Manufacturing’s Cyclical Slowdown Hits 8 Months, But Key Metrics Show Improvement

2024.12.04 04:41

The sector contracted for the 8th straight month, with the November number coming in at 48.4 (anything below 50 is contracting). This was actually above the street estimate of 47.7 and last months number (46.5).

The last time the manufacturing sector was positive for two straight months was over 2 years ago.

“U.S. manufacturing activity contracted again in November, but at a slower rate compared to last month. Demand remains weak, as companies prepare plans for 2025 with the benefit of the election cycle ending.”

Only 3 of 18 manufacturing industries reported growth in the month of November.

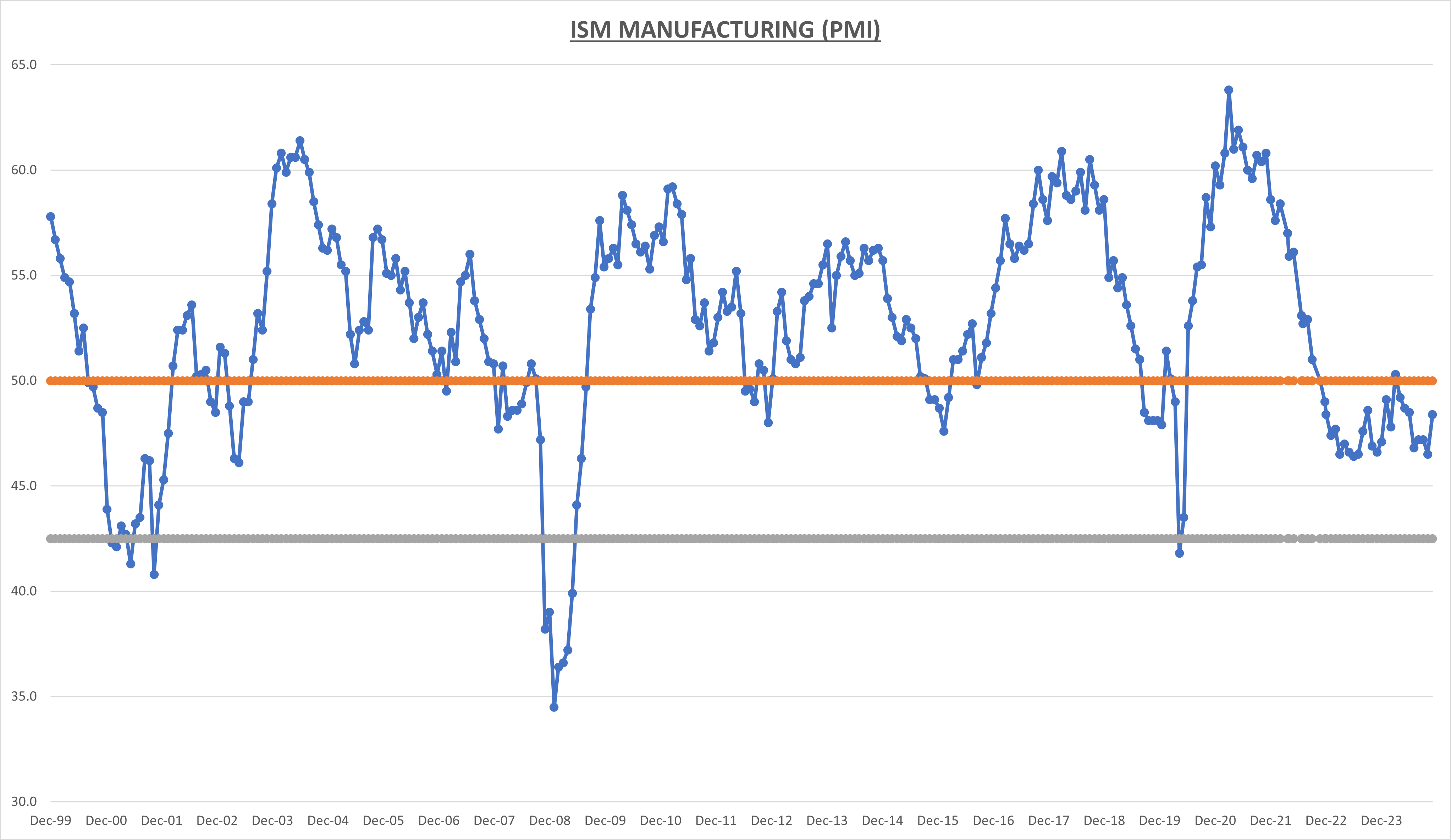

The above chart shows the historical data for this important economic indicator. The orange line is the dividing line between expansion/contraction for the entire sector. While the grey line is the dividing line between economic recessions.

