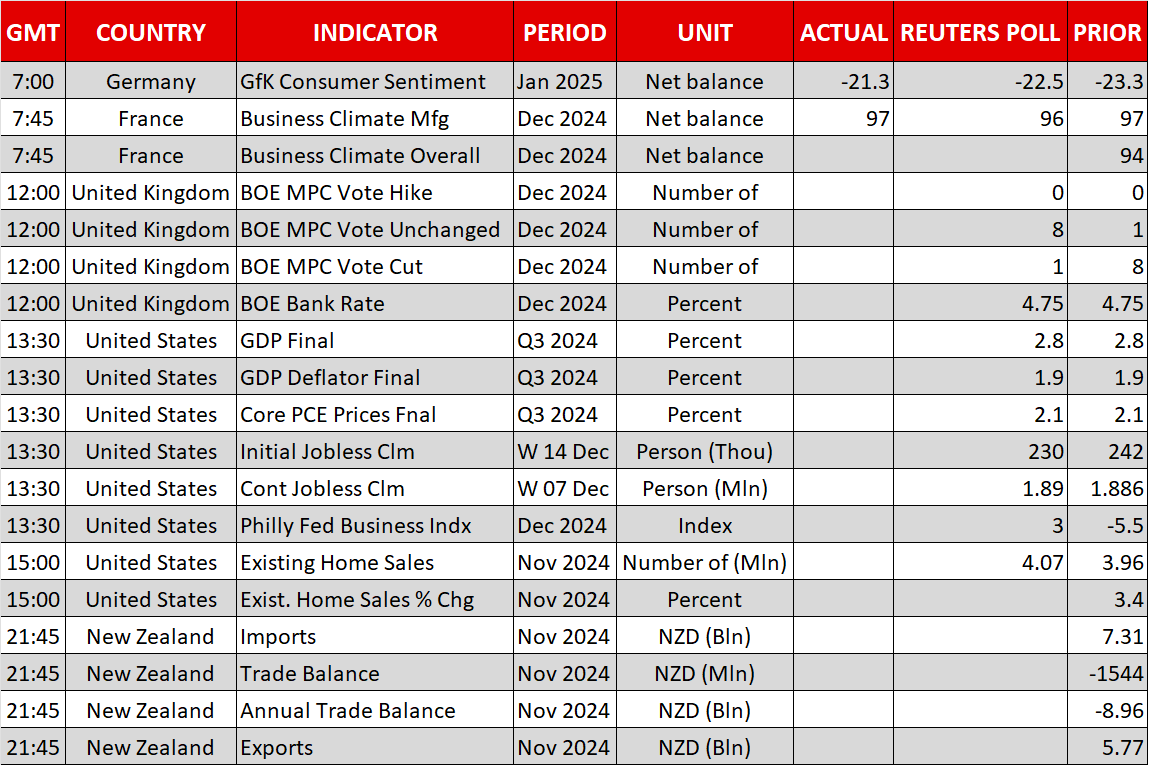

The last of 2024 was more exciting than expected, with Chair Powell announcing a 25bps rate cut and, with the help of the dot plot, pointing to a less aggressive easing pace during 2025. With inflation being closer to the 2% target and the labour market not fueling inflation at this stage, members penciled in two rate cuts in 2025. This outlook is actually quite far from what the market was pricing in ahead of the November US Presidential election.

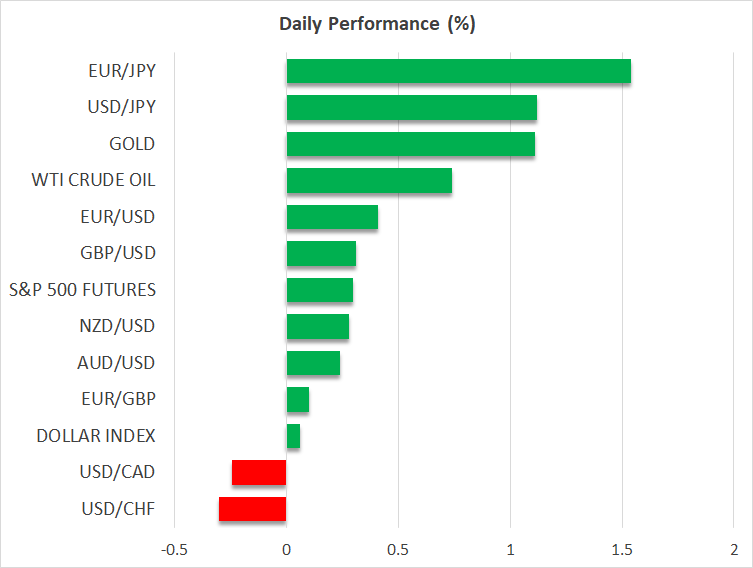

The market reacted sharply, with an aggressive risk-off reaction. ested the November 22 low of 1.033, while US stock indices suffered significant losses, led by the . Drilling down the sectors, yesterday’s weakness was evident across the board, with the consumer discretionary and the real estate sectors posting the strongest losses.

Interestingly, the stronger left its mark on both gold and bitcoin.

dived to $2,584 before recovering a tad above the $2,600 mark, while has returned above the key $100k threshold.

The king of cryptos has been hovering above this threshold, with the bulls taking advantage of any corrections, such as yesterday’s.

BoJ Keeps Rates Unchanged

Compared to the Fed gathering, today’s announcements from the BoJ proved less exciting. Despite the buildup of expectations for a rate hike in early December, driven by the positive economic data and Governor Ueda’s willingness to gradually tighten the BoJ’s monetary policy stance, calmer heads prevailed, keeping rates unchanged.

Based on Ueda’s press conference, the BoJ has decided to wait for further positive information on the wages front, which means that the door is open for a rate hike in March. Interestingly, Ueda also focused on overseas uncertainties. Apart from Trump’s imminent second presidency, Wednesday’s Fed announcement has also played a key role in today’s BoJ stance, with the market now fully pricing in a 25bps rate hike in May 2025.

The end-product of today’s BoJ meeting is that the yen is under pressure again. is testing the resistance set by the November 15 high of 156.74, with the current pace of the rally potentially sounding the alarm at the Japanese Finance Ministry halls. Hence, it won’t be surprising to see another barrage of verbal interventions during today’s trading session.

The BoE is {{0|Next (LON:)}} to Announce Its Decision

Following the hawkish Fed rate cut, the path is clear for the BoE to announce a similar decision. However, the recent mixed set of economic data and the lack of quarterly economic projections means that Governor Bailey et al are probably going to keep their powder dry this time around. The market has endorsed this possibility, as it is currently pricing in only a 1% chance of a 25bps rate cut.

Interestingly, following this week’s strong labour market data and inflation report, the market is pricing in just two rate cuts for 2025. Considering the wider environment, this looks too optimistic, especially since the impact of the 2025 budget remains uncertain. Intriguingly, despite the opposing trends in central bank expectations, the pair has, up to now, failed to decisively trade below the 0.8220 level.