Looking For A Fed Pivot

2022.10.06 14:47

[ad_1]

When will the Federal Reserve cease and desist its policy of raising interest rates and tightening policy? No one knows, including the Fed, for a simple reason: the path of inflation remains uncertain. The possibilities for reading the tea leaves, however, are endless. Let’s check in with some of the usual suspects for an update.

We can start with the talking heads at the Fed. Atlanta Fed President Raphael Bostic on Wednesday suggested a pivot may come after two more rounds of rate hikes at the upcoming Nov. 2 and Dec. 14 FOMC meetings. He said:

“Ideally, I would like to reach a point where policy is moderately restrictive — between 4% and 4.5% by the end of this year — and then hold at that level and see how the economy and prices react.”

The Fed funds target rate is currently 3.0%-3.25% and Fed funds futures are pricing in high odds that it will rise in two doses through the end of the year.

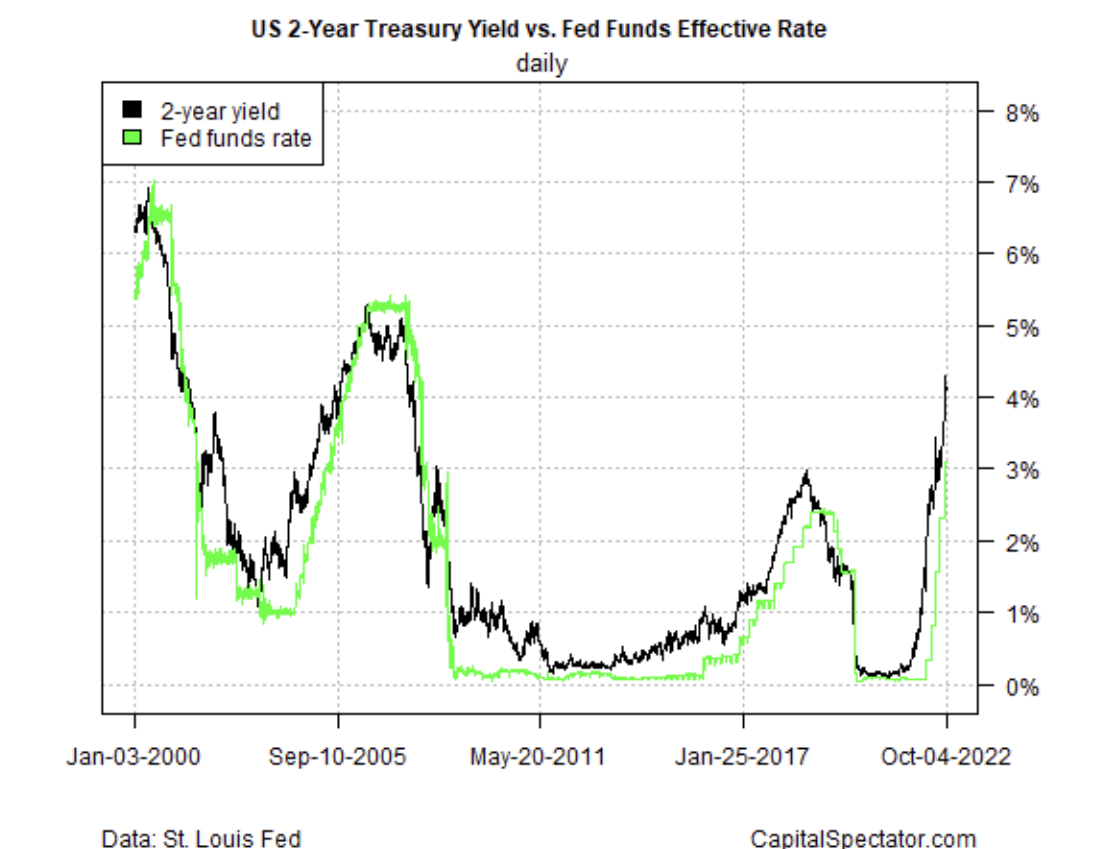

Trend behavior in Treasury yields suggests as much. Notably, the key rate, which is considered the most policy-sensitive spot on the yield curve, remains well above the Fed funds rate. That spread in favor of the 2-year yield suggests that market sentiment continues anticipate that a hawkish outlook will prevail for the near term. When the 2-year yield makes a convincing U-turn, the case will strengthen for anticipating a Fed pivot. By that standard, the odds of a pivot remain low.

