Market craves weaker US data

2024.06.04 05:10

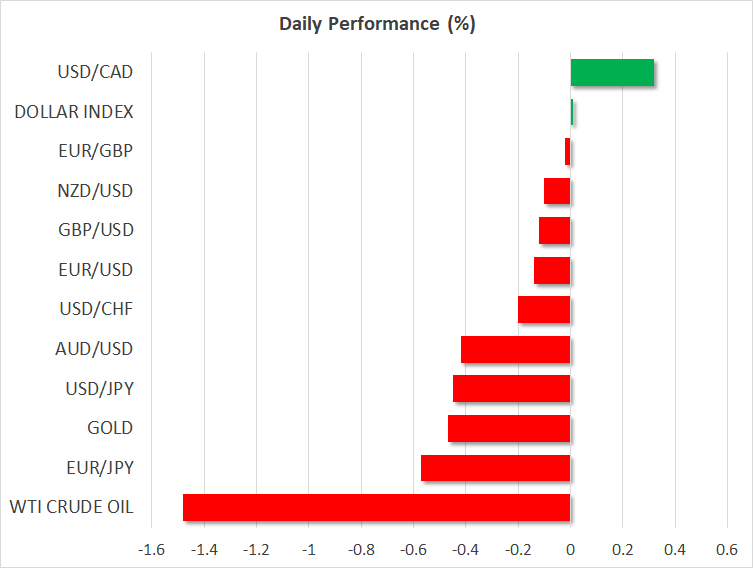

- Monday’s weaker ISM survey pushes the dollar lower

- Euro/dollar rallies to a 3-month high ahead of the ECB

- BoC could announce a rate cut tomorrow; may suffer

- Oil tanks as bearish factors multiply

Dollar gets on the backfoot

A rather busy week for the US economy started on the back foot for the US dollar yesterday as the ISM manufacturing survey edged lower in the sub-50 territory, pointing to a deteriorating outlook for this sector. Interestingly, the drop in both the new orders and prices paid subindices was music to the ears of the Fed doves, but more evidence of lower price pressures is needed to put a rate cut firmly on the table again.

The market reacted forcefully to this data release with euro/dollar climbing to its highest level since mid-March and the 10-year US Treasury yield dropping to just above 4.4%. The market is currently fully pricing in a 25bps rate cut at the November 7 Fed meeting, but such an action looks extremely difficult considering the fact that the US Presidential elections will be held on November 5.

Therefore, assuming that the data does not take a turn for the worse over the summer, the market could face the possibility of the first rate cut by the Fed, if still needed, occurring at the December meeting.

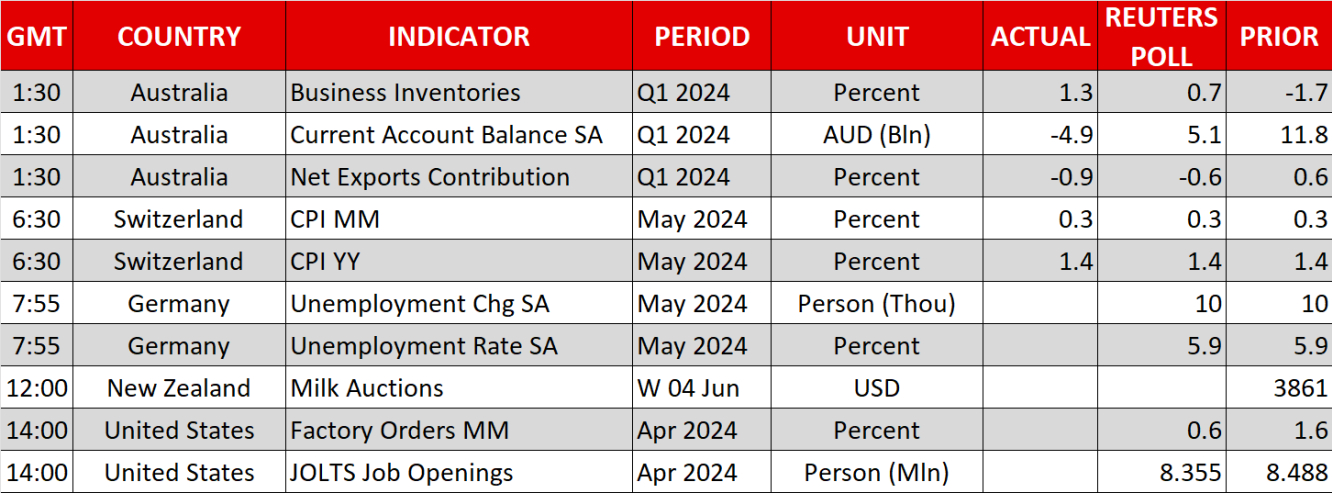

Returning to this week and following Monday’s market response, the importance of this week’s data releases has increased exponentially. Wednesday’s data prints, particularly the ISM services survey that represents the largest sector of the US economy, could prove much more market-moving than usually seen, especially if it shows further signs of economic slowdown.

Euro, pound gain against the dollar

Both the euro and the pound benefited from Monday’s dollar retreat. The former’s outlook remains firmly in the hands of the ECB while the latter continues to be affected by pre-election campaigning. The latest development is Nigel Farage’s decision to lead the protest-based Reform party in the July election. The Conservative party stands to lose the most from Farage’s endeavor although his leadership style could attract voters from across the political spectrum. Certain analysts even talk about the possibility of a much weaker Labour parliamentary majority than expected at the start of this election campaign.

BoC meeting on Wednesday

The Bank of Canada kicks off a very busy month of central bank meetings with the market pricing in an 84% probability of a rate cut being announced on Wednesday. Compared to the neighbouring USA, Canada has been experiencing lower inflationary pressures and a weakening labour market. Despite some indications of a growth pickup lately, momentum remains feeble, especially as the housing sector is still trying to find its footing.

Should BoC members judge that substantial progress has been made since April, they could announce a 25bps rate cut or signal a July rate move, which is currently fully priced in by the market. The loonie stands to suffer against the dollar in either case and potentially quickly surrender a good part of its recent gains.

Oil tanks

In the meantime, oil prices appear to be in freefall with WTI oil dropping to the lowest level since early February 2024. The perceived slowdown of the US economy, the lack of an upside growth surprise from China and the expected higher supply from October 2024, following Sunday’s OPEC+ gathering, are acting as bearish factors at this juncture.