Jackson Hole: Markets Expect a Hawkish Powell

2023.08.23 04:10

This week is marked by non-relevant economic data to report, with the most significant event being the meeting scheduled for Friday. The speech by Federal Reserve Chairman Jerome Powell is already on the agenda.

It’s highly likely that during this intervention, Powell will provide updates on the central bank’s stance regarding in the US and whether it will continue to raise interest rates in the upcoming months of 2023.

In previous years, the Jackson Hole meeting – which is not an official Federal Open Market Committee meeting – has served as a stage for announcing new monetary policies. This is why this gathering generates so much anticipation among investors.

For instance, in 2011, Ben Bernanke gave strong hints of future action right before the start of Operation Twist, and in 2016, Janet Yellen also hinted that the Federal Reserve would begin raising interest rates.

Historically, this has been a meeting where Fed members have provided significant market-relevant information. This time around, it seemed that a similar scenario would unfold.

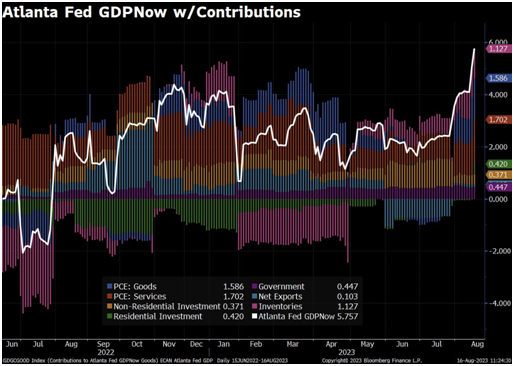

However, due to the very positive economic data in recent weeks that seem to suggest we are experiencing higher-than-normal economic activity, which has raised alarms about a potential inflation outbreak in the coming months, the likelihood of a major announcement regarding the end of interest rates hikes at Jackson Hole has diminished.

Atlanta Fed GDPNow w/Contributions

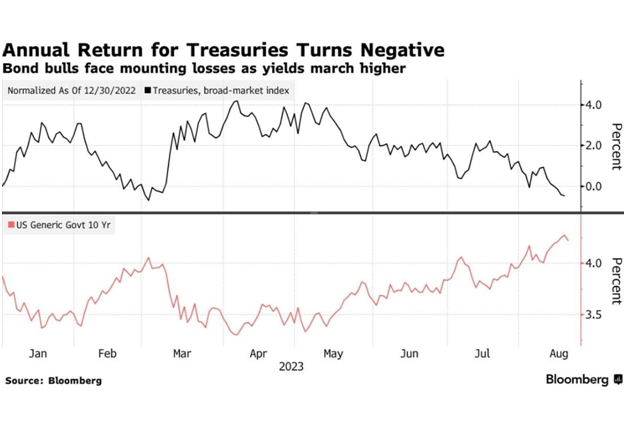

Another factor to consider is that the bond yield is approaching 2006 levels and broke the March levels, which was one of the triggers for the minor banking crisis in March.

This time around, many market participants, which probably includes banks, are back at losing money with their treasury positions – so an overly aggressive Fed approach at this meeting is not expected to avoid triggering another crisis of this kind.

Annual Return for Treasuries Turn Negative

Furthermore, auto and mortgage payments are at levels not seen for several decades, which means that the banking sector wouldn’t be the only one in a tight spot if the Federal Reserve decides to take a more aggressive path to control inflation, making it less likely.

All this means that J Powell will probably choose to communicate as little as possible and tell markets he is data-dependent.

We will see how the market reacts, but they seem to expect a hawkish Powell, so he could deliver a surprise even if he chooses to say very little.