U.S. 2-Year Yield Vs. Fed Funds Effective Rate

U.S. 2-Year Yield Vs. Fed Funds Effective Rate

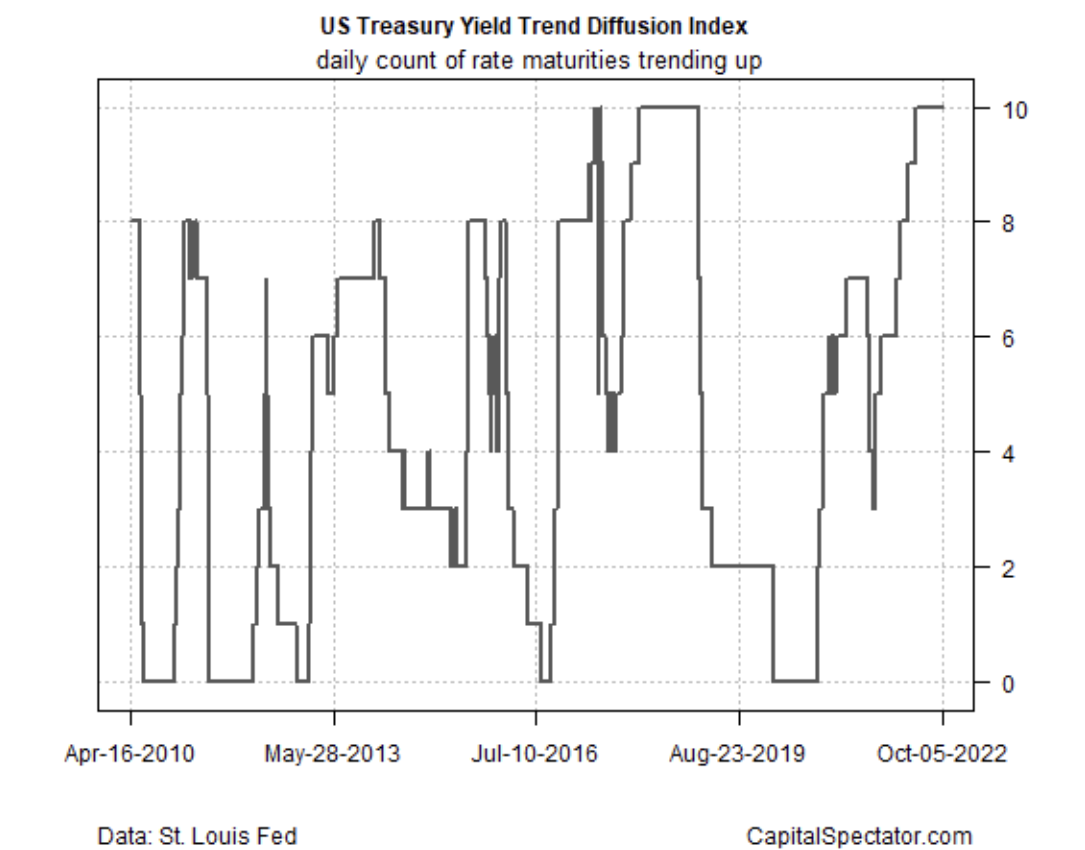

Another way to monitor market sentiment is by tracking the trending behavior across the Treasury yield curve. The chart below shows the history of the daily count of ten maturities – from the 3-month yield up through the 30-year rate – in terms of upside trending behavior. As of yesterday (Oct. 5) all 10 rates were trending higher, defined as a rate’s 50-day moving average above its 200-day average.

