Japanese Yen on the Front Foot as BoJ Hike Eyed; Stocks Stage a Recovery

2024.07.29 08:37

- Yen looks to extend gains as BoJ set to press ahead with policy normalization

- Wall Street bounces back on hopes of upbeat tech earnings, Fed rate cut signal

- Gold and oil in tepid rebound despite heightened tensions in the Middle East

BoJ to Kick Off Trio of Central Bank Meetings

The edged higher on Monday as investors anticipate the Bank of Japan to take the next steps in its policy normalization plans when it announces its latest decision on Wednesday.

Expectations are running high that the BoJ will not only reduce its bond purchases, but that it may also hike interest rates for a second time this year.

It’s almost likely that there will be some form of an announcement on tapering this week, with some reports suggesting a halving of the monthly JGB purchases over the next few years. What is less certain is whether or not policymakers will also agree to raise rates or leave that decision for another meeting.

Investors have been upping their bets of a rate hike in recent weeks, pricing in around a two-thirds probability of a 10-basis-point increase, amid growing calls by Japanese government officials for the BoJ to do more to tackle the weak yen.

Yen on a Roll

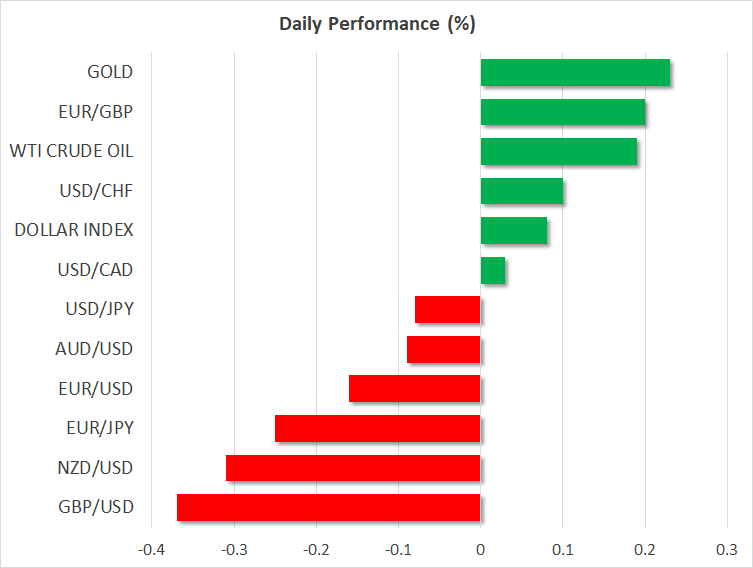

The yen has surged by about 4.5% against the this month. But much of the gains have been on the back of the unwinding of yen carry trades rather than on policy speculation.

Although the nearing of a BoJ hike and a Fed cut is undoubtedly adding fuel to the rally, the trigger seems to have been Trump’s recent comments on the strength of the dollar and the weak yen amongst others, which has set off a massive reversal of global carry trades. This in turn has sparked a short squeeze in the yen, further boosting the currency.

A rate hike accompanied by a hawkish tone could see the yen rallying further but it may also be the right time for a technical correction if the BoJ disappoints.

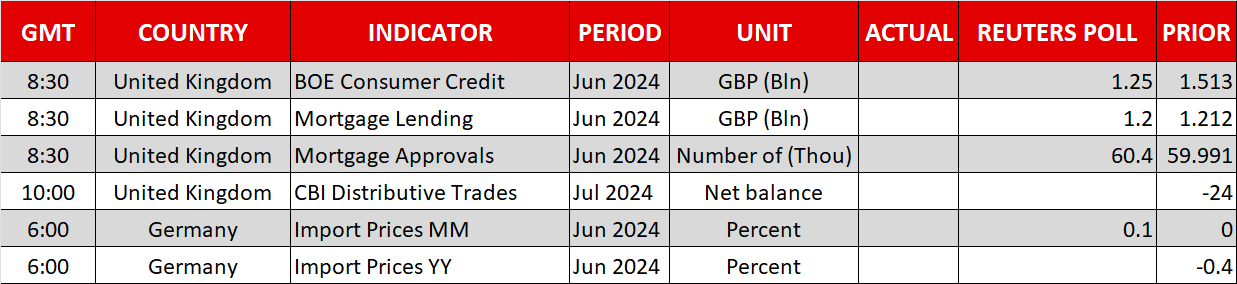

Rising Odds of a BoE Cut

The yen’s newfound strength has made for a mixed dollar, as commodity-linked currencies have sunk in the past couple of weeks, while the and have been somewhat more resilient. But sterling’s losses seem to be deepening as expectations grow that the Bank of England will cut rates on Thursday.

The odds have risen from around 50% to almost 60% in the last few days, and although any decision to cut will likely be a close call, the optimism about looser monetary policy is contributing to the turnaround in risk sentiment. The Fed also meets this week, and many investors are betting that FOMC members will flag a rate cut in September even as they keep policy unchanged on Wednesday.

Stocks Perk Up, Weak Start for Commodities

However, following last week’s upside surprises in Q2 and readings, the Fed may not be ready to commit to a September cut just yet. This poses a downside risk for stocks, which are attempting a rebound after being on the slide since mid-July.

For Wall Street traders, however, the Fed will not be the only focus as there’s a flurry of tech earnings coming up, starting with Microsoft tomorrow.

In commodities, is struggling to reclaim the $2,400 level as the US dollar pulls higher, while prices are up only marginally despite a flare-up in tensions in the Middle East.