A manufacturing PMI below 42.5 (grey line) has typically coincided with an overall economic recession.

So while the manufacturing sector is in a cyclical slowdown, its not yet to the point to where it has historically dragged the entire US economy into recession.

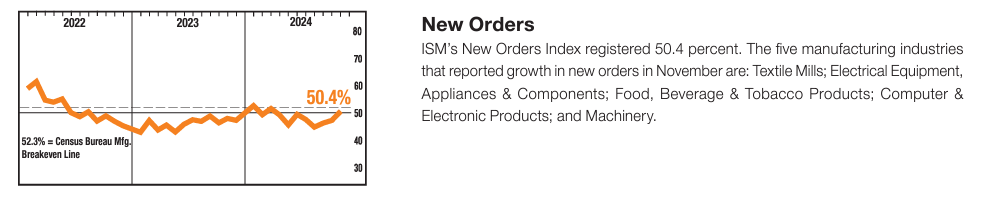

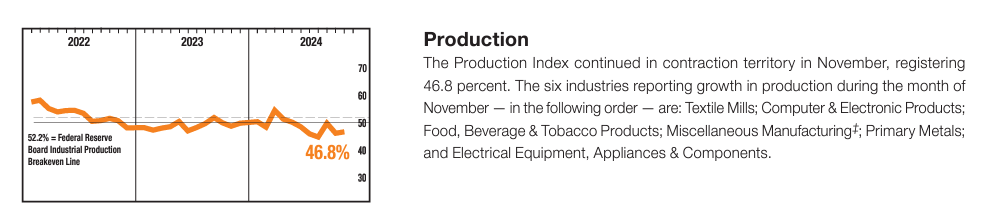

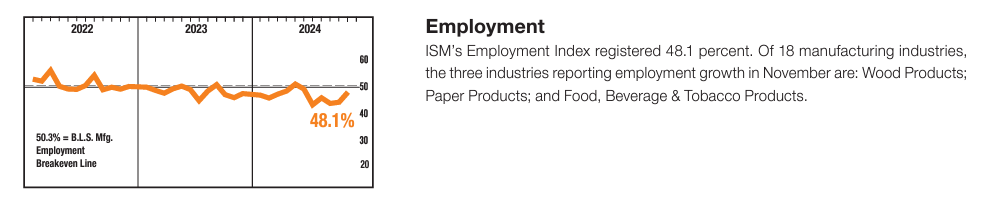

If we drill down within the manufacturing report, we see some signs of life. The 3 most leading components of the report are , production, and employment.

New orders (chart above) gained last month, and is in expansion territory for the first time in 7 months.

Production came in a bit better than October, but remains in contraction. With 6 industries reporting growth.

Employment also remains in contraction but increased 3.7 points in November.

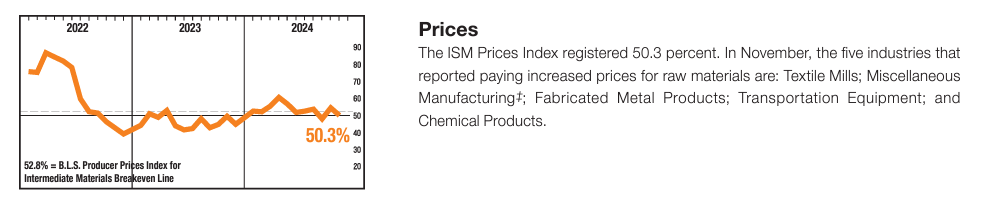

Prices pain (key inflation metric) fell 4.5 points, which is a welcome outcome. Only 5 industries reported paying higher prices in November.

A mixed bag overall. Not awful, but not great either. More of the same for the manufacturing industry for the last 2 years. Remember the manufacturing sector is only about 1/3rd of today’s economy.

While the services sector (think technology, finance, health care, etc.) represents the remaining 2/3rds. We had a manufacturing boom during COVID, as people had nothing else to do but stay home and buy goods.

Now that has reversed, we are experiencing a reversion to the mean. We get the services PMI data on Wednesday.

The street expects a November reading of 55.5, which would be well in expansion territory. The Services PMI has been strong all throughout the manufacturing slump, which has kept the overall economy from tipping over.