U.S. Treasury Yield Trend Difusion Index

U.S. Treasury Yield Trend Difusion Index

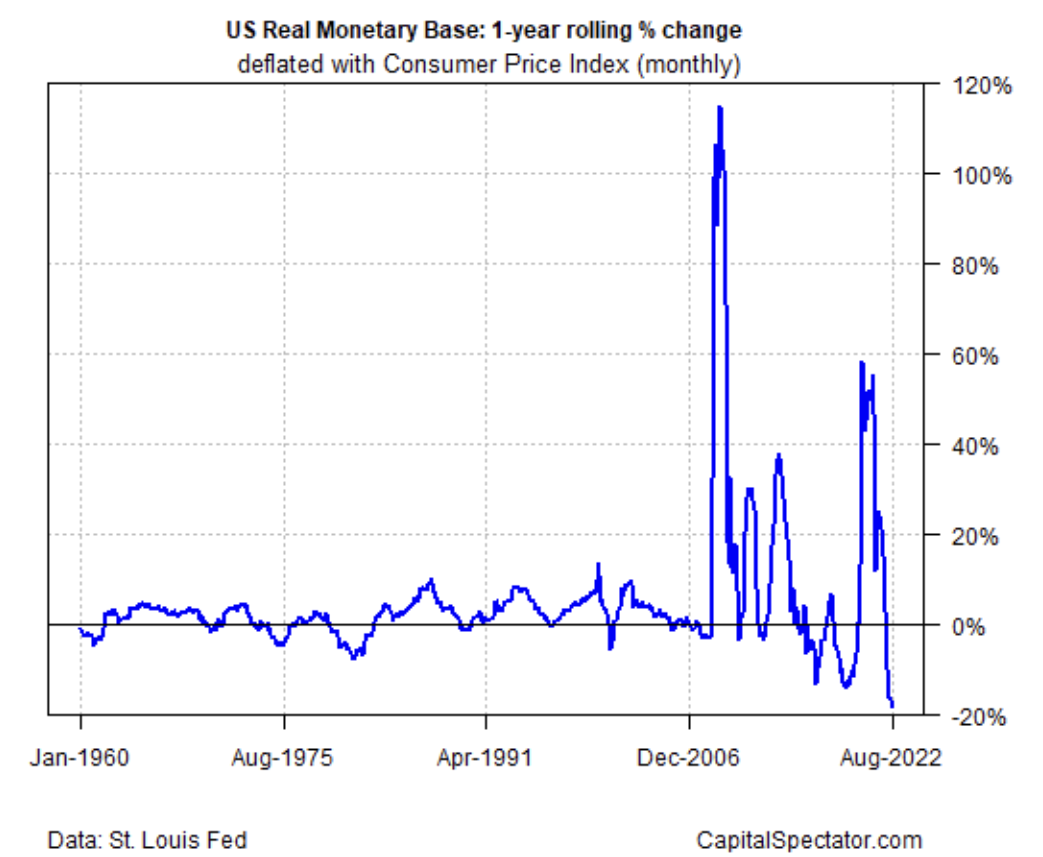

Another way to look for pivot clues is by monitoring the Fed’s decisions on managing base money (M0), which is a key factor in the directional bias for money supply changes. Using this definition of M0, and adjusting for , shows that the year-over-year trend remains deeply negative, which indicates that the central bank’s hawkish policy persists in no uncertain terms.

U.S. Real Monetary Base (Rolling 1-Year Change)

U.S. Real Monetary Base (Rolling 1-Year Change)

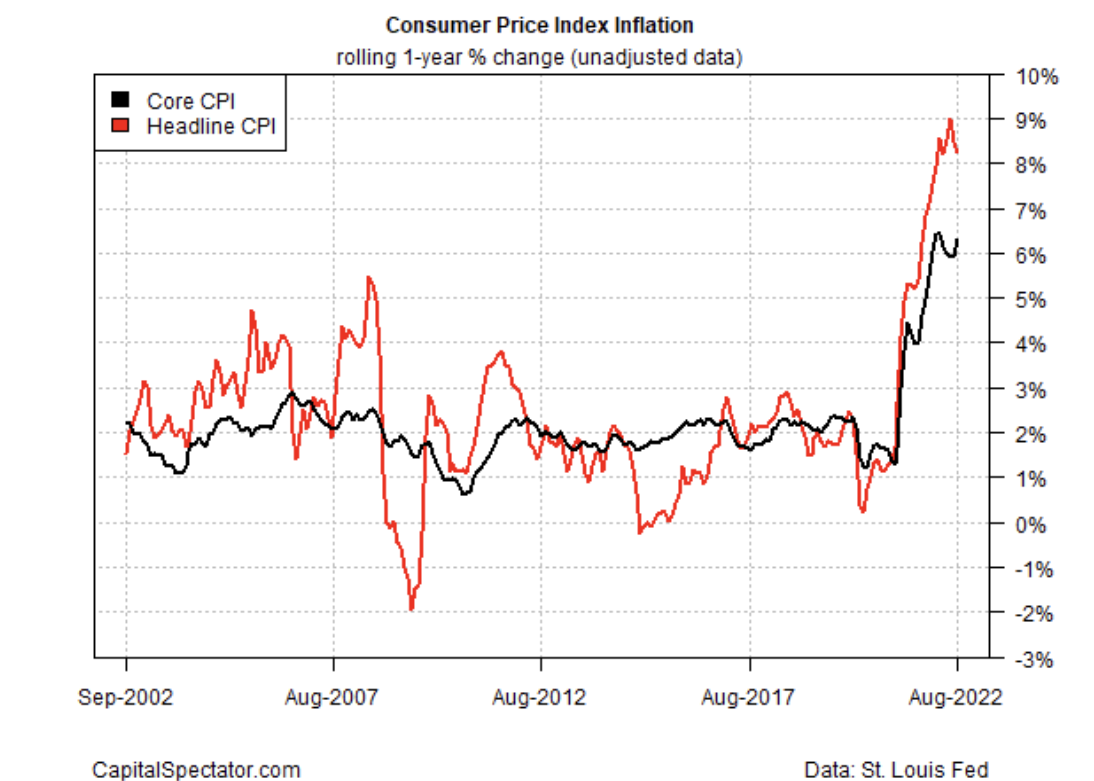

Perhaps the critical data set to watch is incoming inflation reports. Until the Fed is convinced that a sustained downturn in pricing pressure is in progress, the case for a pivot will probably remain weak. Indeed, Federal Reserve Bank of San Francisco President Mary Daly told us so in an interview on Bloomberg TV yesterday:

“The American people — they need confidence that we’re resolute,” she said. If core inflation is rising and the job market isn’t cooling “that’s not very comforting to the American people, and I think then that the downshifting on the tightening would be a much harder decision to make.”

On that basis, there’s still a long way to go as long as core consumer remains elevated.

[ad_2]

Source link