Market May Not Rise Much More as Earnings Estimates Fall

2022.11.11 05:08

[ad_1]

Earnings season for the third quarter was better than expected for the , with earnings and revenue both surprising to the upside. However, it is what comes next that is likely to weigh on markets going forward, as 2023 earnings estimates are falling rapidly for both the and the S&P.

As earnings forecasts slide, P/E multiples are likely due to rise, especially if the prices remain at current levels. As of now, neither the S&P nor Nasdaq is cheap, but not expensive either. Instead, they appear fairly valued. But that means there is a cap to how much the market can rise, given that declining earnings are likely to push that PE multiple higher.

Falling Earnings Estimates

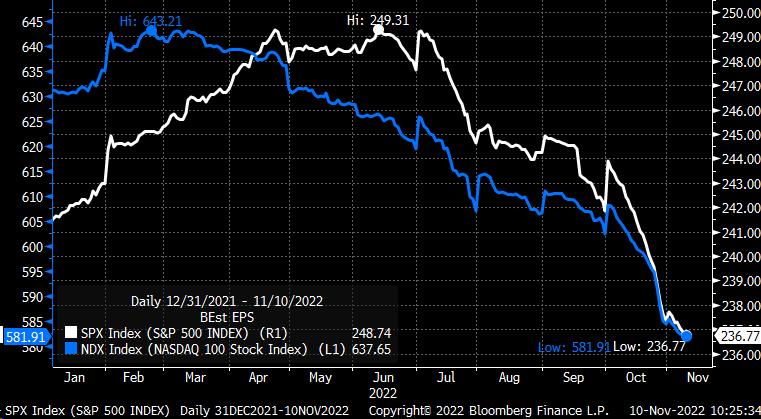

Earnings for the S&P 500 have dropped to about $236.77 per share from a peak of about $249.31 per share. Meanwhile, the Nasdaq 100 is expected to earn $581.91 per share in 2023, down from $643.21 per share in February. It is a sharp decline, with most of that significant decline coming in October alone.

That has resulted in the S&P 500 P/E ratio moving up to around 16.4 and the Nasdaq 100 ratio climbing to approximately 19.5.

Both PE ratios are well below the market peak but still at the upper end of their historical range which becomes problematic if earnings estimates continue to fall.

A Range Bound Market

An overvalued market limits the amount stocks can increase in the long run. For example, the S&P 500 trading at 17 times next year’s earnings seems reasonable, but that would cap the S&P 500 value to around 4,000.

However, as earnings continue to fall, which they should as the economy continues to slow due to tightening monetary policy, the value at which the S&P 500 hits 17 times next year’s earnings also falls. Therefore valuations will likely keep a lid on markets, especially given investors’ expectations.

This may be a critical issue because, barring a pivot by the US Federal Reserve, at best, this market may be range bound between a P/E of 14 to 17, which has been the range for years—suggesting an S&P 500 that trades between roughly 3,300 and 4,000 until there is some form of resolution.

Either the Fed needs to shift its course of trying to restrict monetary policy, or there needs to be evidence that a recession is unlikely so that earnings estimates can either stop falling or reverse higher. Outside of that, a sustainable rally in the market will be capped by rising valuations and falling earnings estimates.

Disclaimer: This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice.

[ad_2]

Source link