Is the U.S. Stock Market Gearing Up for a Santa Claus Rally?

2022.12.05 08:22

[ad_1]

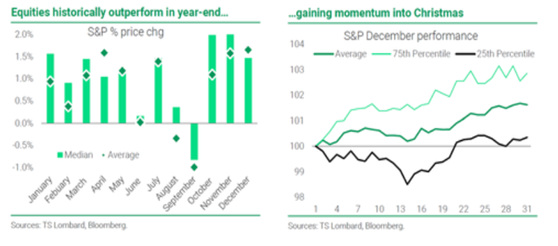

Historically, falls heading into the summer and Christmas holidays. Stocks historically outperform by the end of the year. Data compiled by TS Lombard’s Skylar Montgomery Koning, in the chart, shows the monthly mean and median changes relative to the comparable 30-year benchmark — and, indeed, the S&P tends to outperform in the last three months of the year by as much on a mean as well as a median basis.

Seasonality chart – stocks.

Looking specifically at December’s performance, the stock rally tends to gain momentum in the two weeks before Christmas, which marks a turning point for the bottom 25th percentile (although the December 2018 crash is still fresh for many traders). So, there is some historical evidence for a Santa Rally scenario. However, as Koning observes,

“It is important to note that an observable pattern has no value unless there is a logical explanation.”

For example, risk assets tend to be inversely related to volatility. In fact, across all developed market equity markets, Japan and the United States (both of which have national Thanksgiving holidays) significantly outperformed in November. Volatility does fall at the end of the year. The net result is a lower average volume in summer and December.

Regarding year-end, it is also important to note that fund managers are judged on annual calendar year performance. Because of the tendency of stocks to rally as the end of the year approaches, investors who have lost money have the incentive to chase the rally to the upside, while those who have gained money are more likely to tidy up their books.

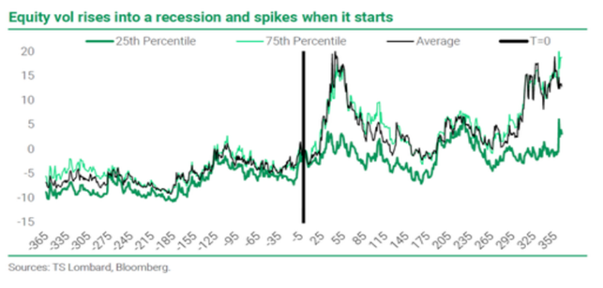

Equity volatility.

On a weekly basis, US jobs data came in better than estimates, continuing to undermine the central bank’s efforts to curb high . More specifically, according to the announcement of the Ministry of Labor, the hirings in November against the forecasts for only 200,000, therefore S&P 500 gained +1,13%, +0,13%, +2,03%, and in Europe lost -0,08%.

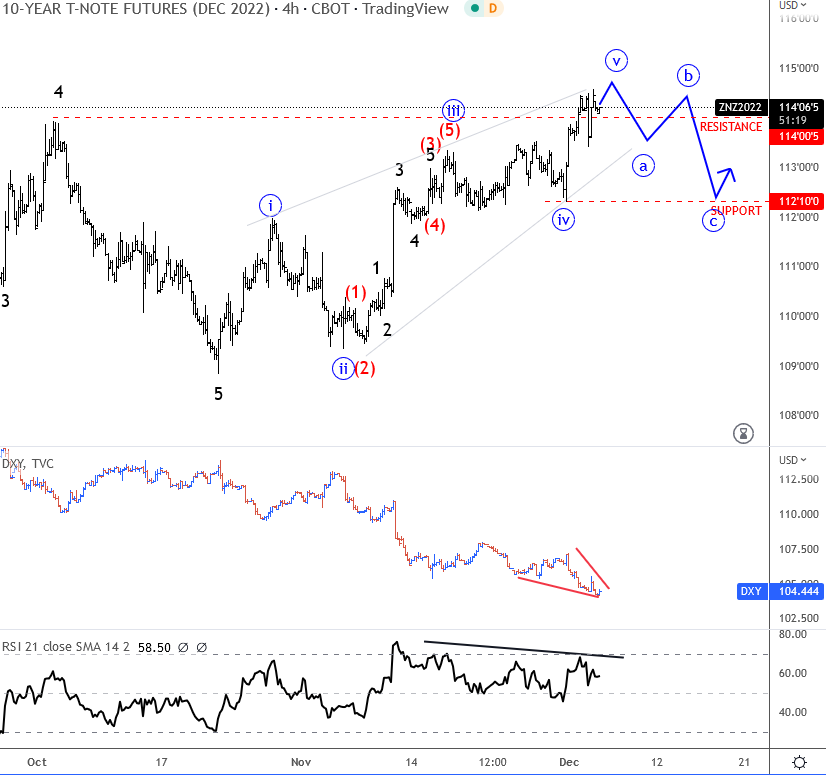

Tehnical look – U.S. Dollar

Technically speaking, we see notes coming higher, but in the fifth wave of a bullish reversal while is falling back to the lows, hunting stops that were placed after NFP. But the focus should be Powell’s words from last Wednesday, when he was not that hawkish anymore, so even good jobs data may not change his decisions.

10-year US notes vs. DXY.

10-year US notes vs. DXY.

[ad_2]

Source link